views

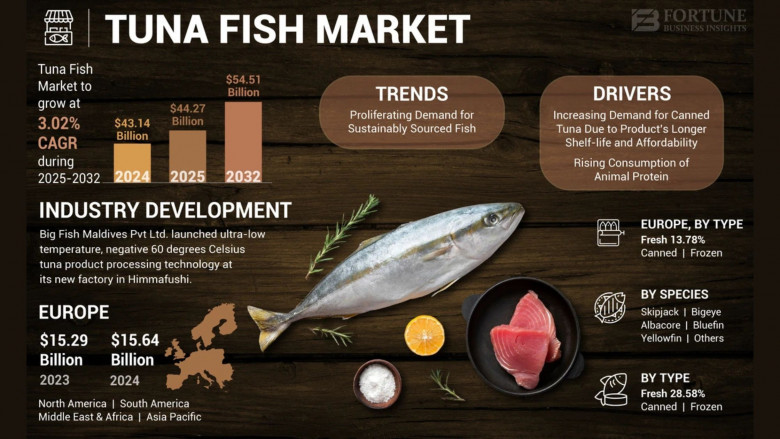

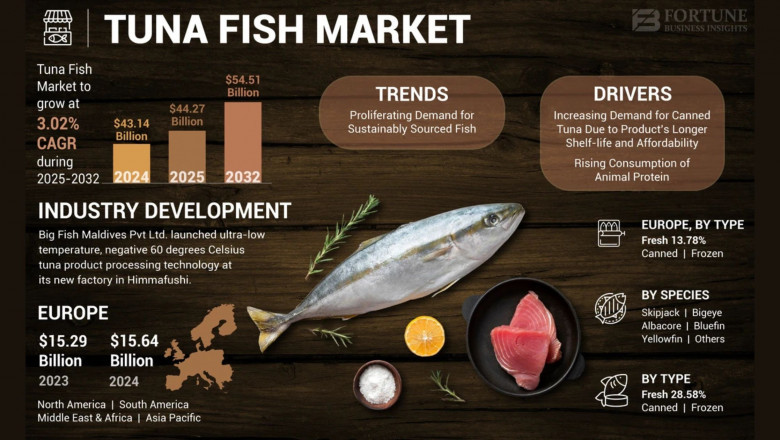

The global tuna fish market was valued at USD 43.14 billion in 2024 and is anticipated to increase from USD 44.27 billion in 2025 to USD 54.51 billion by 2032, indicating a compound annual growth rate (CAGR) of 3.02% over the forecast period. The U.S. tuna fish market is forecasted to hit USD 10.17 billion by 2032, fueled by the rising popularity of fresh seafood and greater consumption of cultural cuisines, particularly those of Asian origin. Europe led the market in 2024 with a 36.25% share.

Tuna holds significant commercial value and serves an essential function in marine ecosystems. The six major market-relevant species include Southern Bluefin, Skipjack, Bigeye, Atlantic, Yellowfin, and Pacific. Evolving consumer behavior reflects a higher demand for convenient and healthy food choices, boosting interest in protein-dense foods such as tuna.

Information Source: https://www.fortunebusinessinsights.com/industry-reports/tuna-fish-market-100744

COVID-19 Impact:

Market Growth Hampered by Supply Chain Interruptions

The COVID-19 crisis adversely influenced the global tuna market due to restrictions implemented by governments, which affected commercial fish landings. The shutdown of restaurants, constraints on workforce mobility, and social distancing protocols disrupted the seafood supply chain. The Food and Agriculture Organization (FAO) reported that canned tuna demand fell by 80–90% owing to a decline in restaurant activity.

Segments:

Skipjack Tuna Segment to See Growth Owing to Its Nutritional Value and Accessibility

The market is divided by species into Skipjack, Albacore, Yellowfin, Bigeye, Bluefin, and others. Among these, Skipjack is projected to lead the market because of its broad availability and notable nutritional properties. According to Asia Pacific – Fish Watch, Skipjack comprises more than 70% of all tuna catches in the Western and Central Pacific and about 50% in the Indian Ocean. It offers a low-fat protein source with low sodium content, driving consumer interest.

Increased Canned Tuna Sales Driven by Demand for Convenient Food Options

In terms of product type, the market is segmented into fresh, canned, and frozen. The canned category is anticipated to dominate due to rising health awareness and user-friendly consumption. Canned tuna is a rich source of omega-3 fatty acids, which help lower blood pressure, cholesterol, and risks associated with dementia and inflammation. The availability of diverse product offerings—from plain to grilled or marinated varieties—is contributing to segment expansion.

Report Coverage:

The report provides comprehensive insights into market trends, key growth drivers, and potential hurdles. It emphasizes leading market participants, strategic developments, and competitive dynamics. Additionally, it evaluates product categories, applications, and growth metrics across segments.

Drivers and Restraints:

Canned Tuna Demand Accelerates Due to Cost-Effectiveness and Longevity

Global growth in canned tuna consumption stems from its affordability, long shelf-life, and convenience. Its ability to be stored without refrigeration and transported easily has enhanced its appeal. A growing working demographic has further propelled the demand for processed, ready-to-eat, and ready-to-cook food products.

Regions such as Europe and Asia Pacific are prominent markets for canned tuna, with growing demand also seen in South America and the Middle East. Trends favoring increased seafood consumption—especially processed varieties—are fostering market expansion.

However, a surge in vegetarianism driven by ecological concerns and dietary choices is constraining seafood intake. Plant-based food producers like Beyond Meat and MorningStar Farms are investing in alternatives, potentially impacting tuna market growth.

Regional Insights:

Europe Leads Due to Elevated Seafood Intake

Europe accounted for a notable market share of USD 14.95 billion in 2022. The region’s substantial per capita seafood consumption and organized seafood sector have spurred market demand. Consumers are increasingly drawn to functional foods that support health in fast-paced lifestyles.

For example, in September 2021, John West—a Thai Union Group brand—launched a nutrient-enriched canned tuna line in the U.K. with Energy, Heart, and Immunity variants aimed at young, health-focused buyers.

Competitive Landscape:

Innovation in Product Offerings to Propel Market Expansion

Top industry players are broadening their seafood portfolios to meet shifting consumer preferences. Manufacturers are enhancing product benefits to attract wellness-oriented customers.

In September 2021, John West rolled out a fortified canned tuna series across the U.K., including functional flavors such as Energy, Heart, and Immunity.

LIST OF LEADING ORGANIZATIONS PROFILED IN THE REPORT

- Bolton Group (Italy)

- Century Pacific Foods Inc. (Philippines)

- The Jealsa Rianxeira S.AU. Group (Spain)

- Grupo Albacore S.A. (Spain)

- ITOCHU Corporation (Japan)

- Thai Union Group Inc. (Thailand)

- Dongwon Enterprises Co. Ltd. (South Korea)

- IBL Ltd. (Mauritius)

- FCF Co. Ltd. (Taiwan)

- Sea Delight (U.S.)

Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/tuna-fish-market-100744

Key Industry Development:

In January 2023, Next Tuna, a startup focused on tuna aquaculture, teamed up with Skretting, a producer of fish feed, to formulate dry feeds specifically tailored for Atlantic Bluefin tuna.

Comments

0 comment