views

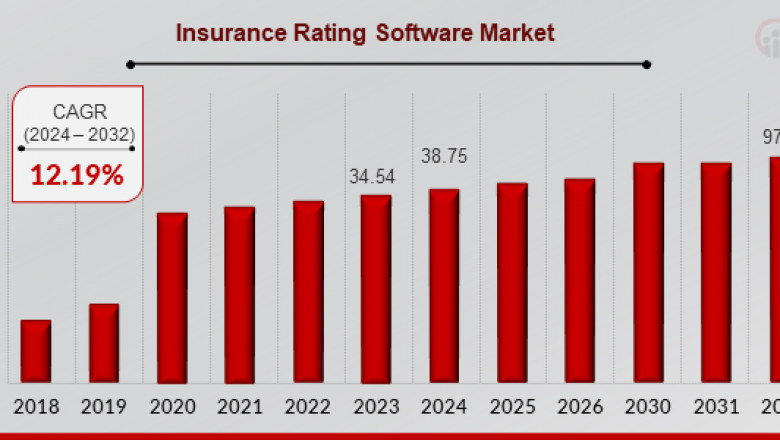

Insurance Rating Software Market: Comprehensive Analysis and Regional Insights

The Insurance Rating Software Market is rapidly evolving as the insurance industry embraces digital transformation to enhance efficiency, reduce operational costs, and improve customer satisfaction. Insurance rating software is a specialized solution designed to automate the process of calculating insurance premiums based on multiple parameters, such as risk assessment, customer profiles, and regulatory compliance. These solutions are critical in ensuring accuracy, transparency, and speed in insurance operations.

With the increasing adoption of advanced technologies like artificial intelligence (AI), machine learning (ML), and cloud computing, the market for insurance rating software is poised for substantial growth. Insurers are leveraging these technologies to develop more personalized and dynamic pricing models, which are aligned with the changing needs of customers. Additionally, the growing demand for digital insurance platforms and the need to comply with stringent regulatory requirements further bolster the market.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/24006

Key Market Segments

The Insurance Rating Software Market can be segmented based on several parameters, including type, deployment mode, end-user, and region.

-

By Type:

-

Standalone Software: Software dedicated solely to insurance rating.

-

Integrated Solutions: Part of broader insurance management platforms.

-

-

By Deployment Mode:

-

On-Premise: Deployed within the organization’s infrastructure.

-

Cloud-Based: Hosted on external servers and accessed via the internet.

-

-

By End-User:

-

Insurance Companies: Large and small insurers.

-

Third-Party Administrators (TPAs): Companies providing outsourced insurance services.

-

Brokers and Agents: Facilitators of insurance products.

-

-

By Region:

-

North America: The largest market due to high adoption of technology and a strong insurance sector.

-

Europe: Significant growth driven by regulatory compliance and digital initiatives.

-

Asia-Pacific: Rapidly growing market due to increasing penetration of digital insurance.

-

Latin America and Middle East & Africa: Emerging markets with untapped potential.

-

Industry Latest News

-

AI-Driven Innovations: Insurance rating software providers are increasingly incorporating AI and ML capabilities to offer real-time risk assessment and dynamic pricing. For instance, major players have launched AI-powered tools that analyze vast datasets to determine more precise insurance premiums.

-

Cloud Adoption: Cloud-based insurance rating solutions are gaining traction, especially among small and medium-sized insurers. Recent developments highlight partnerships between software vendors and cloud service providers to enhance scalability and security.

-

Regulatory Compliance: The evolving regulatory landscape is pushing insurers to adopt advanced software that ensures compliance. Notable updates in 2024 include the implementation of GDPR-like regulations in several countries, necessitating robust software solutions.

-

Mergers and Acquisitions: The market is witnessing consolidation, with larger players acquiring niche software providers to strengthen their offerings. Recent examples include acquisitions by global leaders to expand their capabilities in underwriting and rating.

Key Companies

Several companies are at the forefront of the Insurance Rating Software Market. These include:

-

Vertafore, Inc.: Known for its comprehensive insurance solutions, including rating and underwriting tools.

-

Guidewire Software, Inc.: A leading provider of insurance software, offering cloud-based solutions tailored for rating and policy management.

-

Applied Systems, Inc.: Offers innovative insurance technology solutions, including rating software for agents and brokers.

