views

Market Overview

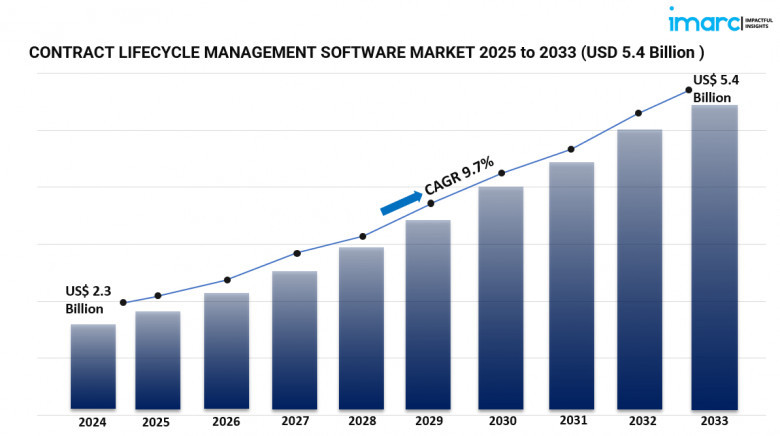

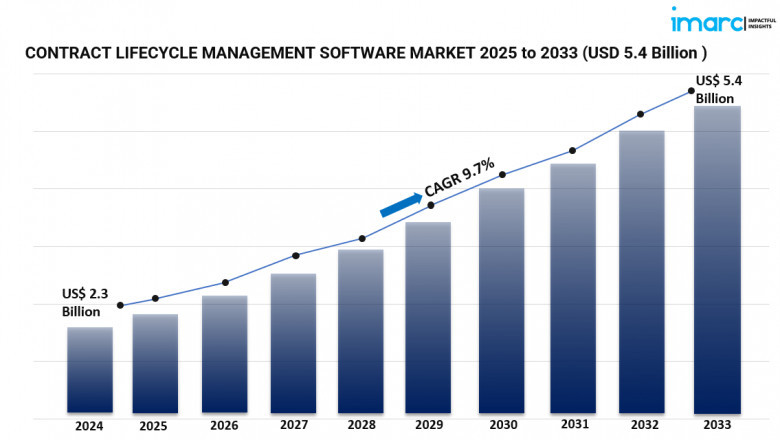

The global Contract Lifecycle Management software market is experiencing significant growth, driven by the increasing complexity of contracts and the need for efficient contract management solutions. In 2024, the market was valued at USD 2.3 billion and is projected to reach USD 5.4 billion by 2033, exhibiting a CAGR of 9.7% during the forecast period. This growth is fueled by the adoption of cloud-based solutions, integration of advanced technologies like AI and ML, and the rising demand for compliance and risk management tools across various industries.

Study Assumption Years

-

Base Year: 2024

-

Historical Years: 2019–2024

-

Forecast Years: 2025–2033

Contract Lifecycle Management Software Market Key Takeaways

-

Market Size and Growth: The CLM software market is projected to grow from USD 2.3 billion in 2024 to USD 5.4 billion by 2033, at a CAGR of 9.7%.

-

Deployment Model: Cloud-based solutions dominate the market, offering scalability and cost-effectiveness, especially for SMEs.

-

CLM Offerings: Licensing and subscription models hold the largest market share, providing flexibility and ease of access to organizations.

-

Enterprise Size: Large enterprises are the primary adopters of CLM software, leveraging it for complex contract management needs.

-

Industry Application: The manufacturing sector leads in CLM software adoption, driven by the need for efficient supply chain and procurement processes.

-

Regional Performance: North America holds the largest market share, attributed to stringent regulatory compliance requirements and advanced technological infrastructure.

Request for a sample copy of this report : https://www.imarcgroup.com/contract-lifecycle-management-software-market/requestsample

Market Growth Factors

1. Technological Advancements and Integration of AI/ML

Artificial intelligence (AI) and machine learning (ML) are embedded in CLM software, thus revolutionizing contract management as old routine activities are automated, enhancing the accuracy of operations, and providing predictive analytics. Efficient contract drafting, risk assessment, and compliance monitoring facilitated by these technologies are thereby reducing manual errors and speeding up the contract cycle. The growing acceptance of AI/ML in CLM solutions enables organizations to manage contracts more efficiently and advance their decisions, creating a big market driver.

