views

Continuous Delivery Market Will Grow Rapidly through Containerization Adoption

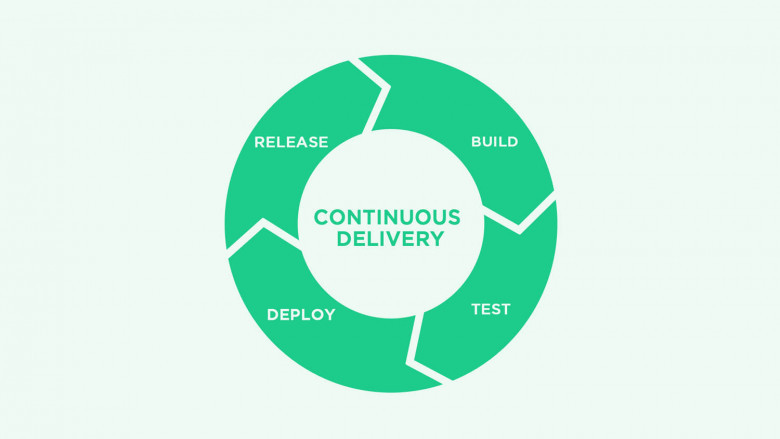

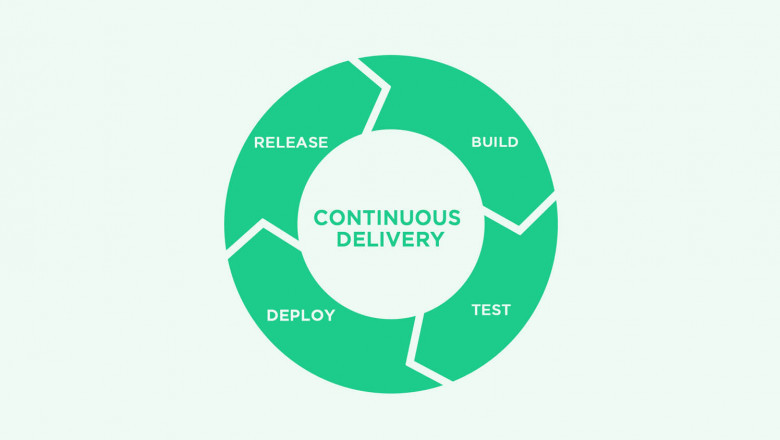

The Continuous Delivery Market encompasses a suite of automated deployment pipelines, orchestration tools, and integration frameworks that enable software teams to release updates reliably and frequently. These solutions streamline build, test, and deployment stages by exploiting containerization, microservices architecture, and Infrastructure as Code, reducing manual errors and accelerating development lifecycles. Organizations benefit from improved collaboration across DevOps teams, tighter feedback loops, and higher release velocity, which drive faster time-to-market and enhanced business agility.

As digital transformation efforts intensify, the need for scalable, automated deployment environments has never been greater. Continuous Delivery Market also offer better risk mitigation through automated rollbacks and canary deployments, bolstering application quality and resilience. With the proliferation of cloud-native applications and the push toward platform engineering, Continuous Delivery products are critical for maintaining competitive advantage.

According to CoherentMI, The continuous delivery market is estimated to be valued at USD 4.93 Bn in 2025 and is expected to reach USD 13.60 Bn by 2032. It is estimated to grow at a compound annual growth rate (CAGR) of 15.6% from 2025 to 2032.

Key Takeaways

Key players operating in the Continuous Delivery Market are:

-Google LLC

-Atlassian Corporation Plc.

-IBM Corporation

-Microsoft Corporation

-XebiaLabs, Inc

Growing demand for accelerated software delivery and seamless integration across hybrid cloud and on-premises environments is driving market growth. Enterprises are increasingly prioritizing continuous integration and continuous deployment workflows to support agile development, DevSecOps initiatives, and real-time feature releases. This demand is further fueled by digital transformation strategies in banking, healthcare, and retail sectors, where faster release cycles translate directly into enhanced customer experiences and business growth. Additionally, stringent compliance requirements in regulated industries have increased investments in automated testing and deployment to ensure consistent quality and security across updates. As organizations seek to optimize resource utilization and minimize downtime, adoption of Continuous Delivery solutions has become a strategic imperative to maintain competitive edge and support complex application portfolios.

Technological advancements continue to reshape the Continuous Delivery landscape by integrating AI-driven pipeline optimization, predictive analytics, and enhanced security capabilities. Machine learning models now proactively identify deployment bottlenecks, while automated governance frameworks enforce compliance and policy controls. Container orchestration platforms such as Kubernetes, combined with service meshes, have expanded the market scope by enabling microservices at scale. Infrastructure as Code tools streamline environment provisioning, reducing configuration drift and manual intervention. Moreover, integration of serverless functions and edge computing capabilities is opening new market opportunities for decentralized delivery pipelines. These innovations are being tracked closely in market research and market insights reports, driving strategic investments and informing market forecast projections.

Market trends

One key trend is the widespread adoption of cloud-native Continuous Delivery architectures. Organizations are migrating legacy applications to containerized environments to leverage auto-scaling, rapid provisioning, and cross-platform portability. This shift is supported by managed Kubernetes services and hybrid cloud strategies, which enable seamless workload distribution and high availability. The move toward cloud-native pipelines not only accelerates deployment times but also reduces infrastructure costs and streamlines maintenance.

