views

A Quick Guide To Connect PayPal and QuickBooks

If you want to boost your game of cashflow and faster payments, PayPal with QuickBooks Online with the help of this concise manual. It is a simple process to import all your PayPal transactions into QuickBooks online and enjoy the benefits of easy finance management. With this feature, you can send/receive money worldwide to/from customers, clients, and vendors. PayPal is an important application for businesses operating overseas as it allows merchants to make transactions in 200+ currencies. Therefore, if you are running a business, you must get your PayPal data synced with QuickBooks to make your process simple and quick. This article consists of the complete procedure to integrate both applications for a seamless workflow.

Connect PayPal and QuickBooks Online to become a pro at managing your finances and take advantage of this valuable tool. Learn the right method to establish the application’s integration by calling our QuickBooks Customer Support Team at 1-877-750-0672.

Connect PayPal and QuickBooks- It’s Importance

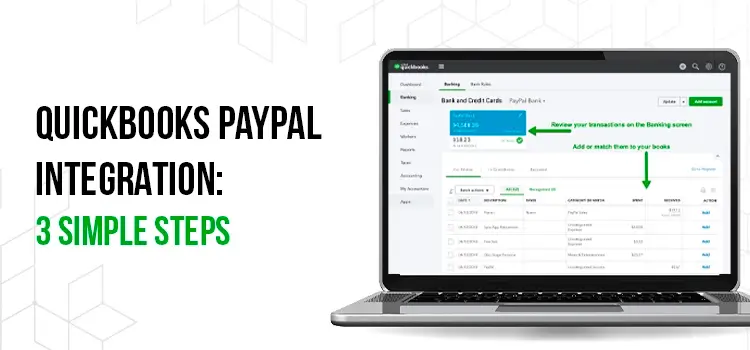

QuickBooks and PayPal Integration is a wise decision as it brings all your transactions into QB. When you integrate them, any balance affecting transactions will be shown in the QuickBooks banking tab. This will make it easy for you to edit and track them.

All PayPal transactions, including sales, fees, purchases, and transfers, can be reviewed in the QB application. The sales receipts grab the customer and product details from PayPal directly, thus enabling you to manage and categorize the data. With the help of reports, you will remain on top of accurate details. The hassle of entering the fees manually is removed, as the fees are automatically recorded in separate accounts.

Benefits of QuickBooks and PayPal Integration

When you connect PayPal and QuickBooks, you open a gateway of numerous features and benefits of this tool. Look at the advancements you can enjoy with the integration of these two applications:

- Save Plenty of Time- Your payments and fees are fully automated and kept on track.

- Credit Card Payments- The customers can make payments via credit cards and you will incur a puny amount of payment fares.

- Reduced Fees- You can receive card payments with low transaction fees of 1.45% + £0.30 to be paid per invoice.

- Increased Cashflow- From QuickBooks, you can send invoices to customers, and they can make payments online with their cards or PayPal accounts.

- Set Alarms For Payments- With this tool, you can set reminders to inform your customers of their due invoices

Simple Process To Connect PayPal and QuickBooks Online

PayPal app transactions can be easily managed by integrating QuickBooks Online with PayPal. The process is quite simple and given below for you to apply and start with your banking tasks effortlessly:

- The initial step requires you to sign in to your QuickBooks Online Account.

- Now, move to the Apps section and choose the Find Apps option.

- Locate the Connect to PayPal tab.

- After that, click on Get The App Now.

- Herein, select QuickBooks Online Company by marking the box and then clicking Install.

- Next, hit on Let’s Do It.

- Later, you will have to authorize QuickBooks to extract data from the PayPal account. Therefore, choose Give Permissions.

- Here, you need to enter the email address linked to your PayPal account and hit Next.

Important: You will have to create a new account on PayPal if you don’t already have an existing account. And when you create a new one, the whole process will have to be re-initiated. Head back to your QuickBooks online and set up the integration.

- In the final step, you must sign in to your PayPal ID.

Sync Your Bank Transactions After PayPal Integration With QuickBooks

- After you have successfully signed in to your PayPal account, you need to authorize the sync.

- The prompts will ask you to Agree and Connect.

- Thereafter, click on Return to Intuit.

- Now, you are supposed to select the correct PayPal bank where your transactions can be found and click on Next.

- Next, you must set the sales tax rates to be implied on sales transactions; hit Next.

- In the case of older transactions, choose the date from which you want your transactions to be imported and select Done.

- You can easily import up to 18 months older transactions to QuickBooks.

- In the QuickBooks Bank transactions, you can check your PayPal connection.

- Also, your new PayPal transactions will be synced to QB online every 15-30 minutes.

PayPal QuickBooks Integration In Short!

With the smart move to link PayPal with QuickBooks, you can import your sales and expenses automatically. Also, track your reports and check into the up-to-date transactions. Therefore, it is essential to sync your data and not lose their records. Hopefully, the article covered the topic to connect PayPal and QuickBooks and related queries. However, if you remain stuck with some issues in integrating the software, call the QB experts at +1-877-750-0672 anytime for guidance.

Read More : QuickBooks Error 15240: Easiest Ways to Troubleshoot the Error Permanently

Read More : How to Fix QuickBooks Error PS077 and PS032 During Payroll Updates

Comments

0 comment