2. Regulatory Compliance and Risk Management

Organizations are increasingly embracing CLM systems, given that complexity in regulatory frameworks is continually being added to the diverse variety of industries. Various CLM solutions have critical centralized repository capabilities, audit trails, and alerts on renewals and obligations, which ensure compliance with legislation such as GDPR and that under CCPA. Thus, the tendency for compliance and risk management among organizations has driven the demand for CLM solutions even in cases where BFSI, healthcare, or manufacturing sectors are involved.

3. Growing Demand for Cloud-Based Solutions

The drift to CLM solutions in the cloud stems from their scalability, deployment readiness, and cost-effectiveness. Cloud-based models do not require the groundwork of pervasive IT infrastructure, providing small and medium-sized enterprises with their own accessibility; enabling features such as concurrent contract access, smooth collaboration, and integration with other enterprise systems for greater operational efficiency. The rising adoption of cloud computing is one great contributing factor to the growth of the CLM software market.

Market Segmentation

Breakup by Deployment Model:

-

Cloud-Based: Offers scalability, remote access, and cost savings, making it the preferred choice for many organizations.

-

On-Premises: Provides enhanced control and security, suitable for organizations with stringent data governance policies.

Breakup by CLM Offerings:

-

Licensing and Subscription: Provides flexibility and regular updates, catering to organizations seeking scalable solutions.

-

Services: Includes implementation, training, and support services to ensure effective utilization of CLM software.

Breakup by Enterprise Size:

-

Large Enterprise: Require comprehensive CLM solutions to manage complex and high-volume contracts across various departments.

-

Small and Medium Enterprise: Seek cost-effective and scalable CLM solutions to streamline contract management processes.

Breakup by Industry:

-

Automotive: Utilizes CLM software for managing supplier contracts and ensuring compliance with industry standards.

-

Electrical and Electronics: Employs CLM solutions to handle complex contracts related to product development and supply chains.

-

Pharmaceutical: Relies on CLM software for managing clinical trial agreements, regulatory compliance, and vendor contracts.

-

Retail and E-Commerce: Uses CLM solutions to manage vendor agreements, licensing, and customer contracts efficiently.

-

Manufacturing: Adopts CLM software to streamline procurement processes, supplier management, and compliance tracking.

-

BFSI: Leverages CLM solutions for managing a wide range of contracts, ensuring regulatory compliance and risk mitigation.

-

Others: Includes sectors like healthcare, education, and energy, utilizing CLM software for various contract management needs.

Breakup by Region:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Regional Insights

North America leads the CLM software market, driven by stringent regulatory compliance requirements and the presence of major industry players. The region's advanced technological infrastructure and early adoption of innovative solutions contribute to its dominant market share. Organizations in North America prioritize efficient contract management to mitigate risks and ensure compliance with complex legal frameworks.

Recent Developments & News

The CLM software market has witnessed significant advancements, with companies introducing AI-powered features to enhance contract management processes. In June 2024, Conga launched a new CLM product built on its platform, integrating AI to streamline contract analysis and decision-making. Similarly, Evisort introduced Document X-Ray in January 2024, offering organizations advanced capabilities to access and analyze agreements. In February 2024, IntelAgree unveiled Saige Assist, a generative AI-based tool designed to revolutionize contract interactions. These innovations reflect the industry's focus on leveraging AI to improve efficiency and compliance in contract management.

Key Players

-

Wolters Kluwer N.V.

-

IBM Corporation

-

Icertis, Inc.

-

SAP SE

-

BravoSolution SPA

-

Contracked BV

-

Contract Logix, LLC

-

Coupa Software Inc

-

EASY SOFTWARE AG

-

ESM Solutions Corporation

-

Great Minds Software, Inc.

-

Koch Industries, Inc.

-

Ivalua Inc

-

Optimus BT

-

Oracle Corporation

-

Symfact AG

-

DocuSign, Inc

-

Newgen Software Technologies Limited

-

Zycus Infotech Private Limited

-

Corcentric LLC (Determine)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=1177&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC's offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Comments

0 comment