views

Sustainable finance refers to financial services that integrate environmental, social, and governance (ESG) criteria into investment decisions, with the goal of promoting long-term economic growth while ensuring positive societal impact and reducing environmental risks. It aims to align capital flows with sustainability objectives such as the Paris Agreement and the UN Sustainable Development Goals. At its core, sustainable finance encourages responsible investment by addressing issues like climate change, social justice, and corporate accountability. It includes products such as green bonds, ESG funds, sustainability-linked loans, and climate-related insurance products. The underlying philosophy is that finance should not only create economic value but also contribute to a more equitable and sustainable world.

Read more - https://market.us/report/sustainable-finance-market/

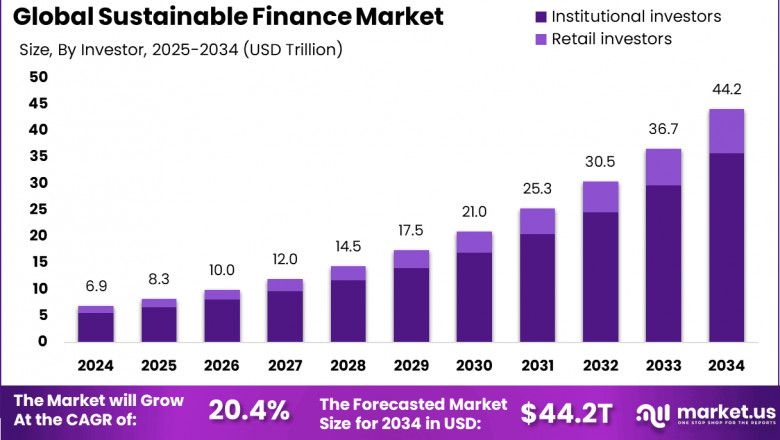

The sustainable finance market has grown from a niche segment to a central pillar in global investment strategies. Investors, institutions, and governments worldwide are increasingly shifting capital into sustainable assets, leading to rapid market expansion. This market is now witnessing steady growth across North America, Europe, and Asia-Pacific, fueled by heightened regulatory pressure, investor demand, and rising awareness of climate risks. According to recent estimates, global sustainable investment assets are projected to surpass several trillion dollars in the next few years, reflecting the scale of transformation underway in the financial ecosystem. Emerging economies are also becoming active players in this space, leveraging sustainable finance to attract green capital and fund climate-resilient infrastructure.

One of the top driving factors is the escalating threat of climate change and its economic repercussions. Investors are no longer just concerned about financial returns but are also focusing on how environmental and social risks can impact long-term portfolio stability. There is a growing demand from both retail and institutional investors for investments that are aligned with sustainability values. Corporates are under increasing scrutiny from consumers and stakeholders, pushing them to disclose ESG performance, which in turn fuels market demand for ESG-compliant financial instruments. The rise of green technology and the push for energy transition also contribute heavily to capital being redirected into clean and sustainable sectors.

Comments

0 comment