views

Europe Private Equity Market Outlook

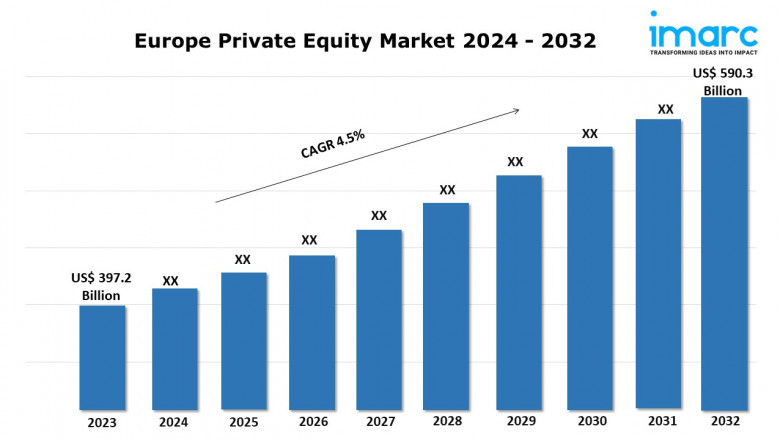

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Size in 2023: USD 397.2 Billion

Market Forecast in 2032: USD 590.3 Billion

Market Growth Rate: 4.5% (2024-2032)

The Europe private equity market was valued at USD 397.2 Billion in 2023 and is projected to grow to USD 590.3 Billion by 2032, with an expected compound annual growth rate (CAGR) of 4.5% from 2024 to 2032.

For an in-depth analysis, you can refer free sample copy of the report: https://www.imarcgroup.com/europe-private-equity-market

Europe Private Equity Market Trends:

The Europe private equity market is experiencing significant growth, driven by the growing consumer inclination towards alternative investment opportunities for funds. In addition to this, investors in the region are augmenting the need for higher returns in a low-interest-rate environment, which is acting as another growth-inducing factor.

Additionally, the rising number of well-established businesses and strategic collaborations among key players are also stimulating the Europe private equity market. Furthermore, the inflating popularity of start-ups and the escalating demand for specialized management teams are positively influencing the market growth across the region.

Emerging trends in the Europe private equity market include strategic mergers and acquisitions (M&As) activities. Apart from this, investors in the region are increasingly considering the societal and environmental impact of their investments, which, in turn, is augmenting the number of ESG-focused funds, thereby further bolstering the market growth. Another significant trend driving the private equity market in Europe is the increasing digital transformation across industries, which is creating new investment opportunities for tech-enabled businesses.

Besides this, the shifting preferences towards sector-specific funds, as investors seek to leverage expertise in particular industries to generate higher returns, are positively influencing the regional market. These drivers and trends, coupled with the rising private equity firms, will continue to drive the regional market in the coming years.

We explore the factors propelling the Europe private equity market growth, including technological advancements, consumer behaviors, and regulatory changes.

Europe Private Equity Industry Segmentation:

The report has segmented the market into the following categories:

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Country Insights:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

Top Players Analysis:

The report provides a detailed analysis of the competitive environment. It covers various aspects such as market structure, positioning of key players, top strategies for success, a competitive dashboard, and a company evaluation quadrant. Furthermore, the report includes comprehensive profiles of all major companies.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=10190&flag=C

Other Key Points Covered in the Report:

- COVID-19 Impact on the Market

- Porter's Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments

0 comment