views

Penile Implants Market to Grow with 3D-Printed Biocompatible Technology

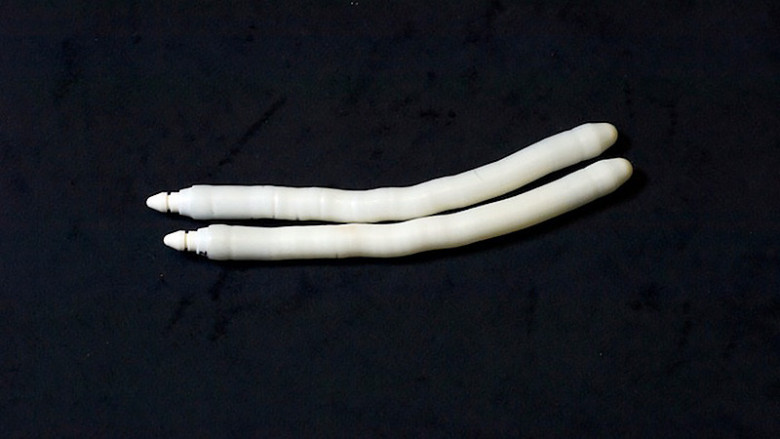

Penile implants are sophisticated medical devices designed to treat erectile dysfunction (ED) in men, offering reliable restoration of sexual function when oral medications or lifestyle interventions prove inadequate. These implants are available in inflatable and malleable forms, featuring advanced biocompatible polymers and 3D-printed structures that ensure durability, minimal infection risk, and enhanced patient comfort. Inflatable models comprise a hydraulic system that mimics natural erection mechanics, while malleable rods provide a simpler, low-maintenance solution.

The integration of 3D-printed biocompatible materials allows for patient-specific customization, reducing procedure time and improving post-operative outcomes. Rising incidence of ED due to aging populations, chronic diseases, and greater health awareness has fueled demand for Penile Implants Market across hospitals and specialized clinics. Market players are focusing on refining implant design, expanding product portfolios, and pursuing strategic partnerships to strengthen market position.

The penile implants market is estimated to be valued at USD 271.4 Mn in 2025 and is expected to reach USD 328.1 Mn by 2032, growing at a compound annual growth rate (CAGR) of 2.4% from 2025 to 2032.

Key Takeaways

Key players operating in the Penile Implants Market are:

-Boston Scientific Corporation

-Coloplast Corp

-PROMEDON GmbH

-SILIMED

-ZSI Zephyr Surgical Implants

These leading market companies leverage robust research and development pipelines and strategic alliances to expand their product offerings. Through portfolio diversification and targeted acquisitions, they enhance their market share and strengthen distribution networks globally. Continuous market analysis and strong business growth strategies help these players maintain competitive advantage amid evolving market dynamics and industry trends.

Key opportunities abound in emerging regions such as Asia-Pacific and Latin America, where growing healthcare infrastructure investment and rising insurance coverage are driving medical device adoption. Increasing awareness about sexual health and wellness therapies presents significant market opportunities for manufacturers and distributors. Market research indicates untapped segments in outpatient clinics and ambulatory care centers, offering room for growth strategies focused on value-based care. Favorable reimbursement policies and government initiatives in key markets further bolster expansion prospects.

Technological advancements in 3D-printed biocompatible technology are reshaping implant design and production processes. Additive manufacturing enables precise customization of implant dimensions and surface properties, reducing procedural time and post-surgical complications. Integration of antimicrobial coatings and smart sensors for real-time pressure monitoring reflects ongoing innovation. These market trends toward personalized, data-driven solutions are elevating patient outcomes and driving regulatory bodies to streamline approval pathways for next-generation implants.

Market Drivers

The primary market driver for the global penile implants market is the rising prevalence of erectile dysfunction, driven by an increasingly aging population and higher incidence of comorbidities such as diabetes, cardiovascular diseases, and obesity. As life expectancy improves worldwide, the proportion of men experiencing ED grows, creating sustained demand for permanent therapeutic solutions. Concurrently, expanding healthcare access and greater willingness to seek specialized treatments have reduced social stigma around sexual health, encouraging more patients to explore surgical options. Technological innovation—particularly in minimally invasive surgical techniques and 3D-printed biocompatible materials—has enhanced the safety profile and efficacy of penile implants, addressing previous market challenges related to infection risk and mechanical failure. Improved implant reliability boosts physician confidence and patient acceptance, leading to broader adoption across clinical settings. Furthermore, supportive reimbursement frameworks in developed economies mitigate cost barriers, enabling hospitals and specialty clinics to invest in advanced implant systems. Cumulatively, these factors underpin steady market growth, with ongoing market research and evolving market drivers guiding stakeholders toward strategic investments in product development and commercialization.

