views

UK Green Bonds Market Overview

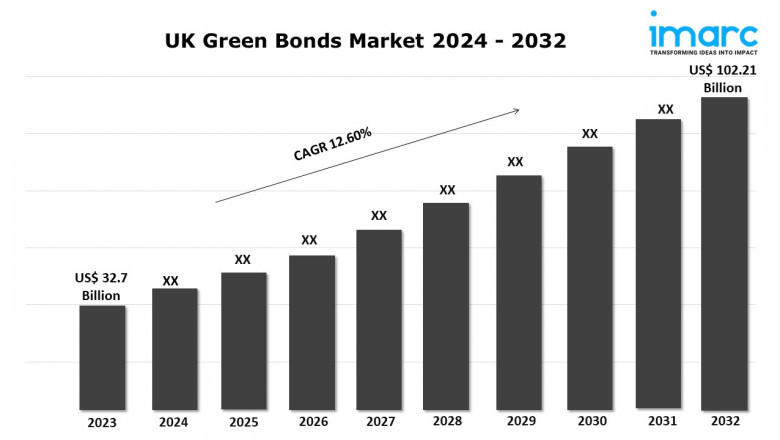

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Size in 2023: USD 32.7 Billion

Market Forecast in 2032: USD 102.21 Billion

Market Growth Rate: 12.60% (2024-2032)

How Big is the UK Green Bonds Industry ?

The UK green bonds market was valued at USD 32.7 Billion in 2023 and is projected to grow to USD 102.21 Billion by 2032, with an expected compound annual growth rate (CAGR) of 12.60% from 2024 to 2032.

UK Green Bonds Market Trends:

The UK market for green bonds is mainly being driven by the growing focus on sustainable finance and responsible investing, prodding both public and private entities to issue green bonds. The commitment by the UK government to achieve net-zero carbon emissions by 2050 has initiated financial initiatives that will propel market growth. Demand for environmentally responsible assets among institutional investors is contributing to this market growth. Rapid development of green finance frameworks and standards is now giving a structured approach that boosts investor confidence and appeal of the market.

Furthermore, this rise in awareness of climate change among companies and individuals putting green projects first is also pushing demand. Further, the widening scope of projects eligible for green bond funding like renewable energy and sustainable infrastructure is widening up the market opportunity scope. In addition to this, financial incentives and tax advantages connected with green investment are pulling in new issuers and investors, thereby providing the market with much more momentum.

Get free sample copy of the report: https://www.imarcgroup.com/uk-green-bonds-market/requestsample

UK Green Bonds Market Scope and Growth Analysis:

The market scope is wide and encompasses renewable energy, sustainable real estate, and infrastructure development. The scope of the market is anticipated to expand steadily as both the public and private sectors put more focus on environmental, social, and governance (ESG) criteria. Given the rapid integration of new regulations and standards to improve the credibility and transparency of green bonds, market analysis predicts this will entice more participation from institutional investors. The incorporation of digital solutions to track the impacts and performance of green projects supports market growth.

The demand for green financing as part of corporate social responsibility initiatives is also further boosting the expansion. With constant innovations in green finance models and a rising number of climate-focused funds, the market scope is bound for long-term growth. A commitment from global financial institutions to boost sustainable investment portfolios is further reinforcing the UK's position as a major player in the green bonds market.

UK Green Bonds Industry and Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Corporate Bond

- Project Bond

- Asset-backed Security (ABS)

- Supranational

- Sub Sovereign and Agency (SSA) Bond

- Municipal Bond

- Financial Sector Bond

End Use Insights:

- Energy/Utility Sector

- Financial Sector and Other Corporates

- Government/Agency/Local

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst For Customization: https://www.imarcgroup.com/request?type=report&id=24986&flag=C

Other Key Points Covered in the Report:

- COVID-19 Impact on the Market

- Porter's Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments

0 comment