views

Market Overview:

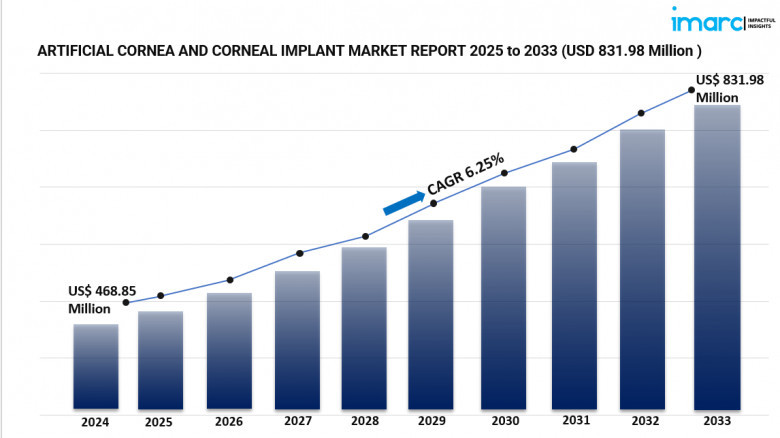

The global artificial cornea and corneal implant market is experiencing significant growth, driven by the rising prevalence of corneal diseases and advancements in ophthalmic technologies. In 2024, the market was valued at USD 468.85 million and is projected to reach USD 831.98 million by 2033, exhibiting a CAGR of 6.25% during 2025-2033. Key factors contributing to this growth include the increasing incidence of corneal infections, the expansion of healthcare facilities, and the growing demand for full-thickness corneal transplantation. Additionally, the surge in vision problems among younger populations due to prolonged screen time and the aging global population further propel market expansion.

Study Assumption Years:

-

Base Year: 2024

-

Historical Years: 2019-2024

-

Forecast Years: 2025-2033

Artificial Cornea and Corneal Implant Market Key Takeaways:

-

Market Size & Growth: Valued at USD 468.85 million in 2024, the market is expected to reach USD 831.98 million by 2033, growing at a CAGR of 6.25% during 2025-2033.

-

Regional Dominance: North America leads with a 50.5% market share, driven by advanced healthcare infrastructure and high prevalence of corneal disorders.

-

Type Preference: Human cornea remains the preferred choice due to its superior biocompatibility and effectiveness in vision restoration.

-

Transplant Techniques: Penetrating keratoplasty holds the largest share among transplant types, effectively treating various serious corneal conditions.

-

Disease Indication: Fuchs' dystrophy accounts for 52.5% of the market share, primarily affecting the aging population.

-

End Users: Hospitals dominate with 57.5% share, attributed to their advanced infrastructure and availability of skilled ophthalmologists.

-

Technological Advancements: Innovations in bioengineered corneas and cell therapies are enhancing treatment outcomes and expanding patient access.

Request for a sample copy of this report: https://www.imarcgroup.com/artificial-cornea-corneal-implant-market/requestsample

Market Growth Factors:

1. Innovations in Ophthalmic Technology:

Technological advances related to ophthalmic devices, which have as an imperative the improvement of patient outcomes, greatly affect the artificial cornea and corneal implant market. Bioengineered corneas, cell therapies, and synthetic matrices are introducing a new paradigm in the treatment methodologies. Vyznova® for bullous keratopathy in Japan is the first such introduction of cell therapies in corneal endothelial disease treatment. These advances do not only improve treatment efficacy but also make unnecessary the use of donor tissues, which is a pressing issue globally. Advanced such technologies for patient treatments are also being made accessible worldwide through collaborative efforts between biotech companies and research institutions for the speedy development and commercialization of such technologies.

