views

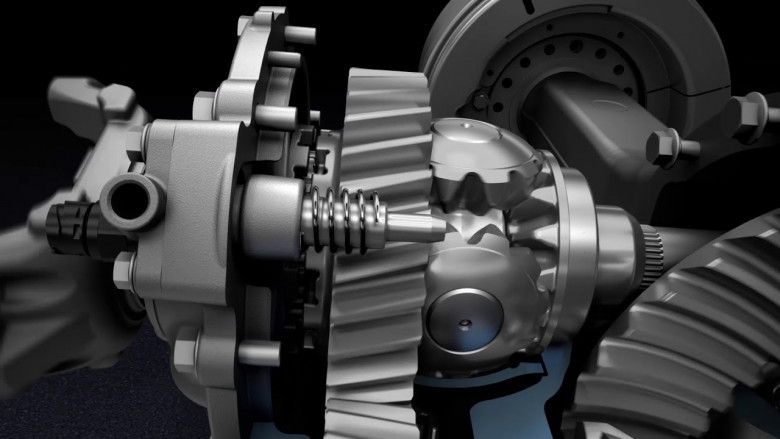

Automotive differentials are critical drivetrain components that distribute torque between wheels, ensuring optimal traction and stability across diverse driving conditions. The market encompasses a range of differential types—open, limited-slip, locking, and torque-vectoring—each offering unique benefits, from improved handling to enhanced off-road capability. Advancements such as electronically controlled differential systems have boosted performance by enabling real-time torque adjustments, which reduce wheel slip and contribute to fuel efficiency. Rising adoption of electric vehicles and all-wheel-drive configurations in passenger cars and light commercial vehicles underscores the demand for sophisticated differentials that align with modern powertrain architectures.

Additionally, the aftermarket segment is witnessing steady growth as automotive companies and service providers upgrade conventional systems to meet stringent emission norms and safety regulations. With increasing consumer focus on vehicle dynamics and comfort, Automotive Differential Market are also being integrated with advanced driver-assistance systems (ADAS) to support functions like torque vectoring for enhanced cornering stability.

The Global Automotive Differential Market is estimated to be valued at USD 25.86 Bn in 2025 and is expected to reach USD 35.67 Bn by 2032, growing at a compound annual growth rate (CAGR) of 4.7% from 2025 to 2032.

Key Takeaways

Key players operating in the Automotive Differential Market are:

-American Axle & Manufacturing Inc.

-BorgWarner Inc.

-Dana Incorporated

-Hyundai WIA Corporation

-TEKT Corporation

These market players hold significant industry share and leverage robust R&D and strategic alliances to sustain competitive advantage. Through capacity expansions and joint ventures, they enhance market revenue streams, strengthen market growth strategies, and address market challenges effectively, thereby reinforcing their leadership in global market dynamics.

Expanding electric vehicle adoption and the surge in hybrid powertrain installations present substantial market opportunities for differential manufacturers. As automakers pursue electrification, the demand for electric differentials and compact, lightweight units with high torque-handling capacity grows, creating new market opportunities in both OEM and aftermarket segments. Furthermore, increasing off-road recreation and demand for sport utility vehicles fuel aftermarket upgrades, driving revenue potential. Manufacturers can capitalize on this by investing in lean manufacturing and modular designs to enhance market scope and optimize supply chains. These strategies align with broader market trends toward sustainability and performance.

E-differential integration has emerged as a pivotal technological advancement, enabling precise torque vectoring and seamless coordination with vehicle stability control systems. This innovation supports enhanced cornering agility and traction management, particularly in all-wheel-drive electric and hybrid vehicles. Real-time torque modulation through electronic controls improves energy efficiency and responsive handling, reflecting significant progress in market research and market insights. Advanced sensors and software algorithms embedded in e-differentials contribute to evolving market segments by offering predictive maintenance and diagnostics. Such developments underscore the transformative impact of electronic differential systems on industry trends and future market analysis.

