views

Capital Gain Bonds in India? A Smart Tax-Saving Investment Option

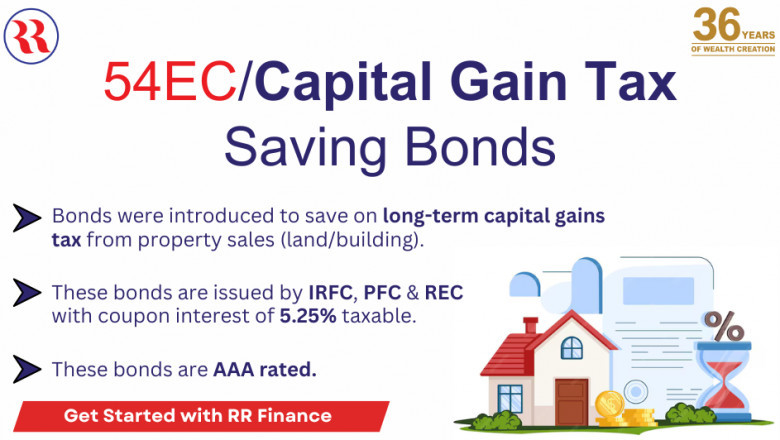

When selling a property, one of the biggest concerns for investors is the long-term capital gains tax, which can significantly reduce profits. Fortunately, the Indian government offers a tax-efficient way to reinvest these gains—Capital Gain Bonds in India, governed by Section 54EC of the Income Tax Act, 1961. These bonds allow individuals to save on capital gains tax while benefiting from secure and steady returns.

What Are Capital Gain Bonds?

Capital gain bonds are government-backed financial instruments designed for investors looking to reinvest capital gains from the sale of property. Instead of paying the standard 20% long-term capital gains tax, investors can allocate their gains into these bonds, which offer tax exemption under Section 54EC.

Issued by reputable public-sector organizations such as:

- Rural Electrification Corporation (REC)

- National Highways Authority of India (NHAI)

- Indian Railway Finance Corporation (IRFC)

These bonds provide a low-risk investment avenue while channeling funds into infrastructure projects that contribute to India’s economic growth.

Key Features of Capital Gain Bonds

Tax Exemption on Capital Gains

Investing in Section 54EC capital gain bonds helps investors save tax on long-term capital gains from property sales, making it a financially prudent choice.Investment Limit

Investors can invest up to ₹50 lakh in these bonds within six months of selling their asset to avail tax benefits.Lock-in Period

Capital gain bonds come with a mandatory five-year lock-in period, ensuring financial discipline while providing a reliable investment.Fixed Interest Rate

These bonds offer stable returns through fixed interest rates, making them attractive to risk-averse investors.Low Risk and High Security

Since these bonds are issued by government-backed companies, they come with minimal risk, ensuring that investors’ money remains secure even during market fluctuations.

How to Invest in Capital Gain Bonds?

Investing in capital gain bonds is a simple process. Investors can purchase them directly from issuing institutions like REC, NHAI, and IRFC either online or through designated branches. The bonds are available in both physical and dematerialized (Demat) formats, making them accessible to different types of investors.

Who Should Consider Investing in Capital Gain Bonds?

Capital gain bonds are ideal for:

- Individuals who have recently sold a property and want to reduce their tax burden.

- Investors seeking low-risk, fixed-income investments.

- Those looking to contribute to infrastructure development while securing tax benefits.

Final Thoughts

Capital Gain Bonds in India provide an excellent opportunity for investors to save on capital gains tax while enjoying steady, risk-free returns. With a fixed lock-in period, government backing, and tax exemptions, these bonds serve as a smart investment option for individuals looking to maximize their financial benefits. By making informed investment decisions, investors can protect their wealth, grow their savings, and contribute to India’s economic development.

Before investing, it is always advisable to review the terms, compare issuers, and consult a financial advisor to ensure that capital gain bonds align with your financial goals.

Comments

0 comment