2. Old Population Rising:

The world increasing aging population is a big driver for the artificial cornea and corneal implant market. Age-related eye problems like Fuchs' dystrophy and keratoconus are more often seen in older adults, making them in need of a very effective treatment solution. In the United States, nearly 12 million adults beyond age 40 have vision impairment. As life expectancy keeps on rising, there will be a significant jump in the number of people who require vision corrective surgeries, including corneal transplant procedures. The artificial corneas and implants make for good alternatives to the surgery for aged patients who may not be potential candidates for conventional transplants due to inherent health complexities. This trend emulates the need to develop and keep treatments as accessible as possible for symptoms concerning age-related ocular diseases.

3. Increased Awareness and Healthcare Investments:

Market expansion is gaining steam through awareness about eye health and advanced vision solutions. Patients and doctors alike are being educated on the options and benefits of artificial corneas and implants by health care outreach and education campaigns. Furthermore, these advanced medical procedures become more available from increased spending on health care, especially in developing regions. Such sound government and fund initiatives as the $6.5 million allocation by the U.S. government for vision and eye health programs at the CDC show a bigger commitment to better facilities around eye care. In this way, advance availability of the newest ophthalmic treatment will be seen, allowing moves into the market.

Market Segmentation:

By Type:

-

Human Cornea: Preferred for its superior biocompatibility and effectiveness in restoring vision, making it the gold standard in corneal transplants.

-

Artificial Cornea: Synthetic alternatives designed to replace damaged corneas, especially beneficial when donor tissues are unavailable or unsuitable.

By Transplant Type:

-

Penetrating Keratoplasty: Full-thickness corneal transplant technique effective for various serious corneal disorders, offering significant improvement in vision.

-

Endothelial Keratoplasty: Selective replacement of the innermost corneal layer, suitable for conditions like Fuchs' dystrophy, with faster recovery times.

-

Anterior Lamellar Keratoplasty: Partial-thickness transplant targeting the front layers of the cornea, preserving healthy endothelial cells.

-

Keratoprosthesis: Use of artificial corneas for patients unsuitable for traditional transplants, providing an alternative solution for vision restoration.

By Disease Indication:

-

Fuchs' Dystrophy: A degenerative eye disease leading to corneal swelling and vision impairment, often requiring surgical intervention.

-

Fungal Keratitis: A fungal infection of the cornea that can cause severe vision loss if not promptly treated.

-

Keratoconus: A progressive thinning of the cornea leading to a cone-shaped deformity, affecting visual acuity.

-

Others: Includes various other corneal conditions necessitating implant interventions for vision correction.

By End User:

-

Hospitals:

Equipped with advanced surgical tools and experienced ophthalmologists, hospitals account for the majority of corneal transplant procedures, ensuring optimal patient care and recovery. -

Ophthalmic Clinics:

Specialize in eye care and offer personalized treatments and follow-ups, making them a preferred option for non-emergency corneal implant procedures. -

Ambulatory Surgical Centers:

Provide outpatient services with cost-effective and efficient care for minor corneal surgeries, contributing to reduced hospitalization times.

Breakup by Region:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Regional Insights:

North America dominates the artificial cornea and corneal implant market, holding a 50.5% share in 2024. This growth is attributed to its well-established healthcare infrastructure, rising incidence of corneal diseases, and strong adoption of advanced ophthalmic technologies. Additionally, government funding and the presence of leading industry players further enhance the region’s market outlook.

Recent Developments & News:

The market has witnessed several notable advancements, such as the launch of Vyznova® in Japan for treating bullous keratopathy using corneal endothelial cell therapy—marking a major leap in regenerative medicine. Moreover, Aurion Biotech’s FDA-approved IND clearance for its cell therapy product and a successful Phase 1 trial in the U.S. underscore the growing traction of innovative treatments. These developments reflect a strong focus on biotechnology and regenerative approaches to restore vision effectively.

Key Players:

-

Advancing Sight Network

-

AJL Ophthalmic S.A.

-

Aurolab

-

Corneat Vision Ltd

-

EyeYon Medical

-

Florida Lions Eye Bank

-

Keramed Inc.

-

L V Prasad Eye Institute

-

LinkoCare Life Sciences AB

-

Mediphacos

-

Presbia PLC

-

San Diego Eye Bank

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=4961&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Comments

0 comment