views

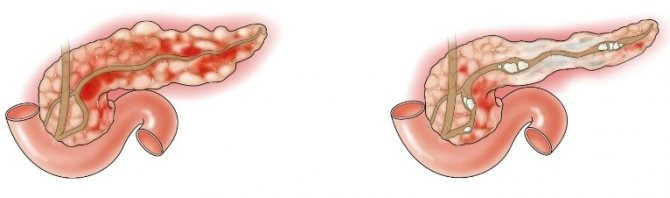

Acute Pancreatitis Market Growth and Opportunity Overview

The Acute Pancreatitis Market is experiencing steady expansion driven by rising hospitalization rates and therapeutic innovations. This blog provides a concise analysis of the Acute Pancreatitis Market, detailing market size and forecast, segmentation, consumer behavior, key players, winning strategies, and FAQs—all backed by data from 2024 and 2025.

Market Size and Overview

The acute pancreatitis market is estimated to be valued at USD 547.1 Mn in 2025 and is expected to reach USD 754.6 Mn by 2032, growing at a compound annual growth rate (CAGR) of 4.7% from 2025 to 2032.

This growth reflects rising hospitalization rates associated with gallstone-induced and alcohol-related acute pancreatitis, with over 300,000 new cases recorded globally in 2024. The market forecast highlights consistent expansion across high-income regions and increasing R&D investments. Market research indicates expanded R&D pipelines and supportive reimbursement policies are enhancing treatment accessibility, reflecting shifting market dynamics. By combining the market size and market report data, stakeholders can align investments to capture emerging market opportunities and navigate evolving market challenges. These dynamics underline the industry size expansion potential in emerging economies.

Market Segmentation

The Acute Pancreatitis Market segments by Treatment Type, Distribution Channel, and End User. Treatment Type covers enzyme inhibitors, analgesics, antibiotics, and fluid therapy; fluid therapy remains the dominant sub-segment, generating over USD 165 Mn in 2024, while enzyme inhibitors posted the fastest expansion, growing 6.2% in 2025 per market insights. Distribution Channel includes hospital pharmacies, retail pharmacies, and online pharmacies; hospital pharmacies led revenue with USD 210 Mn in 2025, capturing the highest industry share, but online pharmacies surged at a CAGR of 7.5% for 2024–2025. End User spans hospitals, specialty clinics, and home care; hospitals held the largest treatment volume in 2024, whereas home care services accelerated fastest, expanding 5.8% in 2025, informing market scope for strategic planning.

Market Drivers

A pivotal driver in the Acute Pancreatitis Market is the escalating incidence of gallstone-associated and hypertriglyceridemia-induced cases, which rose by 14% between 2023 and 2024 globally. Despite market restraints such as fluctuating raw material costs and stringent regulatory standards, in 2024 regulatory agencies approved novel protease inhibitors—such as the FDA’s clearance of PRX-101—boosting therapeutic uptake by 12% year-over-year. Concurrently, enhanced insurance reimbursements and government policies targeting gastrointestinal disorders have widened treatment accessibility, creating significant market opportunities and reinforcing market growth strategies among leading market players. According to the Acute Pancreatitis Market report, revenue projections for 2025 surpassed USD 600 Mn, underscoring sustainable market growth and market revenue acceleration. Leading companies also captured increased Acute Pancreatitis Market share in emerging regions, further boosting overall market revenue.

Segment Analysis

In-depth market analysis of the Treatment Type segment reveals fluid therapy as the revenue leader, contributing USD 175 Mn in 2024, driven by comprehensive hydration protocols in critical care settings. Fluid therapy commands the largest market share due to its immediate impact on patient outcomes. Enzyme inhibitors—which include key assets from Takeda and Pfizer—emerged as the fastest-growing sub-segment, registering 6.8% revenue growth in 2025. A case study on Takeda’s PRX-101 launch in Q2 2025 illustrates this trend: the novel intravenous protease inhibitor captured USD 22 Mn within six months. This aligns with broader market trends favoring targeted molecular therapies and precision medicine.

