views

5 Key Factors That Influence Agricultural Land Prices

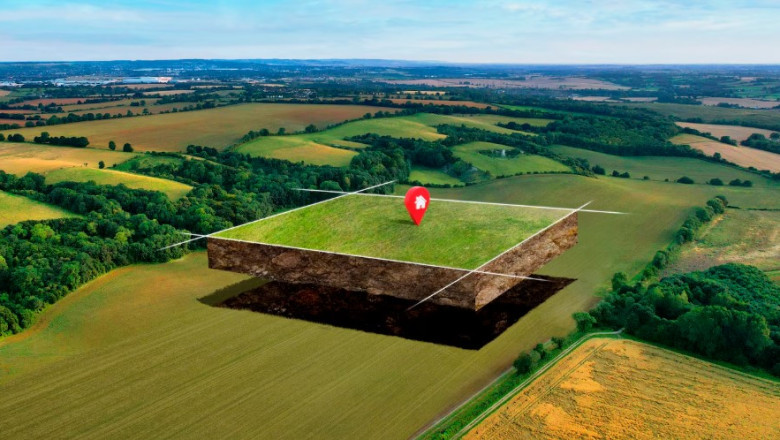

Agricultural land is a valuable asset, but its price isn’t set in stone. Farmers, investors, and landowners often struggle to determine what truly drives land value. A piece of farmland that sells for a premium in one region might be significantly cheaper in another, even if they seem identical on the surface. So, what makes the difference? Understanding the key factors that influence agricultural land valuation is crucial for making informed investment decisions. Here’s what truly dictates the price of farmland and how it impacts buyers and sellers.

1. Location and Accessibility

Location remains a defining factor in property valuation in Sydney and across Australia. Buyers aren’t just purchasing land; they’re investing in its potential for productivity, transport, and access to resources. A remote farm may offer vast acreage at a lower cost, but the hidden expenses of poor accessibility can quickly outweigh the initial savings.

-

Proximity to Major Markets and Distribution Centers

Being close to urban centres, processing facilities, and export hubs can significantly increase land value. Farms near major markets enjoy lower transportation costs, making them more attractive to commercial buyers and investors. In contrast, land situated far from distribution channels often faces a devaluation due to logistical challenges.

-

Infrastructure and Road Access

Road quality matters. A well-connected farm with sealed roads and easy vehicle access holds far more value than one reliant on dirt tracks that become impassable after heavy rains. Poor infrastructure not only increases operational costs but also limits expansion opportunities. Land value in Sydney is heavily tied to infrastructure investments, making it a major consideration for buyers.

-

Regional Climate and Agricultural Suitability

Certain locations are inherently better for agriculture than others. Regions with stable rainfall, favourable temperatures, and minimal risk of extreme weather attract higher valuations. Climate change is also reshaping land prices, with areas experiencing frequent droughts or floods becoming riskier investments.

2. Soil Quality and Productivity

Even the most well-located land won’t hold value if it lacks soil fertility. Farmers know that poor soil means lower yields, higher input costs, and long-term losses. Property valuers in Sydney NSW assess soil quality as a critical factor in valuation.

-

Soil Type and Fertility Levels

High-quality soil rich in organic matter, essential nutrients, and proper drainage capabilities boost land productivity. Conversely, sandy or clay-heavy soils with poor retention capacity require costly amendments, reducing land appeal. Buyers conduct soil tests before purchasing farmland to ensure its long-term viability.

-

Water Availability and Irrigation Potential

Water scarcity is a pressing issue in many parts of Australia. Land with reliable access to water bodies, underground reserves, or government-supported irrigation schemes commands a premium. Without proper water resources, even the most fertile land becomes a liability.

-

Environmental Regulations and Conservation Practices

Strict environmental laws can impact agricultural land use. Some regions impose conservation restrictions, limiting chemical usage, water access, or land clearing. While such regulations protect ecosystems, they can also reduce land profitability, affecting agricultural land valuation.

3. Economic and Market Trends

Land prices don’t operate in a vacuum. Economic forces shape the agricultural market, often causing fluctuations in land values. Investors must stay ahead of these trends to make profitable decisions.

-

Supply and Demand in Agricultural Real Estate

Farmland availability is decreasing due to urban expansion, climate risks, and policy changes. When supply shrinks, prices rise. However, if demand falls due to economic downturns, even prime land can lose value. Understanding regional supply-demand dynamics is essential for smart investing.

-

Commodity Prices and Crop Selection

Profitable crops make land more valuable. If certain crops experience price surges in global markets, the demand for land suitable for their cultivation increases. Investors eyeing property valuation in Sydney often look at long-term commodity trends before making a purchase.

4. Land Use and Zoning Regulations

Government zoning laws dictate what land can be used for, directly influencing its worth. A piece of farmland designated strictly for agriculture may be cheaper than land with zoning flexibility.

-

Agricultural vs. Commercial and Residential Zoning

Land that can be converted for residential or commercial use holds higher value due to increased development potential. Agricultural zoning restrictions keep land prices relatively lower, but they ensure long-term farming stability.

-

Conservation Easements and Land Restrictions

Some properties come with legally binding agreements to preserve natural landscapes or limit development. While this is beneficial for conservation efforts, it restricts agricultural expansion, making some plots less attractive to buyers.

-

Future Development and Urban Expansion

Farmland near growing cities tends to appreciate in value as urban sprawl pushes demand for residential and commercial land. Investors looking for long-term gains often purchase farmland on the outskirts of expanding urban centres.

5. Interest Rates and Financing Options

Land affordability is directly tied to interest rates. Even the best farmland can be out of reach if financing conditions are unfavourable.

-

The Role of Interest Rates in Land Investment

When interest rates rise, borrowing becomes expensive, reducing the number of potential buyers. Lower interest rates make financing land easier, driving up prices due to increased demand. Smart investors keep an eye on national interest rate trends before making purchasing decisions.

-

Financing Options and Loan Accessibility

Lenders assess farmland differently from residential or commercial properties. Access to government-backed agricultural loans, grants, and subsidies can influence how easily buyers secure financing. Limited access to funding can hinder land sales, while favourable lending conditions boost the market.

Conclusion

Agricultural land valuation isn’t a simple equation—it’s a dynamic interplay of location, soil quality, economic trends, zoning laws, and financial conditions. Buyers looking to invest in farmland must weigh these factors carefully to avoid costly mistakes. Whether it’s ensuring good road access, testing soil quality, or keeping up with economic shifts, understanding these elements is key to making a sound investment.

For those navigating the complexities of property valuers in Sydney NSW, seeking expert advice is invaluable. A strategic approach to land investment can mean the difference between long-term prosperity and financial setbacks. By staying informed, investors and farmers can maximise their opportunities and secure farmland that holds its value for years to come.

![[1 (888) 326-1024] How to Get in Touch with Expedia 24/7 Support Team: Phone, Email, and Chat Options](https://timessquarereporter.com/upload/media/posts/2025-06/01/1-888-326-1024-how-to-get-in-touch-with-expedia-24-7-support-team-phone-email-and-chat-options_1748757002-s.jpg)

Comments

0 comment