views

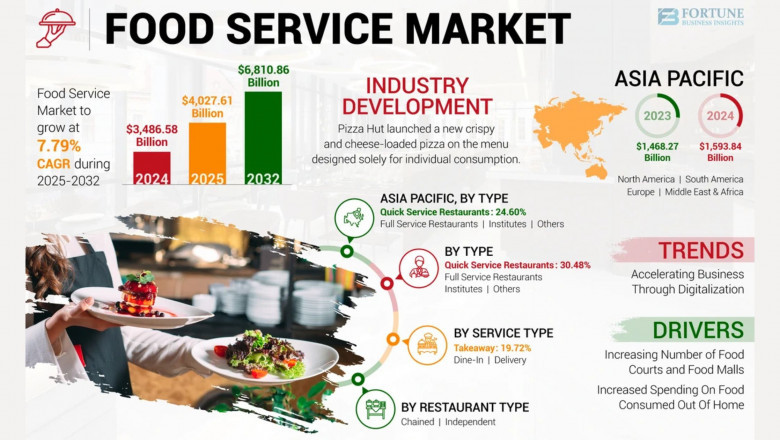

In 2024, the global food service market was valued at USD 3,486.58 billion. It is expected to grow from USD 4,027.61 billion in 2025 to USD 6,810.86 billion by 2032, reflecting a compound annual growth rate (CAGR) of 7.79% during the forecast period. The U.S. food service market is also set for substantial growth, projected to reach approximately USD 1,767.54 billion by 2030. By 2032, the U.S. market is expected to expand further, reaching an estimated USD 1.71 billion, driven by the increasing number of fast food chains and higher consumer spending on quick-service dining. In 2024, the Asia Pacific region led the global food service market, holding a dominant share of 45.71%.

The food service industry encompasses businesses that prepare and distribute food for on-premise dining, takeaway, and delivery. This sector includes food service retailers, counter and table service establishments, and catering providers. The global food service market continues to expand, fueled by rising household incomes, an increasing number of working women, and the growing demand for convenience in fast food consumption.

Information Source: https://www.fortunebusinessinsights.com/food-service-market-106277

Segments:

By Type: Full-Service Restaurants Segment to Gain Momentum Through 2029

Based on type, the market is categorized into quick-service restaurants, full-service restaurants, institutes, and others. Among these, the full-service restaurants segment dominates the market share due to the extensive variety of food options available on menus. The increasing trend of family dining experiences is driving the growth of such establishments, further accelerating the expansion of this segment.

By Service Type: Commercial Food Service Segment to Witness Significant Growth from 2022 to 2029

Regarding service type, the market is divided into commercial and institutional sectors. The commercial segment is anticipated to experience substantial traction throughout the forecast period, primarily due to the rising presence of food chains, food trucks, cafes, restaurants, and online food delivery services. This segment encompasses quick-service restaurants, full-service restaurants, and dine-in/takeaway services.

Report Coverage:

The report provides:

- Key growth drivers, constraints, opportunities, and challenges shaping the market.

- In-depth analysis of regional market trends.

- Profiles of major industry players.

- Strategic initiatives implemented by market participants.

- Updates on industry developments, including product launches, partnerships, mergers, and acquisitions.

Drivers & Restraints:

Expansion of Fast-Food Chains and Quick-Service Restaurants to Propel Market Growth

The growth of the food service industry is largely fueled by increasing dual-income households and rising disposable incomes. The expanding millennial demographic and the growing appeal of fast-food chains serve as key catalysts for market advancement. With fast-food establishments continuously expanding into new and emerging markets, the industry is poised for significant growth in the forthcoming years.

Nonetheless, the lingering impact of the COVID-19 pandemic may influence market trends in the foreseeable future.

Regional Insights:

North America Food Service Market Valued at USD 989.0 Billion in 2021

North America led the global food service market in 2021, generating over USD 989.0 billion in annual revenue. This dominance is attributed to the increasing number of dual-income households, heightened expenditure on fast food, and the expansion of fast-food chains. The presence of a sizable millennial population and rapidly evolving lifestyle trends will further drive regional market growth.

The Asia-Pacific region is projected to witness the highest CAGR from 2022 to 2029, propelled by the rising number of restaurants and fast-food outlets in Tier-II and Tier-III cities. Meanwhile, Europe is expected to experience steady growth due to the increasing prevalence of quick-service restaurants, cafes, pubs, and coffee shops.

Competitive Landscape:

Leading Players Leverage Acquisition Strategies for Market Expansion

During the COVID-19 pandemic, most market players avoided entering volatile markets to mitigate business risks. However, as pandemic-related disruptions subsided, companies actively pursued expansion opportunities. For example, Imperial Dade acquired Empire Distributors, enabling operations across 91 new distribution centers in the U.S. Similar strategies are being employed by key players as they seek growth in untapped markets.

List of Key Players Profiled in the Market Report:

- McDonald's (U.S.)

- Starbucks (U.S.)

- Yum! Brands, Inc. (U.S.)

- Darden Restaurants, Inc. (U.S.)

- Restaurant Brands International Inc. (Canada)

- The Wendy’s Company (U.S.)

- Bloomin’ Brands, Inc. (U.S.)

- Papa John's International, Inc. (U.S.)

- Chipotle Mexican Grill, Inc. (U.S.)

- Domino's (U.S.)

Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/food-service-market-106277

Key Industry Development:

July 2021: Delivery Hero resumed operations in Germany under its Food Panda brand, targeting one of Europe’s largest food service markets.

Comments

0 comment