views

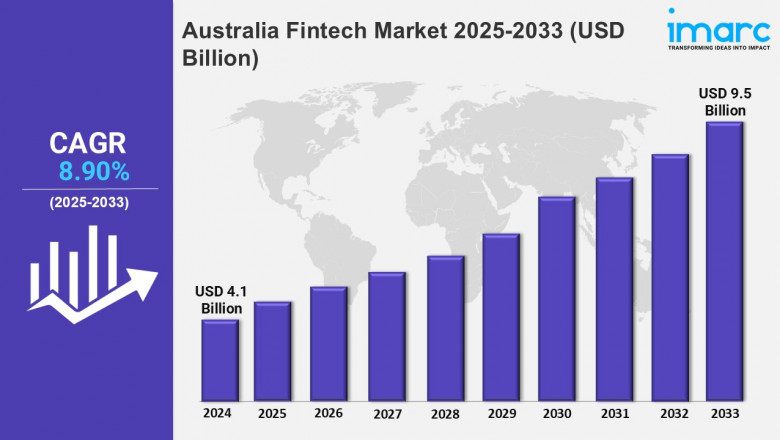

Australia Fintech Market Outlook

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 4.1 Billion

Market Forecast in 2033: USD 9.5 Billion

Market Growth Rate: 8.90% (2025-2033)

The Australia fintech market was valued at USD 4.1 Billion in 2024 and is projected to grow to USD 9.5 Billion by 2033, with an expected compound annual growth rate (CAGR) of 8.90% from 2025 to 2033.

Australia Fintech Market Trends:

The Australian fintech market is undergoing a sea of change due to the rise of many new technological advances and changes in consumer behavior. Digital payments, such as mobile wallets and contactless payments, have begun to gain traction in this market, reflecting the ongoing trend toward cashless transactions. Open banking, provided by CDR, encourages innovation by giving consumers the choice to allow third-party providers access to their financial information in a secure manner to promote competition among various lenders with the aim of providing better services. DeFi, or decentralized finance, and digital currencies have been getting much attention in this region.

The boom of buy-now-pay-later platforms out of the box is changing how lending is done traditionally and attracting young customers with tech-savviness. AI and ML are utilized to enhance fraud detection, credit scoring, and customer service, while regulatory sandboxes allow startups to test their innovative concepts. More collaborations between fintech firms and traditional banks are flourishing, establishing a hybrid ecosystem with agility and trust. Together, these trends illustrate that Australia exists as a very dynamic hotspot for fintech innovation, owing to a correspondingly progressive regulatory climate and a population well-versed in technology.

For an in-depth analysis, you can refer free sample copy of the report: https://www.imarcgroup.com/australia-fintech-market/requestsample

Australia Fintech Market Scope and Growth Analysis:

The Australia fintech sector has excellent growth potential owing to a highly developed digital infrastructure and the demand for financial innovation. The fintech market also extends into different segments, namely payments, lending, wealth management, and insurtech, serving retail and business customers. Adoption of fintech has spread among SMEs for automating operations and easy access to funding; on the other hand, consumers take digital tools to budget, invest, and manage their money. Government initiatives such as the CDR and fintech-friendly regulations create a favorable environment for startups and established players alike.

Growth is propelled by cross-border partnerships and investments through which Australian fintech firms investigate international markets and secure global funding. Increasing focus on financial inclusion is further driving innovation where fintech solutions cater to the portfolio of unserved populations. With a very high smartphone penetration rate and early adoption of technology, Australia is perfectly poised to keep itself on the trajectory of fintech growth, for various available business opportunities in the ecosystem.

By the IMARC Group, the Top Competitive Landscapes Operating in the Industry:

- Afterpay

- Airwallex Pty Ltd

- Athena Mortgage Pty Ltd

- Divipay Pty Ltd

- Judo Bank Pty Ltd (Judo Capital Holdings)

- mx51 Pty Ltd

- PTRN Pty Ltd

- Stripe Inc.

- Wise Australia Pty Ltd

- Zeller Australia Pty Ltd.

Australia Data Center Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Australia fintech market share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Breakup by Deployment Mode:

- Cloud

- On-Premises

Breakup by Technology:

- Application Programming Interface (API)

- Artificial Intelligence (AI)

- Blockchain

- Data Analytics

- Robotic Process Automation (RPA)

- Others

Breakup by Application:

- Payments and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

Breakup by End-User:

- Banking

- Insurance

- Securities

- Others

Breakup by States:

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Tasmania

- Others

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst For Customization: https://www.imarcgroup.com/request?type=report&id=6065&flag=C

Other key areas covered in the report:

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Market Dynamics

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

- Top Winning Strategies

- Recent Industry News

- Key Technological Trends & Development

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments

0 comment