views

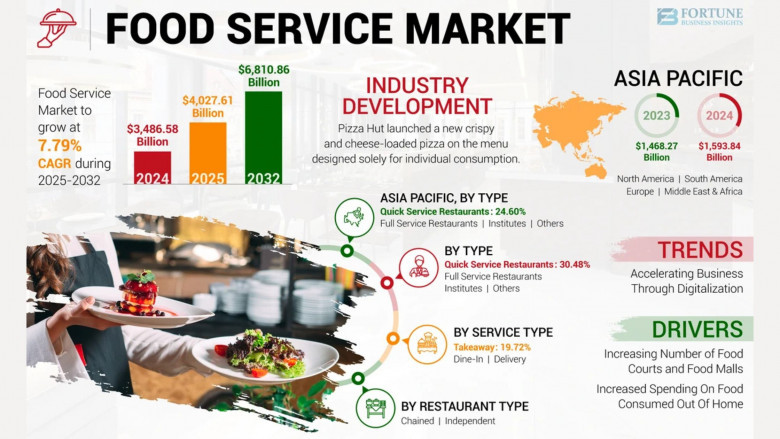

The global food service market reached a valuation of USD 3,486.58 billion in 2024 and is projected to increase from USD 4,027.61 billion in 2025 to USD 6,810.86 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 7.79% throughout the forecast period. The U.S. food service sector is expected to show significant growth, potentially reaching USD 1,767.54 billion by 2030 and USD 1.71 billion by 2032, fueled by a surge in fast food outlets and greater consumer expenditure on quick-service meals. Asia Pacific dominated the market in 2024, accounting for 45.71% of the global share.

Food service establishments encompass businesses that prepare and offer food for dine-in, takeout, or delivery. This sector includes table-service restaurants, counter-service operators, and other food vendors. Market expansion is being propelled by the growing consumption of fast food, supported by higher household earnings, an increase in working women, and the convenience factor of fast food options.

Information Source: https://www.fortunebusinessinsights.com/food-service-market-106277

Market Segmentation

By Type: Full Service Restaurants to Gain Traction by 2029

The market is categorized into quick service restaurants, full service restaurants, institutional, and others. Full service restaurants are expected to experience considerable growth, driven by the popularity of family-style dining and diverse menu offerings.

By Service Type: Commercial Segment to Lead Between 2022 and 2029

In terms of service, the market is divided into commercial and institutional segments. The commercial category is projected to dominate, supported by the growing prevalence of food trucks, cafés, restaurants, and increased demand for online food ordering. This segment includes both quick and full-service models.

Report Highlights

This report provides a detailed examination of:

- Primary growth drivers and potential restraints

- Opportunities across regions

- Comprehensive profiles of major market participants

- Strategic moves including mergers, acquisitions, and new product introductions

- Recent industry developments and innovations

Market Dynamics

Rising Fast Food Chains and Quick-Service Models Fueling Growth

Increased consumer income, especially in dual-income households, along with the demand for quick and convenient meals, is propelling the market. The millennial generation's preference for fast food and the expansion of quick-service chains into emerging economies are also boosting market momentum.

However, some market dynamics may still be influenced by lingering effects from the COVID-19 pandemic.

Regional Overview

North America Reported USD 989.0 Billion in Food Service Revenue in 2021

North America led the global market in 2021 with revenues exceeding USD 989.0 billion, attributed to the widespread presence of fast food restaurants, high disposable income, and evolving consumer preferences. The region also benefits from a large millennial population and an increasing number of working households.

Asia Pacific is forecast to witness the highest CAGR from 2022 to 2029, owing to the rapid rise of food outlets in smaller urban centers. Meanwhile, Europe is expected to experience steady growth, bolstered by the expansion of quick service restaurants, pubs, cafés, and coffeehouses.

Competitive Landscape

Acquisitions Used as a Key Growth Strategy

During the pandemic, many businesses delayed expansion due to economic uncertainty. With conditions improving, leading players are once again investing in growth through acquisitions and market entry strategies. For instance, Imperial Dade acquired Empire Distributors, significantly expanding its U.S. distribution network by adding 91 new facilities. Similar strategies are being implemented by major competitors to strengthen their global reach.

Notable Companies Featured in the Report

- McDonald's (U.S.)

- Starbucks (U.S.)

- Yum! Brands, Inc. (U.S.)

- Darden Restaurants, Inc. (U.S.)

- Restaurant Brands International Inc. (Canada)

- The Wendy’s Company (U.S.)

- Bloomin’ Brands, Inc. (U.S.)

- Papa John's International, Inc. (U.S.)

- Chipotle Mexican Grill, Inc. (U.S.)

- Domino's (U.S.)

Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/food-service-market-106277

Industry Update

July 2021: Delivery Hero marked its return to the German market by relaunching operations under the Food Panda brand, reaffirming its presence in one of Europe’s largest food service markets.