views

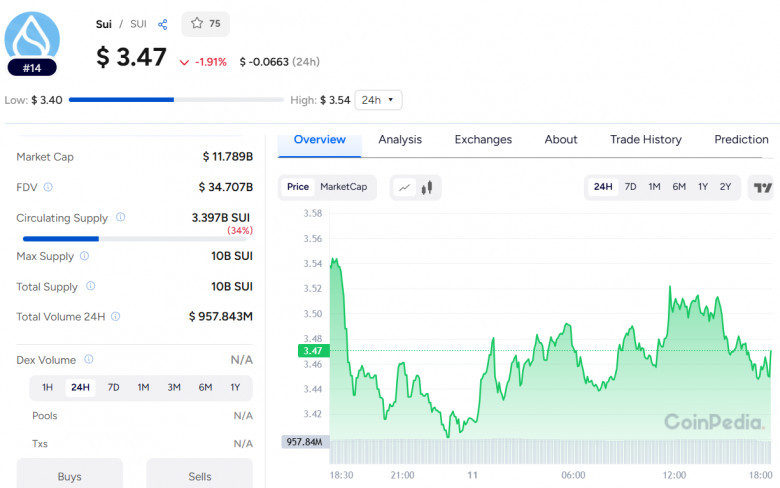

SUI is making headlines again—this time for the right reasons. After a rough May that saw its price drop nearly 30%, the token is rebounding strongly. At press time, the SUI price hovers around $3.50, reflecting a weekly gain of 7.89%. With solid fundamentals and a possible ETF on the horizon, the current SUI price prediction has turned bullish.

ETF Filing Sparks Investor Interest

On June 10, the Sui Foundation announced that Nasdaq filed a proposal with the U.S. SEC to list a 21Shares SUI ETF. Although it’s in early review stages, this marks a significant step toward institutional acceptance. If approved, investors could gain SUI exposure without directly owning the token.

-

This follows an April S-1 filing by 21Shares.

-

The ETF aims to deepen institutional access to the Sui ecosystem.

Technical Levels to Watch

SUI recently broke out of a descending channel, pushing past resistance at $3.55 while holding firm support at $2.92. The price is now above the 9-day SMA of $3.26, with potential upside targets at $3.80 and $4.20.

However, traders should watch the $3.20 to $3.00 zone, where buyers have historically stepped in.

Also Read: Uniswap Price Prediction 2025, 2026 – 2030

Strong On-Chain Support

The bullish momentum is backed by impressive on-chain data:

-

Derivatives trading volume is up 6.44% to $5.16B.

-

Open interest rose 3.53% to $1.52B, signaling strong investor confidence.

Additionally, total DEX volume has crossed $100 billion, highlighting a healthy trading ecosystem.

Final Thoughts

SUI’s recovery isn’t just technical—it’s fundamentally driven. With institutional interest, strong trading metrics, and renewed buying pressure, this could be a key turning point. If momentum holds, the SUI price may continue climbing—making this a token to watch in June 2025.

![¿Cómo puedo contactar con una persona en vivo en los vuelos de Frontier? [Guía paso a paso]](https://timessquarereporter.com/real-estate/public/index.php/upload/media/posts/2025-06/12/como-puedo-contactar-con-una-persona-en-vivo-en-los-vuelos-de-frontier-guia-paso-a-paso_1749705127-s.jpg)

![How Do I Get to a Live Person at Frontier Flights? [Step-by-Step Guide]](https://timessquarereporter.com/real-estate/public/index.php/upload/media/posts/2025-06/12/how-do-i-get-to-a-live-person-at-frontier-flights-step-by-step-guide_1749705004-s.jpg)

Comments

0 comment