870

views

views

Ethereum price prediction turns bullish as ETH consolidates near $1,800 after a 15% rally and short trader liquidations.

Image Share By:

willmartinzone@gmail.com

Ethereum (ETH) broke above the key resistance at $1,700 on April 22, rallying by nearly 15% before facing rejection near $1,861. Since then, ETH has been consolidating between $1,740 and $1,800. As of Wednesday, it hovers near $1,800, with technical and on-chain indicators suggesting the potential for further gains—fueling renewed interest in Ethereum price prediction among traders and analysts.

A daily close above $1,861 could trigger a fresh leg up toward the psychological resistance at $2,000. The RSI on the daily chart stands at 55, pointing to bullish momentum. Notably, if the price clears $1,850 with conviction, a short-squeeze may follow, causing cascading liquidations that could drive ETH swiftly to higher levels.

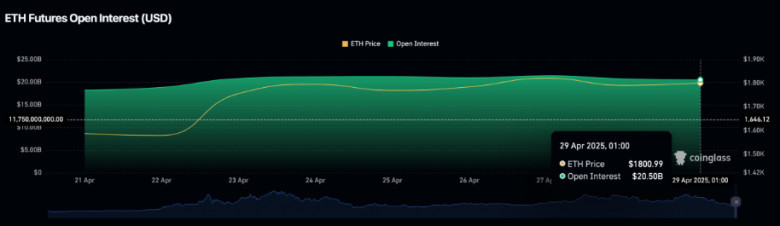

Coinglass data supports this view, showing a $273 million drop in Ethereum futures open interest (OI), now at $20.5 billion. This decline amid a price rally indicates that short traders closed their positions, possibly fueling upward spot market momentum.

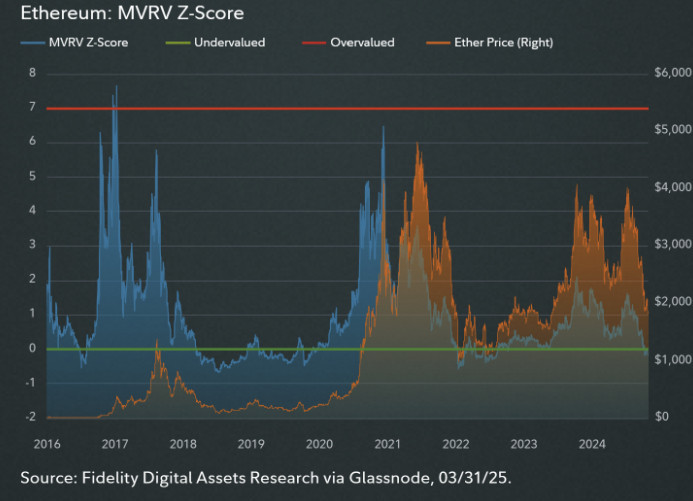

From an on-chain perspective, Fidelity Digital Assets notes that ETH’s MVRV Z-Score dropped to -0.18 in March, a level typically associated with market bottoms. Additionally, the Net Unrealized Profit/Loss (NUPL) ratio has hit zero, suggesting capitulation—where unrealized profits equal losses.

ETH’s realized price of $2,020 remains about 10% above current market value, indicating holders are sitting on unrealized losses. However, the modest drop in realized price implies that long-term holders are showing resilience, potentially forming a price floor.

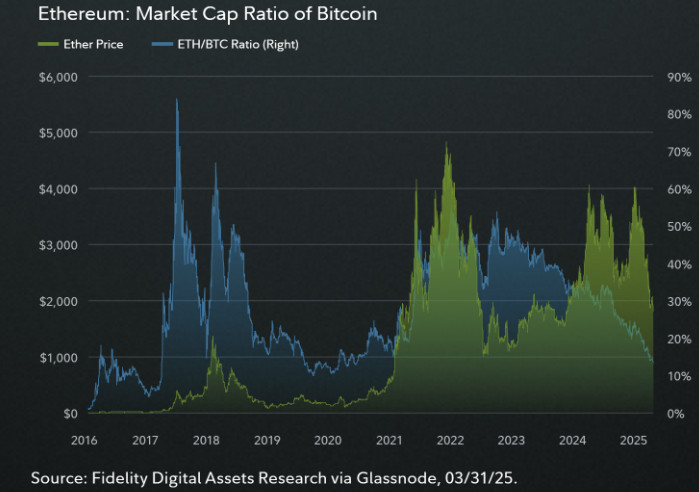

Still, investors should recall that ETH also dipped below its realized price during the 2022 cycle and continued to decline. Furthermore, Ethereum's market cap ratio to Bitcoin sits at 0.13—its lowest in nearly three years—signaling underperformance relative to BTC.

In summary, while technicals and on-chain data offer bullish cues, caution remains essential as ETH nears critical resistance levels.

Comments

0 comment