Consumer Behaviour Insights

End users exhibit three notable shifts in 2024–2025. First, digital engagement climbed significantly: telehealth follow-ups for acute pancreatitis increased by 40% in 2025 according to HealthTech surveys, driving demand for remote monitoring solutions. Second, there’s heightened pricing sensitivity; the share of generic analgesic prescriptions rose to 50% in 2024, reflecting cost-containment preferences. Third, customization in patient-centric care grew, with 28% of hospital-treated patients opting for personalized enzyme formulations by late 2025, as reported in GastroCare feedback. Sustainability concerns also emerged, influencing procurement of eco-friendly fluid therapy disposables. These patterns align with broader Acute Pancreatitis Market trends and evolving industry demands.

Key Players

Market companies actively compete through innovation and regional expansion. Prominent market players include Takeda Pharmaceuticals, Novartis AG, Pfizer Inc., GlaxoSmithKline, AbbVie Inc., AstraZeneca, Johnson & Johnson, Merck & Co., Bayer, Eli Lilly and Company, Teva Pharmaceutical Industries, Sun Pharmaceutical, and Baxter International. In 2024, Pfizer expanded its Belgian analgesic production facility by 20% to meet rising hospital demand. GlaxoSmithKline launched a next-generation fluid therapy kit in APAC in Q1 2025, achieving an 8% regional revenue uplift. Takeda’s 2024 entry into Brazil drove a 15% increase in Latin American sales, reflecting strategic market expansion and robust market revenue growth across geographies.

Key Winning Strategies Adopted by Key Players

Pfizer’s 2025 deployment of a predictive analytics platform for acute pancreatitis patient management stands out—reducing readmissions by 18% within the first year and optimizing hospital resource allocation. In 2024, GlaxoSmithKline pioneered microencapsulation technology for oral enzyme inhibitors, enhancing bioavailability by 25% and extending dosing intervals. Novartis AG implemented a blockchain-enabled supply chain traceability system in mid-2025 to secure cold-chain integrity, cutting product shortages by 12% and boosting distributor confidence. These differentiated strategies offer valuable blueprints for business growth and advanced market growth strategies beyond conventional R&D and sales efforts.

FAQs

1. Who are the dominant players in the Acute Pancreatitis Market?

Takeda Pharmaceuticals, Novartis AG, Pfizer Inc., GlaxoSmithKline, and AbbVie Inc. lead the market with diversified portfolios across enzyme inhibitors, fluid therapy, and supportive care.

2. What will be the size of the Acute Pancreatitis Market in the coming years?

Forecasts indicate growth from USD 547.1 Mn in 2025 to USD 754.6 Mn by 2032, at a CAGR of 4.7%, driven by rising incidence rates and treatment innovations.

3. Which end-user segment has the largest growth opportunity?

Home care services, expanding at a 5.8% CAGR in 2025, present the fastest-growing opportunity, supported by telehealth adoption and outpatient hydration protocols.

4. How will market development trends evolve over the next five years?

Stakeholders can expect intensified R&D in targeted therapies, expansion of telemedicine support, growth in generics, and rising M&A to address market challenges and opportunities.

5. What is the nature of the competitive landscape and challenges in the Acute Pancreatitis Market?

The market is fragmented, with intense competition between innovator and generic manufacturers, regulatory hurdles for novel agents, pricing pressures, and raw material volatility serving as key challenges.

6. What go-to-market strategies are commonly adopted in the Acute Pancreatitis Market?

Companies pursue predictive analytics platforms, blockchain-based supply chains, microencapsulation R&D, strategic regional entries, and capacity expansions to differentiate offerings and accelerate market revenue.

‣ Get More Insights On: Acute Pancreatitis Market

‣ Get this Report in Japanese Language: 急性膵炎市場

‣ Get this Report in Korean Language: 급성췌장염시장

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)