views

Packaging Foams Market

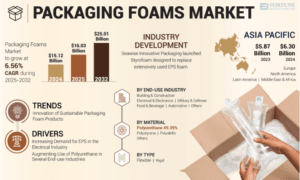

According to Fortune Business Insights, the global packaging foams market size was valued at USD 15.12 billion in 2024. The market is projected to grow from USD 16.03 billion in 2025 to USD 25.01 billion by 2032, exhibiting a CAGR of 6.56% during the forecast period. Asia Pacific dominated the packaging foam market with a market share of 41.66% in 2024.

Packaging foams are used to cushion and protect goods during storage and shipping. These materials are made of either polystyrene, polyurethane, polyethylene, or expanded polyethylene foam, providing numerous properties to the products during handling. These versatile materials come in a variety of sizes and shapes and are often tailored to a specific use or purpose. The increasing trade among countries and the augmenting use of packaging foams for insulation, cushioning soundproofing, and void filling are contributing to the packaging foams market growth.

Fortune Business Insights™ mentions this in a report titled, “Packaging Foams Market, 2025-2032”

Request a FREE Sample Copy: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/packaging-foam-market-109408

List of Key Players Present in the Report:

- Sealed Air (U.S.)

- Smurfit Kappa (Ireland)

- UFP Technologies, Inc. (U.S.)

- Sonoco Products Company (U.S.)

- BASF SE (Germany)

- JSP (Japan)

- Zotefoams plc (U.K.)

- Rogers Foam Corporation (U.S.)

- The Supreme Industries Ltd (India)

- Atlas Molded Products (U.S.)

- NEFAB GROUP (Sweden)

- American Foam Corporation (U.S.)

Segments

High Flexibility of Polyurethane Packaging Boosts Segment Growth

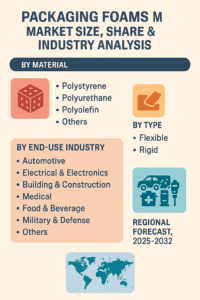

Based on material, the market is classified into polystyrene, polyurethane, polyolefin, and others. The polyurethane segment accounts for the largest packaging foams market share due to its high flexibility, large use in many end-use industries, and ease of cutting and fabricating.

he packaging foams market experienced negative growth during the pandemic, as there was a temporary ban on trade activities. Major end-use industries of packaging foams, such as automotive and building and construction, electrical and electronics, food, and beverage, had declining demands. The medical military and defense sectors observed positive and moderate demands, respectively. However, the post-pandemic phase has brought new opportunities to the market due to the surging e-commerce industry.

Flexible Segment Dominates the Market Due to the Durability of Flexible Foams

By type, the market is categorized into flexible and rigid. The flexible segment dominates the market in terms of share owing to the durability and capability of flexible foams to extend the product lifecycles by maintaining the product’s appearance.

Surging Demand for Packaging in the Automotive Sector Drives Segment Expansion

On the basis of end-use, the market is divided into automotive, electrical & electronics, building & construction, medical, food & beverage, military & defense, and others. The automotive segment is dominating the market, fueled by the high demand for packaging that provides shock absorption, sound insulation, structural reinforcement properties, and vibration dampening from the automotive industry.

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Report Coverage

The report offers:

- Major growth drivers, restraining factors, opportunities, and potential challenges for the market.

- Comprehensive insights into regional developments.

- List of major industry players.

- Key strategies adopted by the market players.

- The latest industry developments include product launches, partnerships, mergers, and acquisitions.

Drivers & Restraints

Surging Demand for Expanded Polystyrene (EPS) to Boost Market Expansion

The increasing demand for Expanded Polystyrene (EPS) for electronic device packaging due to the change in the consumer electronics industry drives the packaging foams market growth. The market is also driven by the increasing use of antistatic foam to protect electrical devices owing to the rising threats of static electricity accumulation to electronic components while transporting or storage.

However, the non-biodegradable nature of the expanded polystyrene poses a threat to the environment, including marine pollution may impede market expansion.

Regional Insights

Growing Demand for Electronic Products to Drive Market Expansion in Asia Pacific

Asia Pacific is the dominating and is anticipated to be the fastest-growing region in the market. The increasing demand for electronic products drives the growth, and the presence of the biggest exporter and manufacturer nation of electronic products in the region is expected to drive the market growth.

Europe is the second-leading region in the market for packaging foams due to the surging awareness, innovation, and use of green packaging in the region.

Information Source: https://www.fortunebusinessinsights.com/packaging-foam-market-109408

Competitive Landscape

Key Players are Offering Innovative Packaging to Strengthen Their Market Position

In terms of the competitive landscape, the packaging foams market comprises key players, such as Sealed Air, Smurfit, and others. These players are offering innovative packaging in the packaging industry to strengthen their market position.

Key Industry Development

March 2024 - Seawise Innovative Packaging launched Styrofoam, an alternative form of packaging that is designed to replace extensively used EPS foam. The new packaging is designed to be a cost-effective solution for companies trying to reduce the use of plastics in their supply chain.

December 2023 - Woamy launched a bio-foam product for plastic-free packaging in collaboration with Paptic and Secto Design. The new packaging foam products are fully bio-based, plastic-free, biodegradable, and recyclable.

Comments

0 comment