views

India Cyber Insurance Market Outlook

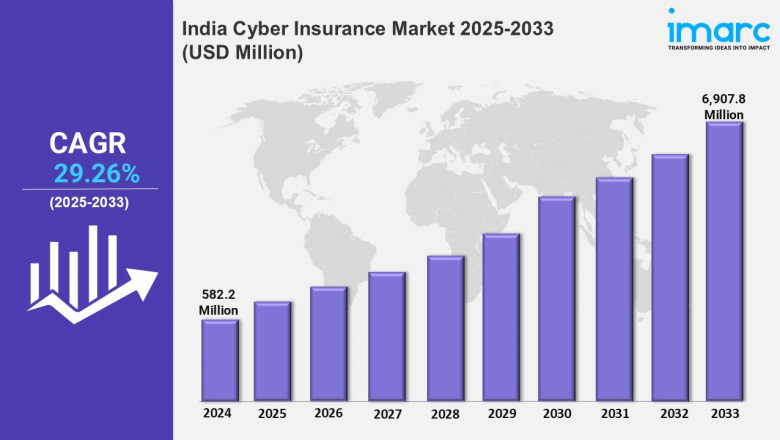

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 582.2 Million

Market Forecast in 2033: USD 6,907.8 Million

Market Growth Rate: 29.26% (2025-2033)

The India cyber insurance market size reached USD 582.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,907.8 Million by 2033, exhibiting a growth rate (CAGR) of 29.26% during 2025-2033.

India Cyber Insurance Market Trends:

Owing to the escalation in the frequency of cyber threats and attacks like data breaches and ransomware across industries, significant market expansion will be seen in cyber insurance in India. Such a rise in demand is primarily a function of greater digitalization of businesses, coupled with tougher data protection laws that warrant comprehensive cyber risk cover. The extensive adoption of cloud computing, as well as AI and IoT, has made enterprises more vulnerable to cyber risks and thus has compelled them to opt for strong insurance propulsion. Moreover, SMEs are gradually realizing the need for cyber insurance to absorb financial losses arising from cyber incidents. At the same time, compliance requirements and other regulatory developments-witness the Digital Personal Data Protection Act-are forcing businesses into focusing on cybersecurity measures and hence ushering in demand for appropriate insurance.

Insurers also expanded their offerings, providing financial fraud coverage, reputational damage, and business interruption among the most complete coverage products. There are also partnerships between insurers and cybersecurity companies that gear up their capacities toward risk assessment, thereby assisting in establishing new pricing models that become less volatile. On the other hand, there are hurdles in underwriting complexity and the ever-changing nature of cyber risks that challenge market development. However, with increased awareness of the threats posed by these risks and concerted efforts to manage them, the cyber insurance landscape in India will progressively evolve and expand.

For an in-depth analysis, you can refer free sample copy of the report: https://www.imarcgroup.com/india-cyber-insurance-market/requestsample

India Cyber Insurance Market Scope and Growth Analysis:

A huge surge of the Cyber Insurance market in India is because of increased cyberattacks and data breaches, which are being offset by the rapid pervasiveness of digital technologies across industries. The ensuing realization by companies not so much of the unfavourable aspects of these attacks in terms of financial fallout, but also the reputational prospect required more end-to-end coverage for cyber insurance policies. In more precise terms, it involves the growth of digital payment systems, cloud computing and IoT devices thereby heightening vulnerabilities and goading organizations to seek adequate coverage for cyber risks. This is necessarily complex because other than bringing along with various duties for regulatory compliance, many organizations, by virtue of data protection mandates, have to adopt cyber insurance in their overall risk management module.

On top of that, the coming of small and medium enterprises into the digital fold broadens the scope for affordable solutions for meeting their specific challenges in terms of cyber insurance overall. Insurers are also cotourting innovative ideas to bring specialized policies that cover ransomware, business interruption, and data breach liability. With artificial intelligence and blockchain technologies proliferating and rendering better advancements in cybersecurity technologies, the insurance providers should be able to conduct more risk assessments and draw up adaptive policies that curb with the evolving nature of risk along the lines of cyber threats. That said, this offers an intricate picture, which seems to suggest that in the coming years, the India Cyber Insurance market shall be buoyed continuously into an uptrend.

India Cyber Insurance Market Report Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India Cyber Insurance Market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Component Insights:

- Solution

- Services

Insurance Type Insights:

- Packaged

- Stand-alone

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

End Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key highlights of the Report:

- Recent Industry News

- Key Technological Trends & Development

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments

0 comment