views

Market Overview:

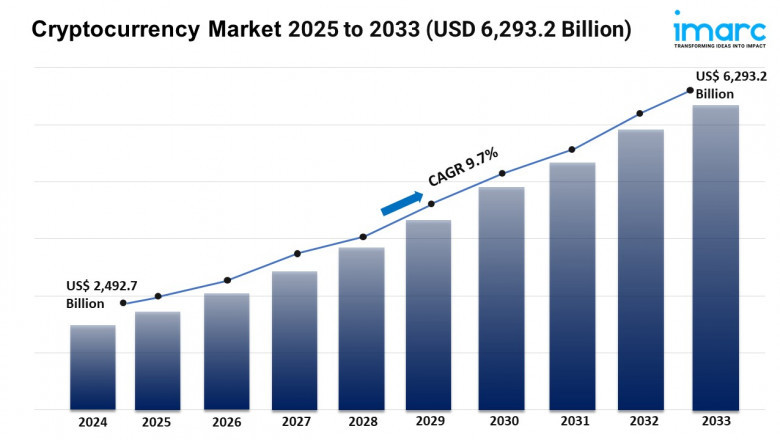

- The global cryptocurrency market size reached USD 2,492.7 Billion in 2024.

- The market is expected to reach USD 6,293.2 Billion by 2033, exhibiting a growth rate (CAGR) of 9.7% during 2025-2033.

- Europe leads the market, accounting for the largest cryptocurrency market share.

- Bitcoin accounts for the majority of the market share in the type segment as it is a preferred choice for those entering the crypto space.

- Software holds the largest share in the cryptocurrency industry.

- Transaction remains a dominant segment in the market due to its high liquidity, rapid settlement times, and diverse range of use cases.

- Trading represents the leading application segment.

- The rising institutional adoption is a primary driver of the cryptocurrency market.

- Regulatory developments and technological advancements are reshaping the cryptocurrency market.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/cryptocurrency-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Factors Affecting the Growth of the Cryptocurrency Industry:

- Institutional Adoption:

Companies, banks, and hedge funds are among the financial institutions interested in cryptocurrencies, seeing them as a promising alternative asset. This interest boosts liquidity and market confidence. With the introduction of instruments like Bitcoin futures and ETFs, institutions can now invest more easily. As more institutions join, the market becomes more stable. Typically, large investors prioritize long-term profitability over short-term gains, providing strategies that contribute to the development of critical infrastructure, such as regulatory frameworks, risk management tools, and secure storage services. This enhances the legitimacy and accessibility of cryptocurrencies.

- Regulatory Developments:

Favorable regulatory environments in countries like the United States and Switzerland have encouraged the wider use of cryptocurrencies by providing clear guidelines on their use, taxation, and trading. By setting rules for anti-money laundering compliance, consumer protection, and fraud prevention, regulation has played a key role in legitimizing the market. In major financial centers, clear regulations make investing safer. This encourages innovation in blockchain technology and decentralized finance. As countries establish solid regulatory frameworks, institutional investors will gain confidence. This will lead to greater participation and a more mature market.

- Technological Advancements:

Advances in blockchain and cryptocurrency technology are essential for the market's growth. Improvements like faster consensus algorithms, better scalability, and stronger security features make daily use of cryptocurrencies easier. Ethereum's switch to a Proof-of-Stake (PoS) system boosts energy efficiency and reduces transaction fees. This attracts more developers and users to decentralized applications (dApps). Advancements in decentralized finance (DeFi) and smart contracts are broadening cryptocurrency use. Now, users can lend, borrow, and create financial tools without banks. As these developments progress, they will enhance the user experience. This will make cryptocurrencies more accessible and secure.

Leading Companies Operating in the Global Cryptocurrency Industry:

- Advanced Micro Devices Inc.

- Alphapoint Corporation

- Bitfury Holding B.V.

- Coinbase Inc.

- Cryptomove Inc.

- Intel Corporation

- Microsoft Corporation

- Quantstamp Inc.

- Ripple Services Inc.

Cryptocurrency Market Report Segmentation:

Breakup By Component:

- Hardware

- Software

Software dominates the market on account of its ability to enable the development of decentralized finance (DeFi) and non-fungible tokens (NFTs).

Breakup By Process:

- Mining

- Transaction

Transaction represents the majority of shares due to its high liquidity, rapid settlement times, and a diverse range of use cases.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Europe enjoys the leading position owing to a large market for cryptocurrency driven by growth in decentralized finance (DeFi) platforms.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments

0 comment