Another prominent trend is the integration of AI and machine learning into Continuous Delivery platforms. AI-powered testing and anomaly detection tools can predict deployment failures, optimize resource allocation, and recommend rollback actions in real time. Predictive analytics provide actionable market insights, helping teams understand deployment success rates and performance metrics. These capabilities enhance operational efficiency and reduce time spent on manual troubleshooting, addressing key market challenges related to reliability and scalability.

Market Opportunities

An emerging opportunity lies in catering to mid-market and small enterprise segments, which are increasingly adopting DevOps and Continuous Delivery practices. Vendors that offer scalable, subscription-based models and user-friendly interfaces can tap into these underserved markets. Customized solutions that integrate with popular version control systems, ticketing tools, and cloud providers will gain traction, driving higher market share and recurring revenue streams.

Another significant opportunity is the incorporation of DevSecOps into Continuous Delivery workflows. As security becomes a top priority, embedding automated security testing, vulnerability scanning, and compliance checks into deployment pipelines creates value for risk-averse industries such as finance, healthcare, and government. Solutions that provide unified dashboards for code quality, security posture, and deployment metrics will address market restraints and unlock new avenues for market expansion by ensuring that security is integrated from code commit through production release.

Impact of COVID-19 on Continuous Delivery Market Growth

Before the pandemic, the continuous delivery market was on a steady upward trajectory, supported by organizations investing in DevOps automation to accelerate software releases. Development teams followed established continuous integration and delivery pipelines, and many enterprises focused on refining their release cadence to meet customer demands. Market dynamics were driven by a need for faster time-to-market, improved code quality, and seamless collaboration across distributed teams. However, adoption rates varied by industry segment, and some enterprises faced resource constraints that slowed broader deployment.

When COVID-19 struck, organizations were forced into sudden remote work models, creating both opportunities and challenges. The requirement for uninterrupted software updates to support digital customer interactions led to a sharp surge in demand for continuous delivery solutions. Companies that had already implemented robust CI/CD pipelines saw fewer disruptions, while those in early stages scrambled to integrate cloud-native tools. This period highlighted key market trends such as the shift toward cloud-based orchestration, containerization, and infrastructure as code. Yet supply-chain slowdowns and budget reallocations posed market challenges, especially for smaller vendors lacking flexibility.

In the post-COVID era, enterprises are investing heavily in resilient delivery frameworks to ensure business continuity. Continuous delivery platforms are being enhanced with AI-driven testing, automated rollbacks, and real-time performance monitoring. Future strategies should focus on scaling pipelines without sacrificing security, upskilling teams in cloud-native best practices, and fostering cross-functional collaboration via unified dashboards. Vendors must address evolving compliance requirements and integrate observability tools to capture end-to-end insights. As organizations aim for faster innovation cycles, prioritizing modular architectures and adopting shift-left security will be key to sustaining long-term market growth.

Geographical Regions Concentrating Value in the Continuous Delivery Market

North America dominates in terms of investment value, driven by high technology adoption rates among large enterprises and a strong presence of service providers offering end-to-end DevOps toolchains. The U.S. market, in particular, benefits from mature IT infrastructure, significant R&D spending, and a favorable regulatory environment that encourages automation. Europe follows closely, with the U.K., Germany, and France leading investments in cloud-native continuous delivery solutions. These regions capitalize on well-established software development practices and robust cybersecurity standards, creating a fertile ground for advanced pipeline orchestration and release management platforms.

The Asia Pacific region accounts for a substantial share as well, fueled by rapid digitization across banking, telecommunications, and e-commerce sectors. Japan and Australia feature comprehensive IT landscapes, while China and India are expanding their cloud service ecosystems to support localized continuous delivery deployments. Latin America and the Middle East show growing interest but still represent a smaller portion of overall value, primarily due to budgetary constraints and the pace of digital transformation. Across all mature markets, demand is shaped by enterprise requirements for high availability, compliance, and scalability, making advanced CI/CD offerings essential to meeting stringent release schedules.

Fastest Growing Region for Continuous Delivery Adoption

The Asia Pacific region is the fastest growing market for continuous delivery solutions, propelled by surging demand for digital services and aggressive cloud adoption initiatives. Governments and private enterprises across China, India, Southeast Asia, and South Korea are investing in robust IT infrastructures to support e-governance, fintech, and online retail platforms. The proliferation of 5G networks and edge computing further amplifies the need for agile delivery pipelines capable of managing distributed workloads with minimal latency.

In this region, small and medium-sized businesses are increasingly recognizing the benefits of automation to accelerate application rollouts and reduce operational overhead. Service providers are partnering with local players to offer cost-effective, cloud-based continuous delivery platforms that integrate seamlessly with popular container orchestration frameworks. Moreover, training programs and developer communities in Asia Pacific are growing rapidly, addressing talent shortages and fostering innovation in CI/CD practices.

As organizations look to capitalize on emerging opportunities in smart manufacturing, IoT, and digital healthcare, the emphasis on rapid iteration and high-quality software releases becomes critical. Vendors focusing on localized support, flexible subscription models, and compliance with regional data-security standards are best positioned to capture this dynamic and rapidly expanding market segment.

‣ Get More Insights On: Continuous Delivery Market

‣ Get this Report in Japanese Language: 継続的デリバリー市場

‣ Get this Report in Korean Language: 지속적인배달시장

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

Comments

0 comment