views

Market Overview:

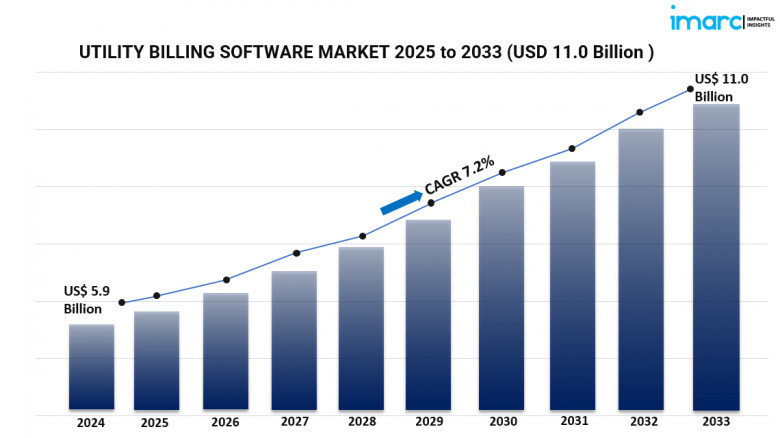

The global utility billing software market is experiencing robust growth, driven by increasing awareness of energy conservation, evolving regulatory mandates, and rising customer expectations. In 2024, the market reached a valuation of USD 5.9 billion and is projected to expand to USD 11.0 billion by 2033, exhibiting a CAGR of 7.2% during 2025-2033 . Key factors propelling this growth include rapid urbanization, significant technological advancements, and the global expansion of utility services.

Study Assumption Years:

-

Base Year: 2024

-

Historical Years: 2019-2024

-

Forecast Years: 2025-2033

Utility Billing Software Market Key Takeaways:

-

The market is projected to grow from USD 5.9 billion in 2024 to USD 11.0 billion by 2033, at a CAGR of 7.2% during 2025-2033 .

-

Cloud-based deployment models hold the largest market share, offering scalability and cost-efficiency.

-

Power distribution emerges as the leading end-user segment, driven by the need for accurate billing and regulatory compliance.

-

North America dominates the market, attributed to advanced infrastructure and high adoption of digital technologies.

-

The integration of IoT and smart meters enhances data collection and billing accuracy, fueling market growth.

-

Utility companies are increasingly adopting UBS to meet evolving customer expectations for transparency and real-time access.

-

Strategic collaborations and technological advancements are shaping the competitive landscape.

Request for a sample copy of this report : https://www.imarcgroup.com/utility-billing-software-market/requestsample

Market Growth Factors:

1. Technological developments make smart grid integration possible.

The market for utility billing software is significantly affected by technological developments, notably smart grid and IoT device integration. Real-time monitoring and management of utility usage made possible by smart grids thereby promotes accurate billing and efficient energy supply. Smart meters provide detailed data that aids utility companies in offering customized services and dynamic pricing strategies. Moreover, the integration of cloud computing increases the scalability and flexibility of billing systems, therefore enabling utilities to quickly adapt to changing needs. These technical advancements not only boost operational efficiency but also raise customer awareness of their energy consumption, therefore promoting sustainability and energy saving.

2. Legislative compliance and data protection

Regulations like the General Data Protection Regulation (GDPR) in Europe and related rules throughout several regions call for the deployment of strong utility billing software to guarantee compliance with data protection legislation and billing standards. Offering audit trails, secure data storage, and automated reporting, advanced billing software solutions enable utilities to meet these compliance responsibilities. Furthermore, the focus on responsibility and honesty in billing practices fosters trust between customers and government entities, hence promoting the adoption of complex payment systems.

3. Rising Customer Expectations and Digital Conversion

Customers now anticipate real-time access to billing information, customized services, and seamless communication channels; hence, the digital transformation of the utility industry is altering expectations. Utility billing software provides user-friendly interfaces, mobile applications, and self-service portals that provide visibility and ease to address these expectations. Real-time notifications, consumption analysis, and flexible payment options improve consumer engagement and happiness. Rising competition in the utility sector turns great customer experiences into a strategic need, hence pushing utilities to spend on advanced billing systems that match the digital preferences of today's customers.

Market Segmentation:

Breakup by Deployment Mode:

-

On-premises: Installed locally on a company's own servers and infrastructure, offering control over data and customization.

-

Cloud-based: Hosted on the vendor's servers and accessed through a web browser, providing scalability and reduced IT overhead.

Breakup by Type:

-

Platform as a Service (PaaS): Offers a platform allowing customers to develop, run, and manage applications without the complexity of building and maintaining infrastructure.

-

Infrastructure as a Service (IaaS): Provides virtualized computing resources over the internet, offering flexibility and scalability.

-

Software as a Service (SaaS): Delivers software applications over the internet on a subscription basis, eliminating the need for installations.

Breakup by End User:

-

Water: Utilities managing water supply and billing services.

-

Power Distribution: Companies distributing electricity to end-users, requiring accurate consumption tracking and billing.

-

Oil and Gas: Firms involved in the distribution and billing of oil and gas services.

-

Telecommunication: Providers offering communication services, necessitating detailed billing systems.

-

Others: Includes utilities managing services like waste management and sanitation.

Breakup by Region:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Regional Insights:

North America leads the utility billing software market, driven by advanced infrastructure, high adoption of digital technologies, and stringent regulatory frameworks. The region's focus on sustainability and energy efficiency further propels the demand for sophisticated billing solutions. The integration of smart meters and IoT devices enhances data accuracy and customer engagement, solidifying North America's dominant position in the market.

Recent Developments & News:

The utility billing software market has witnessed notable developments aimed at enhancing service offerings and expanding market reach. In December 2022, Harris Computer acquired Service-Link, integrating mobile workforce management solutions into its Utilities Group. In October 2022, Exceleron Software enhanced its MyUsage solution to support Amazon Web Services and tier-1 private cloud options, providing customers with greater flexibility and scalability. Furthermore, in January 2020, AMCS, an Ireland-based technology provider, acquired Utilibill Pvt. Ltd., aiming to broaden its utility billing capabilities.

Key Players:

-

Continental Utility Solutions Inc.

-

ePsolutions Inc.

-

Exceleron Software

-

Harris Computer (Constellation Software Inc.)

-

Jayhawk Software Inc.

-

Jendev Corporation

-

Methodia Group

-

Oracle Corporation

-

Sigma Software Solutions Inc.

-

SkyBill SIA

-

Utilibill Pvt. Ltd.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5190&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC's offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.