Current Challenges

The penile implants sector faces several market challenges that stem from evolving patient expectations and stringent regulatory landscapes. Lengthy approval processes and varying reimbursement policies across regions hinder seamless product rollout, impacting business growth and delaying market entry for innovative devices. High manufacturing costs and the need for sterility further add to the industry size constraints, placing pressure on profit margins. Additionally, limited awareness among potential candidates reduces market share, as many healthcare providers still view conservative therapies as first-line options. Integrating new materials and design improvements requires extensive clinical trials, driving up R&D spends and complicating market research efforts. In emerging economies, inadequate infrastructure and a shortage of trained surgeons act as significant market restraints, limiting adoption despite rising demand. Meanwhile, evolving market trends toward minimally invasive solutions demand continual product refinement, posing both a challenge and a driver for future developments in this field.

SWOT Analysis

Strength: Robust clinical validation and proven efficacy have cemented the appeal of penile implants, reinforcing physician confidence and enabling higher adoption rates across established market segments. Improved designs offer enhanced durability and patient satisfaction, supporting positive industry trends.

Weakness: High upfront costs and complex surgical procedures restrict uptake among cost-sensitive healthcare providers, limiting access in lower-reimbursement settings. Dependency on skilled surgeons and specialized training programs creates barriers to scaling implants in under-served regions.

Opportunity: Rising awareness of quality-of-life treatments and expanding insurance coverage present significant market opportunities, encouraging new entrants to invest in improved supply chains and outreach programs. Advancements in biomaterials and smart implant technologies could unlock untapped market segments and drive business growth.

Threats: Intensifying competition from non-surgical alternatives, such as regenerative medicine and pharmacological therapies, may erode implant market share over time. Stringent regulatory requirements and potential recalls pose ongoing risks, where any safety concerns could stall the entire market’s momentum.

Geographical Regions – Value Concentration

North America remains the primary hub for penile implant revenue, driven by high healthcare expenditure, well-established reimbursement frameworks, and a strong focus on advanced surgical interventions. The U.S. market share dominates globally, supported by extensive market research and active physician training programs that facilitate rapid adoption of next-generation designs. Western Europe follows closely, with Germany, France, and the U.K. accounting for significant industry size due to robust public healthcare systems and growing patient advocacy for sexual health solutions. In Asia Pacific, Japan and Australia represent mature markets with favorable regulatory pathways; however, overall value concentration is lower compared to developed Western regions. Emerging economies in Latin America and the Middle East exhibit steady gains but still lag in terms of per-capita spending and infrastructure necessary for widespread implantation. Robust collaborations between research institutions and device manufacturers in these key regions ensure sustained market growth and improvement in clinical outcomes.

Geographical Regions – Fastest Growing

The Asia Pacific region is poised as the fastest growing territory for penile implants, fueled by rising disposable incomes, increased healthcare awareness, and expanding reimbursement schemes in China and India. Rapid urbanization and greater acceptance of elective urological procedures are significant market drivers, as more patients seek permanent solutions over ongoing medication regimens. Southeast Asian nations like Thailand and Malaysia are also emerging as dynamic hubs, with government initiatives to upgrade hospital networks and introduce specialized training in urological surgery. Latin America follows closely, notably Brazil and Mexico, where improving healthcare infrastructure and strategic partnerships with global market players accelerate product availability. Eastern Europe is another growth frontier—countries such as Poland and Russia are experiencing an uptick in private healthcare spending coupled with improved regulatory clarity, spurring market opportunities. Across these regions, intensified market analysis efforts and localized clinical studies are key to overcoming market restraints and capturing a larger share of the global penile implant landscape.

‣ Get this Report in Japanese Language: 陰茎インプラント市場

‣ Get this Report in Korean Language: 음경임플란트시장

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)