views

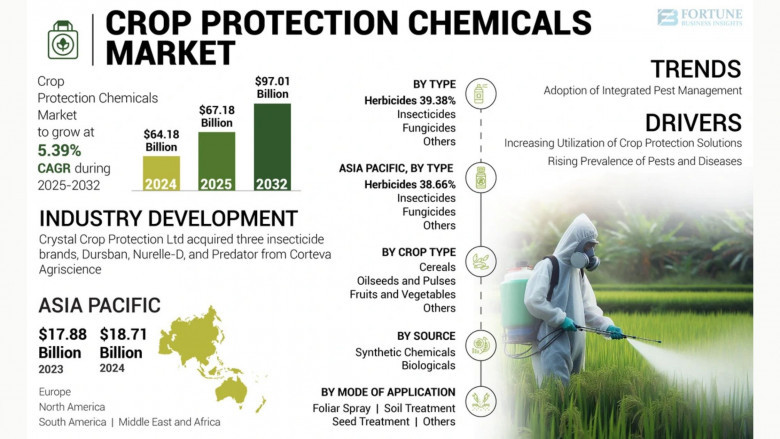

The global crop protection chemicals market was valued at USD 64.18 billion in 2024 and is forecasted to reach USD 67.18 billion in 2025, growing further to USD 97.01 billion by 2032. This growth reflects a compound annual growth rate (CAGR) of 5.39% during the forecast period (2025–2032). In the United States, the market is expected to expand significantly, reaching approximately USD 11.14 billion by 2032, driven by the adoption of advanced agricultural technologies and modern farming practices. Asia Pacific led the market in 2024 with a 29.15% share.

Crop protection chemicals—including herbicides, fungicides, and insecticides—play a critical role in minimizing crop losses caused by pests and diseases. As reported by the Royal Society of Chemistry, around 800 active chemical ingredients are approved for crop protection use globally.

Information Source: https://www.fortunebusinessinsights.com/industry-reports/crop-protection-chemicals-market-100080

Market Segmentation

The market is segmented by type into herbicides, fungicides, insecticides, and others. By crop type, it includes cereals, fruits & vegetables, oilseeds & pulses, and others. Based on the mode of application, the categories are seed treatment, soil treatment, foliar spray, and others. Regionally, the market is analyzed across North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

Report Scope

This comprehensive report evaluates market growth drivers, challenges, and opportunities. It includes in-depth analysis of key market segments, strategic initiatives by major players, and the impact of regional dynamics on overall market development.

Key Market Drivers and Challenges

Increasing Focus on Agricultural Yield Enhancement to Propel Market Expansion

Integrated pest management (IPM) practices—such as biological control methods, use of pest-resistant crop varieties, and modifications in agricultural techniques—are becoming popular among farmers due to their long-term effectiveness and minimal environmental impact. These methods emphasize reducing risks to human and animal health while improving crop productivity. According to India’s Directorate of Plant Protection, Quarantine & Storage, IPM techniques have led to yield increases of 40.14% in rice and 26.63% in cotton crops.

The transition to improved crop management practices and the growing use of crop protection solutions have contributed to a decline in insect pest-related losses, from 13.6% post-Green Revolution to 10.8% by the early 21st century. However, the emergence of pesticide-resistant pest species poses a potential threat to market growth.

Regional Insights

Asia Pacific to Lead with Expanding Agricultural Needs

With a market size of USD 16.54 billion in 2020, Asia Pacific is expected to dominate throughout the forecast period. The region's heavy dependence on agriculture, coupled with population growth and food security concerns, is fueling demand for crop protection products. In contrast, regions like North America and Europe are transitioning toward sustainable agriculture, with a growing emphasis on bio-based and eco-friendly crop protection alternatives.

Competitive Landscape

Collaborations and Acquisitions Drive Competitive Edge

Key market participants are focusing on diversifying their crop protection portfolios through acquisitions and strategic alliances. These moves aim to strengthen market presence and offer innovative, effective pest control solutions.

Key Companies Featured in the Report

- Rotam CropSciences Ltd (China)

- UPL Ltd. (India)

- ChemChina (China)

- Corteva, Inc. (U.S.)

- Syngenta AG (Switzerland)

- Nufarm (Australia)

- Sumitomo Chemicals (Japan)

- FMC Corporation (U.S.)

- BASF SE (Germany)

- Bayer CropScience (Germany)

Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/crop-protection-chemicals-market-100080

Industry Developments

- May 2020: FMC Corporation acquired the intellectual property rights and technology related to Fluindapyr, a novel fungicide active ingredient, from Isagro S.p.A. for approximately USD 60 million.

- March 2020: Corteva Agriscience partnered with AgPlenus in a multi-year collaboration to develop next-generation herbicides, leveraging their combined expertise to enhance Corteva’s product pipeline.