views

The Ultimate Guide to Payroll Management Services: Benefits and Best Practices

In today’s fast-paced enterprise world, coping with payroll correctly is crucial for every corporation. Payroll management services help corporations streamline profits processing, tax calculations, compliance, and employee blessings even as lowering administrative burdens. Whether you run a small startup or a massive business enterprise, outsourcing payroll can save time, enhance accuracy, and enhance worker pleasure.

What Are Payroll Management Services?

Payroll management services encompass the management of worker salaries, tax deductions, blessings, and compliance with labor legal guidelines. These services make sure that employees are paid accurately and on time at the same time as keeping businesses compliant with tax guidelines and hard work guidelines.

Payroll processing is greater than simply issuing paychecks; it includes several important duties together with:

Salary calculations

Tax deductions and filings

Direct deposit processing

Compliance with federal and national guidelines

Employee benefits and deductions management

Payroll reviews and analytics

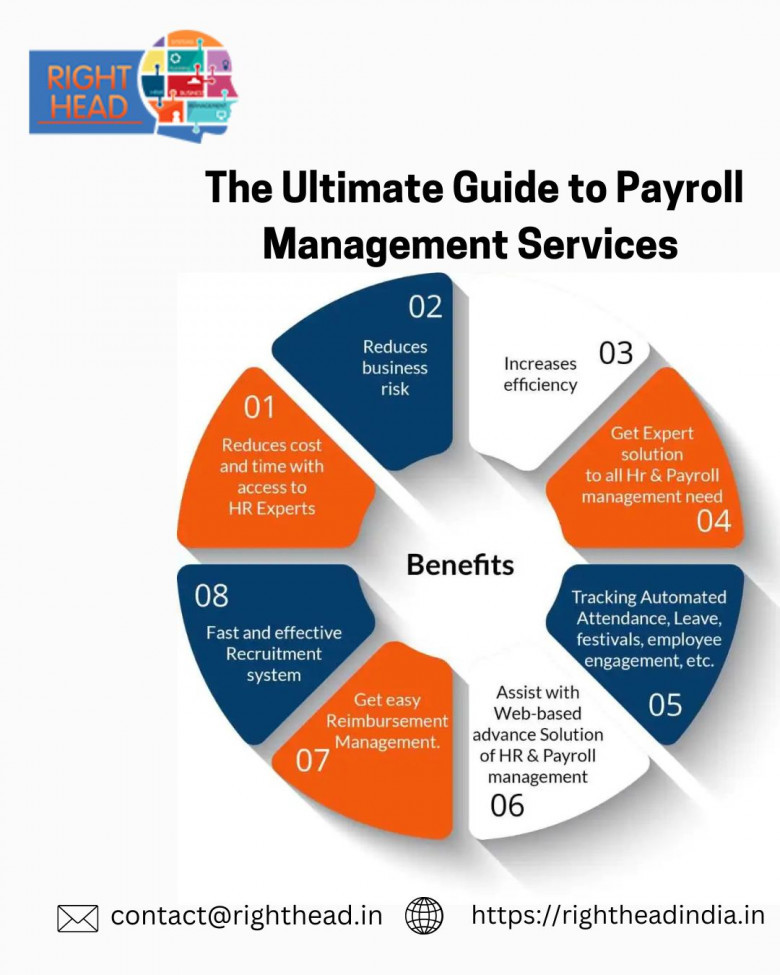

Key Benefits of Payroll Management Services

1. Time and Cost Savings

Handling payroll internally can be time-ingesting and costly. Payroll management offerings help groups reduce charges via lowering the need for in-residence payroll workforce and minimizing human errors which can cause costly consequences.

2. Compliance with Tax Laws

Tax policies often change, making it difficult for groups to live updated. Payroll companies ensure compliance with tax legal guidelines, lowering the hazard of fines and penalties.

3. Accuracy and Reduced Errors

Manual payroll processing is liable to errors that can cause employee dissatisfaction and felony issues. Payroll control services use automated systems that reduce errors and ensure timely income disbursement.

4. Enhanced Data Security

Payroll facts are sensitive and should be included from unauthorized get right of entry to. Reputable payroll carrier carriers use encryption and stable information storage to guard employee facts.

5. Focus on Core Business Activities

Outsourcing payroll lets organizations pay attention to their core operations instead of getting slowed down with administrative responsibilities. This improves ordinary productivity and performance.

How Payroll Management Services Work

The payroll management method includes numerous steps to make certain seamless payroll execution:

Employee Information Collection: Payroll companies collect employee details, including salaries, tax information, and benefits.

Salary and Tax Calculation: The payroll machine calculates gross salaries, tax deductions, and other withholdings.

Approval Process: Payroll reviews are reviewed and authorized earlier than processing bills.

Salary Disbursement: Employees obtain their salaries through direct deposits or checks.

Tax Filing and Compliance: The payroll company ensures that tax filings are correct and submitted on time.

Reporting and Record-Keeping: Businesses acquire payroll reviews for report-retaining and audits.

Choosing the Right Payroll Management Service Provider

When deciding on a payroll provider provider, keep in mind the following factors:

Industry Experience: Choose a company with knowledge of your enterprise’s payroll necessities.

Compliance Assurance: Ensure the provider stays up to date with tax laws and exertions guidelines.

Security Measures: Opt for a company that uses encrypted and stable systems.

Scalability: Choose a service which could develop with your enterprise desires.

Customer Support: Reliable customer support is crucial for resolving payroll-related troubles quickly.

conclusion

Payroll control offerings play a crucial role in making sure that corporations deal with employee repayment successfully at the same time as staying compliant with tax laws. Outsourcing payroll can help organizations keep time, reduce errors, beautify security, and improve usual productivity.If you’re searching out a dependable payroll management service, invest in a provider that gives steady, accurate, and compliant payroll solutions tailor-made for your commercial enterprise needs. By doing so, you’ll be capable of focusing on what clearly subjects—developing your commercial enterprise and achieving long-term success.

Comments

0 comment