Managing payroll is one of the most important responsibilities for small business owners. Employees rely on timely and accurate paychecks, and businesses must ensure compliance with tax regulations and labor laws. However, manual payroll processing can be time-consuming and prone to errors.

This is where a payroll check generator becomes a game-changer. A payroll check generator helps small businesses automate payroll, create accurate pay stubs, and ensure employees receive their wages on time.

In this article, we’ll cover:

✔️ What a payroll check generator is

✔️ Why small businesses need one

✔️ The best payroll check generators available

✔️ Key features to look for

✔️ How to choose the right payroll tool

What Is a Payroll Check Generator?

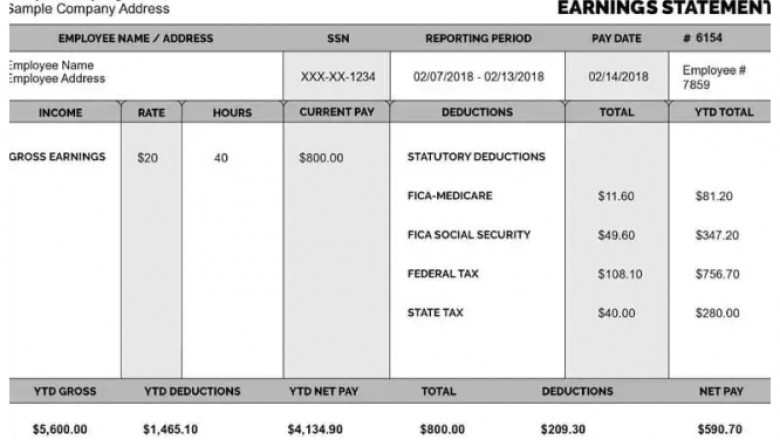

A payroll check generator is an online tool or software that allows businesses to create paychecks and pay stubs quickly and accurately. These tools calculate gross wages, tax withholdings, deductions, and net pay, ensuring that employees receive error-free paychecks.

A good payroll check generator can:

✔️ Automate payroll calculations

✔️ Generate professional pay stubs

✔️ Calculate tax withholdings accurately

✔️ Ensure compliance with labor laws

✔️ Save time and reduce payroll errors

For small businesses that don’t have an in-house payroll team, using a payroll check generator can make payroll management simple and stress-free.

Why Small Businesses Need a Payroll Check Generator

For small businesses, managing payroll manually can be a hassle. Here’s why a payroll check generator is a must-have:

✅ Saves Time

Manually calculating wages, deductions, and taxes for each employee can take hours. A payroll check generator automates the process, allowing you to generate paychecks and pay stubs in minutes.

✅ Reduces Payroll Errors

Even small miscalculations in taxes or wages can cause legal and financial issues. A payroll generator ensures accuracy by automatically calculating:

✔️ Gross pay and net pay

✔️ Federal and state tax deductions

✔️ Social Security and Medicare deductions

✅ Ensures Compliance with Tax Laws

Using a payroll check generator helps small businesses stay compliant with IRS regulations and avoid penalties for incorrect tax reporting.

✅ Provides Professional Pay Stubs

Employees need pay stubs for financial transactions such as:

✔️ Loan applications

✔️ Rental agreements

✔️ Tax filing

A payroll check generator creates professional, detailed pay stubs that serve as valid proof of income.

✅ Affordable and Easy to Use

Most payroll check generators are cost-effective and don’t require complex setup. Even businesses with a small budget can find free or low-cost options to handle payroll efficiently.

Best Payroll Check Generators for Small Businesses

Now that you understand why a payroll check generator is essential, let’s explore some of the best tools available:

1. Gusto – Best for All-in-One Payroll Management

⭐ Best for: Small businesses needing full payroll automation

💰 Pricing: Starts at $40/month + $6 per employee

Features:

✔️ Full payroll automation with direct deposit

✔️ Automatic tax filing for federal, state, and local taxes

✔️ Employee self-service portal for pay stubs and W-2s

✔️ Benefits management (health insurance, 401k, etc.)

Gusto is a great all-in-one payroll solution for businesses that need more than just check stubs.

2. QuickBooks Payroll – Best for QuickBooks Users

⭐ Best for: Businesses already using QuickBooks Accounting

💰 Pricing: Starts at $45/month + $6 per employee

Features:

✔️ Automatic payroll processing

✔️ Same-day direct deposit available

✔️ Tax calculation and filing included

✔️ Seamless integration with QuickBooks Accounting

If you already use QuickBooks, their payroll service is a great choice to keep all financial records in one place.

3. ADP Payroll – Best for Growing Businesses

⭐ Best for: Businesses planning to scale

💰 Pricing: Custom pricing (varies by business size)

Features:

✔️ Scalable payroll services for small to large businesses

✔️ Direct deposit & paper check printing

✔️ Tax compliance and filing

✔️ HR and benefits management tools

ADP Payroll is ideal for small businesses that want a scalable solution with HR and compliance features.

4. Paychex – Best for Compliance and Security

⭐ Best for: Businesses needing tax and HR compliance

💰 Pricing: Custom pricing

Features:

✔️ Automated payroll processing

✔️ Tax and labor law compliance tools

✔️ Employee benefits management

✔️ Direct deposit & check printing

Paychex is a good option for businesses that prioritize compliance and security.

5. Check Stub Maker – Best for Simple Pay Stub Generation

⭐ Best for: Small businesses and freelancers needing quick pay stubs

💰 Pricing: Free basic version, paid options available

Features:

✔️ Instant pay stub generation

✔️ No sign-up required

✔️ Basic tax calculations included

✔️ Download and print in minutes

For businesses that only need pay stub creation (without full payroll services), Check Stub Maker is a quick and cost-effective solution.

How to Choose the Right Payroll Check Generator

With so many options available, here’s how to find the best payroll check generator for your small business:

1. Consider Your Business Needs

✔️ Do you need full payroll processing or just pay stub generation?

✔️ Do you have multiple employees, or are you a solo business owner?

✔️ Do you want direct deposit capabilities?

2. Look for Key Features

The best payroll check generators should include:

✔️ Accurate tax calculations

✔️ Customizable pay stubs

✔️ Direct deposit or check printing options

✔️ Secure and easy-to-use interface

3. Compare Pricing

✔️ If you only need pay stubs, a free payroll check generator may be enough.

✔️ If you need full payroll processing, investing in a paid service might be worth it.

4. Check for Tax Compliance

Make sure the payroll tool complies with IRS tax regulations and offers automatic tax filing if needed.

5. Read User Reviews

Check customer reviews and ratings to ensure the tool is reliable and user-friendly.

Final Thoughts: Choosing the Best Payroll Check Generator

A payroll check generator is essential for small businesses to automate payroll, save time, and reduce errors. Whether you need full payroll services or just a pay stub maker, there are affordable and efficient options available.

💡 Key Takeaways:

✔️ Gusto & QuickBooks Payroll – Best for full payroll automation

✔️ ADP & Paychex – Best for businesses focused on compliance and security

✔️ Check Stub Maker – Best for quick and affordable pay stub generation

Comments

0 comment