Market Drivers

One of the primary market drivers propelling the Automotive Differential Market is the accelerating shift towards vehicle electrification and advanced powertrain architectures. Electric and hybrid vehicles require specialized differentials—commonly known as e-differentials—that seamlessly integrate electric motors with differential mechanisms to manage torque distribution electronically. This transition is fueled by stringent emission regulations, consumer demand for greener mobility, and government incentives supporting electric vehicle adoption. E-differentials deliver key benefits, including enhanced energy recovery, precise torque vectoring, and improved vehicle stability under diverse driving scenarios. Additionally, these systems enable manufacturers to optimize packaging and reduce mechanical complexity by eliminating conventional driveshafts and axle differentials in some EV platforms. Consequently, investment in R&D, coupled with collaborative initiatives between automakers and component suppliers, is fostering innovation in differential technology. This driver not only amplifies market revenue potential but also shapes future market growth strategies, reinforcing the importance of electronic differentials in achieving sustainable business growth.

Current Challenges in the Automotive Differential Market

The automotive differential market is grappling with multiple market challenges that influence industry size and business growth. Stringent emission norms and evolving emission-control standards are reshaping design requirements, driving manufacturers to develop low-friction components and lightweight alloys. At the same time, fluctuating raw material costs introduce market restraints, causing unpredictable production expenses and squeezing profit margins. The shift toward electric vehicles presents both market opportunities and hurdles, as traditional mechanical differentials must evolve or be replaced by innovative e‐axle systems. Additionally, supply chain disruptions and semiconductor shortages have exposed vulnerabilities in procurement and testing, slowing down product rollout and hampering market growth strategies. As a result, companies are investing more in market research and leveraging advanced analytics to improve resilience, optimize inventory, and strengthen relationships with tier‐1 suppliers. Finally, the rise of autonomous driving prototypes introduces new load profiles and torque demands that challenge existing differential designs and require robust validation protocols.

SWOT Analysis

Strength:

• Extensive expertise in precision gearing and material engineering positions established manufacturers to address evolving market trends and maintain high industry share.

• Strong R&D budgets enable rapid prototyping of novel differential configurations—such as torque-vectoring systems—boosting overall business growth.

Weakness:

• Heavy reliance on legacy manufacturing lines limits agility when adapting to electric‐vehicle compatible differentials, impeding swift rollouts of advanced solutions.

• High tooling and validation costs for new differential variants strain profitability, especially amid intense competition and thinning margins.

Opportunity:

• Growing demand for all‐wheel and electric‐vehicle platforms offers lucrative market opportunities to introduce modular, electronics‐integrated differential assemblies.

• Collaborative ventures between OEMs and specialized startups on smart driveline components can unlock fresh avenues for market expansion and diversified revenue streams.

Threats:

• Intensifying price wars and aggressive pricing by low‐cost region suppliers could erode premium product positioning and suppress average selling prices.

• Potential regulatory shifts regarding recycling and end‐of‐life vehicle mandates may impose additional compliance burdens, elevating aftermarket service costs.

Geographical Regions

Regions by Market Value Concentration

North America and Western Europe collectively dominate the automotive differential market in terms of value due to high adoption of premium vehicles and robust aftermarket ecosystems. Advanced manufacturing hubs in Germany, the United States, and Japan benefit from strong automotive heritage, which supports sophisticated gear machining capabilities. Market analysis indicates that these regions enjoy well‐established distribution networks for OEM and aftermarket differentials, ensuring consistent aftermarket revenue and reinforcing market share. Meanwhile, emerging economies in Asia Pacific—especially China and India—are gradually increasing contribution to overall industry revenue as local OEMs scale up production of passenger and light commercial vehicles.

Fastest Growing Region

Asia Pacific is poised as the fastest‐growing region for automotive differentials, driven by rapid urbanization, rising disposable incomes, and government incentives for electric vehicle adoption. China leads in EV sales, creating high demand for specialized e‐axles and torque‐vectoring differentials. India’s expanding passenger vehicle segment and South Korea’s focus on advanced driveline R&D also contribute to surging growth rates. In South America, favorable trade agreements and growing light commercial vehicle fleets further bolster regional expansion. Increasing investments in plant capacity, localized supply chains, and targeted market growth strategies amplify Asia Pacific’s trajectory in this dynamic market.

‣ Get this Report in Japanese Language: 自動車用差動装置市場

‣ Get this Report in Korean Language: 자동차차동장치시장

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)