-

Sapiens International Corporation: Specializes in digital insurance platforms, including advanced rating engines.

-

Insurity, Inc.: Provides cloud-based and on-premise software solutions, catering to both large insurers and niche markets.

-

Zywave, Inc.: Focuses on insurance and benefits software, including rating and proposal tools.

-

Xactware Solutions, Inc.: Offers software and tools for rating and claims management.

Market Drivers

-

Growing Digitalization in Insurance: The increasing shift towards digital insurance platforms is a major driver. Customers demand faster and more personalized services, and insurers are investing in technologies to meet these expectations.

-

Regulatory Requirements: The need to comply with ever-changing regulations drives the adoption of robust rating software. These solutions ensure transparency and accuracy, mitigating risks of non-compliance.

-

Rising Demand for Automation: Automation in insurance processes reduces manual errors and speeds up operations. Insurance rating software is integral to achieving operational efficiency.

-

Integration with Advanced Technologies: The integration of AI, ML, and big data analytics into rating software enhances risk assessment and enables dynamic pricing models.

-

Cost-Effectiveness: Cloud-based solutions offer cost benefits by eliminating the need for heavy infrastructure investments, making them appealing to small and medium-sized insurers.

Browse In-depth Market Research Report - https://www.marketresearchfuture.com/reports/insurance-rating-software-market-24006

Regional Insights

-

North America: North America dominates the Insurance Rating Software Market, driven by high technology adoption, a mature insurance industry, and a focus on regulatory compliance. The U.S. leads the region with a significant share due to the presence of major insurance companies and software vendors.

-

Europe: Europe is witnessing steady growth, attributed to strict regulatory frameworks and increasing digital transformation initiatives. Countries like the UK, Germany, and France are at the forefront of adopting advanced insurance technologies.

-

Asia-Pacific: The Asia-Pacific region is the fastest-growing market, fueled by the rapid expansion of the insurance sector in countries like China, India, and Japan. The rise of digital insurance platforms and government initiatives to boost financial inclusion are key contributors.

-

Latin America: In Latin America, countries like Brazil and Mexico are leading the adoption of insurance rating software, driven by the need for modernization in insurance processes.

-

Middle East & Africa: Although still in nascent stages, the Middle East & Africa market holds significant potential, with increasing penetration of insurance products and growing awareness of digital solutions.

Future Trends and Opportunities

-

AI and Predictive Analytics: The use of AI and predictive analytics will become more prevalent, enabling insurers to offer tailored policies and dynamic pricing models.

-

Blockchain Integration: Blockchain technology is expected to revolutionize insurance operations, ensuring transparency and security in rating and underwriting processes.

-

Expansion of Cloud-Based Solutions: Cloud adoption will continue to rise, driven by its scalability, cost-effectiveness, and accessibility.

-

Focus on Customer Experience: Insurers will prioritize enhancing customer experience by offering seamless and intuitive rating and policy management solutions.

-

Emergence of InsurTech Startups: The market will see increased participation from InsurTech startups, introducing innovative solutions and challenging traditional players.

Conclusion

The Insurance Rating Software Market is poised for significant growth, driven by technological advancements, regulatory compliance needs, and the increasing demand for automation in insurance operations. With robust adoption across regions and the integration of cutting-edge technologies, the market offers immense opportunities for vendors and insurers alike. Companies that focus on innovation, scalability, and customer-centric solutions will lead the market in the coming years.

Explore MRFR’s Related Ongoing Coverage In ICT Domain:

3D Gaming Console Market -

https://www.openpr.com/news/3726185/3d-gaming-console-market-outlook-2032-usd-58-87-billion-with

Application Outsourcing Market -

https://www.openpr.com/news/3730374/application-outsourcing-market-to-reach-usd-241-89-billion

Cloud Integration Software Market -

https://www.openpr.com/news/3730388/steady-growth-for-cloud-integration-software-market-projected

Corporate Flows B2B Payment Market -

https://www.openpr.com/news/3730408/mrfr-report-corporate-flows-b2b-payment-market-set-to-hit-usd

Cybersecurity In Logistic Market -

https://www.openpr.com/news/3730422/future-outlook-cybersecurity-in-logistic-market-expected

Comments

0 comment