views

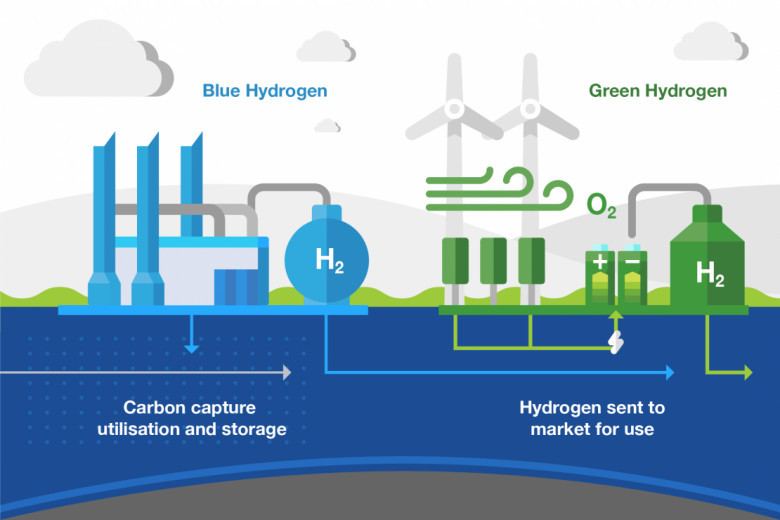

The blue hydrogen market is rapidly emerging as a critical component in the global energy transition. As governments, corporations, and industries strive to decarbonize, blue hydrogen is gaining attention for its ability to provide clean energy while leveraging existing natural gas infrastructure. Unlike green hydrogen, which is produced using renewable energy, blue hydrogen is generated from natural gas through steam methane reforming (SMR), with carbon capture and storage (CCS) technologies mitigating its environmental impact.

In 2025 and the coming years, the blue hydrogen market is expected to witness substantial growth driven by rising demand for low-carbon energy solutions, favorable government policies, and technological advancements. However, challenges such as infrastructure costs, carbon capture efficiency, and competition from green hydrogen remain key concerns.

Growing Demand for Low-Carbon Hydrogen Solutions

One of the primary trends shaping the blue hydrogen market is the growing global emphasis on decarbonization. Major economies like the United States, European Union, China, and Japan are setting ambitious net-zero targets. This has led to an increased push toward adopting hydrogen as a clean fuel, particularly in hard-to-abate sectors such as heavy industry, shipping, and aviation.

Blue hydrogen offers a transitional solution—balancing the scalability of fossil fuel infrastructure with the environmental benefits of carbon capture. Countries with abundant natural gas resources are especially investing in blue hydrogen production to meet climate goals without overhauling their entire energy systems.

Technological Advancements in Carbon Capture and Storage (CCS)

The efficiency and cost-effectiveness of CCS technology are crucial to the blue hydrogen market. Recent innovations have led to significant improvements in capturing carbon emissions during hydrogen production. Companies are investing in advanced materials, membrane separation techniques, and solvent-based technologies to enhance CCS performance.

As capture rates improve and costs decline, blue hydrogen becomes more competitive with green hydrogen. Furthermore, new projects are focusing on integrating CCS with hydrogen production at scale, making the technology more viable for commercial deployment.

Government Policies and Strategic Investments

Government support is a critical driver in the growth of the blue hydrogen market. Several national hydrogen strategies emphasize blue hydrogen as a near-term solution to meet emissions targets. For example, the U.S. Infrastructure Investment and Jobs Act allocates billions in funding for hydrogen hubs, many of which are centered around blue hydrogen development.

Similarly, the European Union includes blue hydrogen in its Hydrogen Strategy, recognizing its role in building a robust hydrogen economy. Tax incentives, subsidies, and carbon pricing mechanisms are making blue hydrogen more attractive to investors and energy providers alike.

Expansion of Hydrogen Hubs and Infrastructure

To facilitate blue hydrogen deployment, countries are investing in the development of hydrogen hubs—integrated networks where hydrogen production, storage, distribution, and end-use are co-located. These hubs allow for economies of scale and reduce the logistical challenges associated with hydrogen transport.

In 2025, new blue hydrogen hubs are emerging in regions with existing natural gas infrastructure and geological formations suitable for CO₂ storage. These locations offer strategic advantages in terms of cost and accessibility, accelerating the commercialization of blue hydrogen technologies.

Industrial and Commercial Adoption on the Rise

The blue hydrogen market is witnessing increased interest from industries such as steel, cement, chemicals, and oil refining—sectors where electrification is not always feasible. Hydrogen can replace fossil fuels as a feedstock or energy source, helping these industries lower their carbon footprint.

Additionally, blue hydrogen is gaining traction in power generation and transport, particularly in long-haul trucking and maritime shipping. Fuel cell vehicles powered by hydrogen offer a low-emission alternative to diesel, and blue hydrogen provides a scalable supply option during the clean energy transition.

Key Challenges Facing the Blue Hydrogen Market

Despite its potential, the blue hydrogen market faces several challenges. One major concern is the lifecycle emissions associated with natural gas extraction, including methane leakage. Without stringent controls, blue hydrogen may not offer the intended climate benefits.

Moreover, the high capital costs associated with carbon capture facilities and pipeline infrastructure can hinder project viability. Investors may also hesitate due to the uncertainty surrounding future carbon pricing and regulatory frameworks.

Finally, competition from green hydrogen—especially as renewable energy costs continue to fall—could pose a long-term threat to the blue hydrogen market’s growth. As technology improves, green hydrogen may become more economically attractive, reducing the market share for blue hydrogen.

Outlook for 2025 and Beyond

Looking ahead, the blue hydrogen market is poised for steady growth, especially in regions where natural gas is abundant and CCS infrastructure is already being developed. Collaboration between governments, private companies, and research institutions will be crucial in overcoming the current limitations.

While blue hydrogen may not be the final destination in the clean energy journey, it plays a vital role as a bridge to a fully renewable future. In the short to medium term, it offers a scalable and relatively low-emission solution for decarbonizing high-impact sectors.

By 2030, industry analysts expect blue hydrogen to account for a significant portion of the global hydrogen supply, particularly in regions where green hydrogen remains cost-prohibitive. With the right policies and innovation, blue hydrogen can be an essential pillar of the global clean energy transition.

Comments

0 comment