views

Confused by Digital Tax Rules? Easy Self-Assessment Guide for UK Landlords And Sole Traders

Tax season can be a stressful time for many landlords and sole traders across London, especially with the government’s new digital tax system called Making Tax Digital (MTD). If you’ve found yourself puzzled by the changing rules and wondering how to stay compliant without hassle, this guide is designed to make things clearer and simpler for you.

Making Tax Digital: What Landlords and Sole Traders Need to Know

Making Tax Digital (MTD) is a UK government plan to improve the tax system by going digital. It affects individuals and businesses, especially landlords and sole traders, who will need to keep digital records and submit tax updates online.

From 6 April 2024, if your annual income is over £10,000, you’ll need to follow MTD rules for Income Tax Self Assessment (ITSA).

Rather than sending one tax return each year, you’ll now need to report your income and expenses to HMRC every quarter using compatible software. This new process aims to make tax reporting more accurate and efficient.

Who Does MTD Apply To?

If you are a:

- landlord with an annual income exceeding £10,000 from UK property

- Sole trader with business income above £10,000 per year,

you must comply with MTD for ITSA starting April 2024. Even if your income fluctuates, once you cross this threshold, digital tax rules come into effect.

Benefits of Making Tax Digital

Although adapting to MTD may seem complicated at first, it offers several advantages:

- Simplified record-keeping: Digital systems help keep your financial records organised and easy to access.

- Quarterly updates: You send tax data four times a year, making your tax payments more manageable.

- Reduced errors: Digital submissions mean fewer mistakes and less chance of missing important details.

- Better financial planning: By reviewing your tax data regularly, you can plan your finances more effectively throughout the year.

How to Prepare for Making Tax Digital

- Choose MTD-Compatible Software

HMRC requires you to use software that can submit your tax information digitally. There are many options tailored for landlords and sole traders, including FreeAgent, QuickBooks, and Xero. - Keep Digital Records

You’ll need to record all income and expenses digitally — this includes rent received, repairs, insurance, and other related costs. - Understand Quarterly Reporting

Instead of waiting until the end of the tax year, you’ll submit updates every three months. This helps you stay on top of your tax affairs and reduces the year-end burden. - Seek Expert Help

If navigating this new digital system feels overwhelming, professional tax advisors can help you set up, manage submissions, and ensure you stay compliant.

What Happens if You Don’t Comply?

Failing to follow MTD rules can lead to penalties and interest charges from HMRC. Penalties typically start small but can increase if issues persist. Staying compliant not only keeps you clear of fines but also streamlines your tax process.

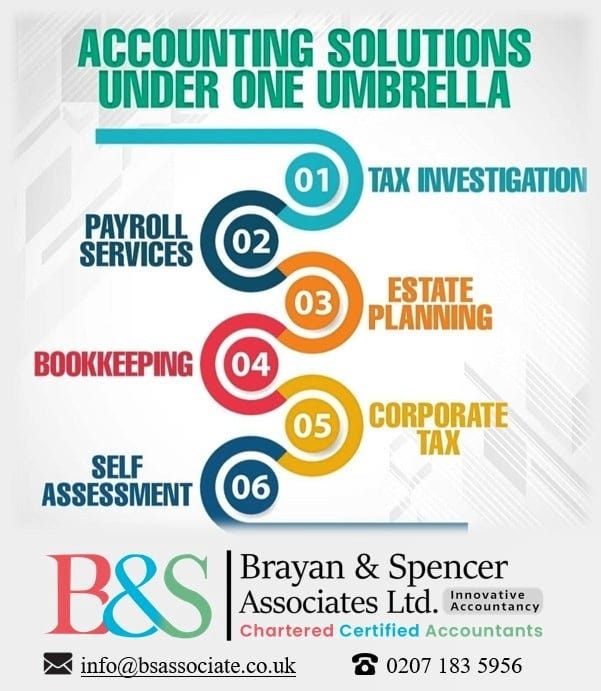

Why Choose Brayan & Spencer Associates?

For many landlords and sole traders in London, understanding and implementing MTD can be a challenge. Brayan & Spencer Associates specialise in helping individuals and businesses transition smoothly to Making Tax Digital. Their expert team offers:

- Advice on selecting the right MTD software

- Support with digital record-keeping and quarterly submissions

- Ongoing help with annual self-assessment returns

- Friendly, straightforward guidance tailored to your needs

Take Control of Your Tax Affairs Today

Making Tax Digital might sound complex, but with the right preparation and support, it can become a seamless part of managing your business finances. Don’t wait until the deadline — start organising your digital records now.

If you are a landlord or sole trader in London needing help with Making Tax Digital and self-assessment, contact Brayan & Spencer Associates at 0207 183 5956 or visit www.bsassociate.co.uk for expert support and personalised advice.