views

Ethereum (ETH) is showing resilience as developers fix issues with the Pectra upgrade on the Sepolia testnet. Despite concerns, ETH aims to maintain its $2,200 support level amid market skepticism.

Read ETH Price Prediction 2025 for more in-depth details

Pectra Deployment Hiccups on Sepolia

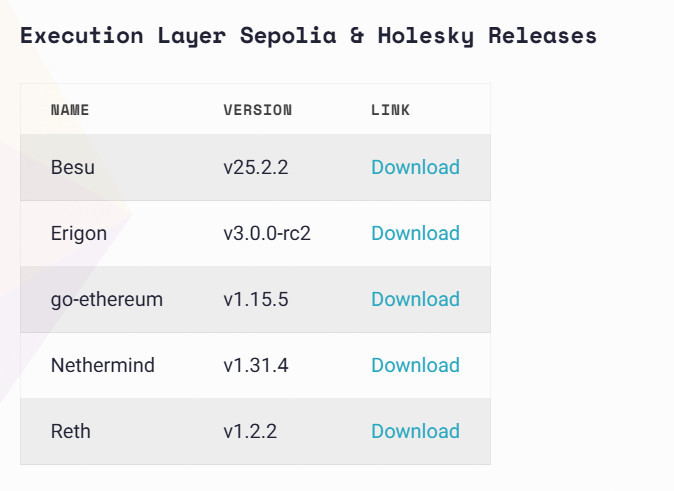

The Pectra upgrade hit a snag on the Sepolia testnet, a crucial environment for testing before mainnet deployment. A bug in Sepolia's deposit contract prevented execution layer (EL) clients from processing transactions. Ethereum core developer Tim Beiko confirmed that the issue has been resolved.

This is the second testnet issue in two weeks for Pectra, following a failure to finalize on the Holesky testnet due to EL client configuration issues. Developers assured the community that these problems are specific to testnets and won't affect the Ethereum mainnet.

Pectra aims to introduce account abstraction features, ERC-20 gas fee payments, enhanced wallet recovery, and increased staking capacity from 32 ETH to 2,048 ETH per node. However, it's unclear if developers will stick to the original April mainnet deployment schedule.

Also Read: Toncoin Price Prediction 2025, 2026 – 2030

ETH Price Analysis: Key Levels to Watch

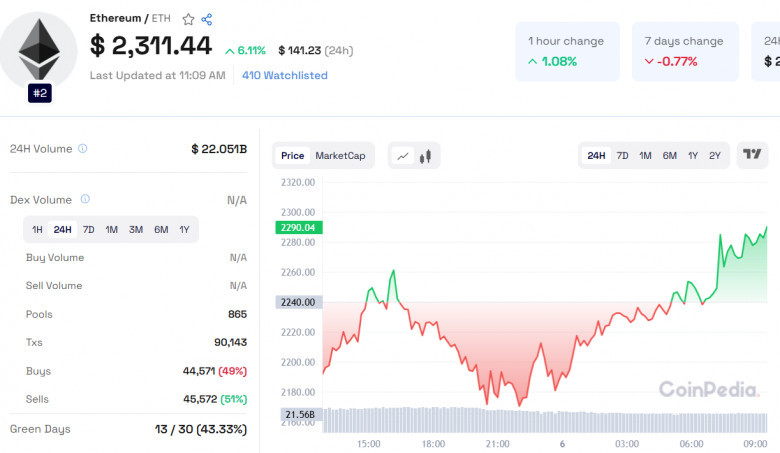

ETH experienced $44.63 million in futures liquidations, struggling to hold the $2,200 support. A weekly close below this level could trigger a drop to $1,500. However, reclaiming the ascending channel could see ETH target $2,850.

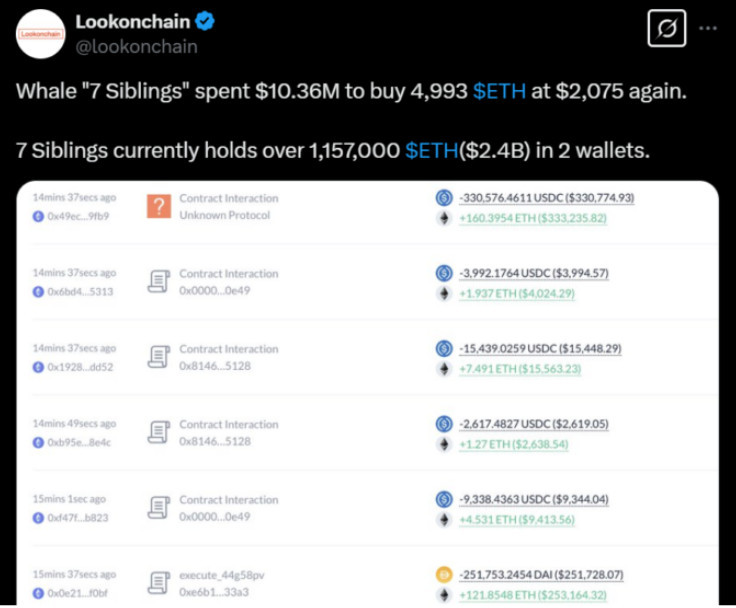

Indicators show bearish momentum but also potential seller exhaustion. Notably, whale "7 Siblings" recently purchased 4,993 ETH for $10.36 million, highlighting strong market confidence.

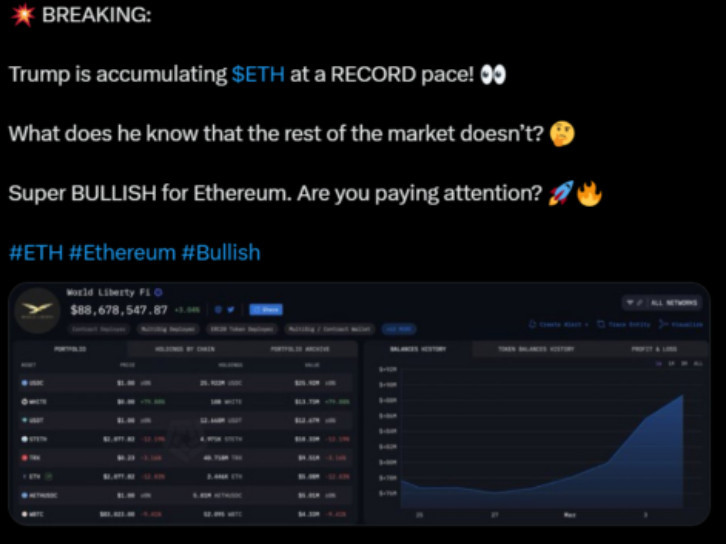

Adding intrigue, former U.S. President Donald Trump has reportedly been accumulating Ethereum, fueling bullish sentiment.

Crypto analyst ValeriyaApex sees a strong demand zone between $1,700 and $1,800, with potential rallies to $4,127 or even $4,874. However, a break below $1,500 could invalidate the bullish outlook.

Ethereum's path remains uncertain, but strong whale activity and institutional interest suggest a potential bullish turnaround.

Comments

0 comment