views

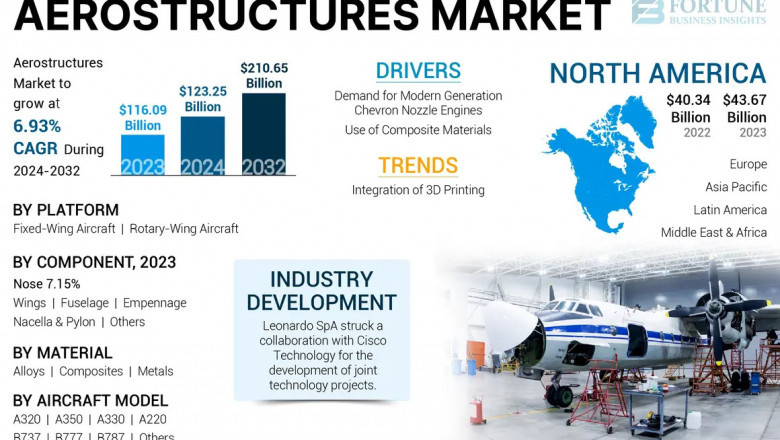

According to the Fortune Busines Insights the global aerostructures market size was valued at USD 116.09 billion in 2023. The market is projected to grow from USD 123.25 billion in 2024 to USD 210.65 billion by 2032, exhibiting a CAGR of 6.93% during the forecast period.

Aerostructures are aircraft airframe components that are combined together for forming a basic framework of an aircraft. The mounting deployment of advanced technologies such as 3D printing for producing ducts, panels, wings, and other components is anticipated to propel industry expansion over the forthcoming years.

The COVID-19 pandemic negatively affected the market owing to a decline in annual orders and deliveries of key manufacturers.

Fortune Business Insights™ provides this information in its research report, titled “Aerostructures Market Size, Share, Forecast, 2024-2032”.

List of Key Players Mentioned in the Report:

- AAR Corp (U.S.)

- Bombardier Inc (U.S.)

- SAAB AB (Sweden)

- Spirit Aerosystems Inc. (U.S.)

- Triumph Group Inc. (U.S.)

- Cyient Ltd (India)

- Elbit Systems Ltd (Israel)

- GKN Aerospace (U.K.)

- Leonardo SpA (Italy)

- The Boeing Company (U.S.)

- Airbus SAS (France)

Information Source:

https://www.fortunebusinessinsights.com/industry-reports/aerostructures-market-101663

Segmentation:

Wings Segment to Expand Driven by Mounting Demand in New-Generation Aircraft

By component, the market is divided into wings, nose, fuselage, nacelle & pylon, empennage, and others. The wings segment is poised to surge at the fastest pace over the analysis period owing to the rising demand for lighter composite wings in new-generation aircraft.

Alloys Segment Held Key Share Owing to High Demand for Various Alloy Materials

Based on material, the market is fragmented into composites, alloys, and metals. The alloys segment registered a leading share in the market in 2023 due to high demand for magnesium, aluminum, zinc, copper, and other materials in aerostructures.

Rotary-Wing Segment to Record the Highest CAGR Impelled by Rising Procurement of Military UAVs

On the basis of platform, the market is subdivided into fixed-wing aircraft and rotary-wing aircraft. The rotary-wing segment is poised to depict the highest CAGR over the analysis period due to the mounting procurement of military unmanned aerial vehicles (UAVs) for ISR applications.

A320 Segment Registered Major Share Fueled by Rise in Product Demand

Based on aircraft model, the market is segregated into A320, A350, A330, A220, B737, B777, B787, and others. In 2023, the A320 segment held a key share driven by an escalation in the demand for aerostructures for this aircraft model.

Based on geography, the market has been studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Report Coverage:

The report gives an in-depth industry analysis based on material, component, platform, aircraft model, and geography. It further presents the latest trends and the key strategies adopted by leading companies to gain a strong market foothold. The pivotal factors set to propel industry expansion have also been presented in the report.

Drivers and Restraints:

Surging Demand for Modern Generation Engines with Chevron Nozzles to Fuel Industry Expansion

There is a rising demand for modern engines equipped with chevron nozzles, which helps in noise reduction. The technology also offers the benefit of reduced acoustic levels in the exhaust. The nozzles have been adopted in the modern generation Boeing 747 and 787 aircraft. The globally rising orders of such engines is slated to augur well for aerostructures market growth over the ensuing years.

However, the high cost of product maintenance and repair may hinder industry expansion.

Regional Insights:

North America to Emerge Prominent Driven by Presence of Top OEMs

In 2023, North America market size hit a valuation of USD 43.67 billion. The region is anticipated to lead the global market considering the presence of top OEMs and the escalating demand for aerostructures across commercial airlines.

The Asia Pacific market is set to depict the highest CAGR over the projection period considering the upsurge in the number of OEMs and supportive government policies.

Competitive Landscape:

Leading Companies Introduce New Products to Retain their Industry Positions

To maintain their market positions, major industry players are focused on the launch of new products. They are also signing up for other strategies such as acquisitions and partnerships to increase their aerostructures market share. Bombardier Inc., and Airbus SAS are some of the leading companies in the global market.

Key Industry Development:

February 2024 – Senior secured two significant contracts with Airbus Atlantic and Airbus SAS. The company announced an extension to its multi-year contract with Airbus, which involves the supply and manufacturing of aircraft components that are vital for Airbus A330 and A320 aircraft programs.

![¿Cómo puedo contactar con una persona en vivo en los vuelos de Frontier? [Guía paso a paso]](https://timessquarereporter.com/public/upload/media/posts/2025-06/12/como-puedo-contactar-con-una-persona-en-vivo-en-los-vuelos-de-frontier-guia-paso-a-paso_1749705127-s.jpg)

![How Do I Get to a Live Person at Frontier Flights? [Step-by-Step Guide]](https://timessquarereporter.com/public/upload/media/posts/2025-06/12/how-do-i-get-to-a-live-person-at-frontier-flights-step-by-step-guide_1749705004-s.jpg)

Comments

0 comment