66

views

views

PepeCoin price prediction heats up as PEPE tests key support after dropping below 50 EMA, despite strong trading volume.

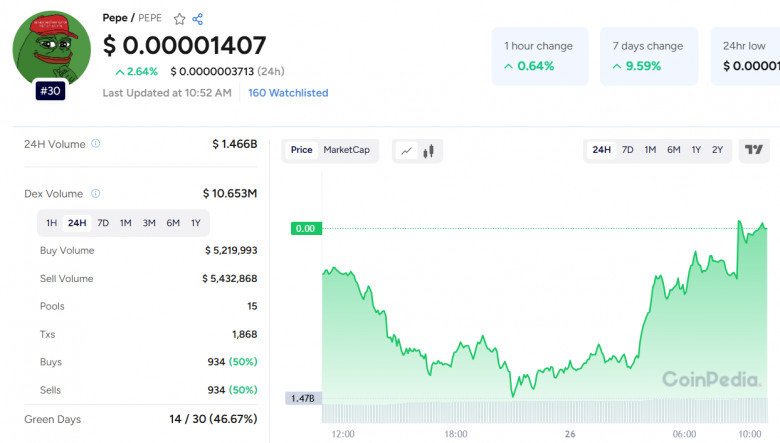

Pepe Coin (PEPE), one of the most watched meme coins, is currently trading at $0.00001407 with a massive 24-hour trading volume of over $1.46 billion. Despite a slight uptick of 0.64% in the past hour and a 2.64% gain since yesterday, PEPE is under pressure after slipping below its 50-period EMA ($0.00001395) on the 2-hour chart. This technical breakdown adds weight to short-term bearish sentiment, though many traders are closely watching key support levels for a potential reversal, making PepeCoin price prediction a hot topic across the crypto community.

Price action is now testing the ascending trendline near $0.00001330—a key level that has acted as strong support during previous consolidations. A hold at this level could trigger a rebound toward resistance at $0.00001395, followed by $0.00001421 and potentially the target of $0.00001540. However, a clean break below $0.00001330 could lead to deeper losses, with $0.00001194 and $0.00001091 as the next downside targets.

The MACD indicator shows a bearish crossover with a widening histogram, signaling downward momentum in the short term. Yet, community sentiment remains highly optimistic, with bold predictions circulating on X (formerly Twitter). Some analysts foresee a $69B to $300B market cap for PEPE by 2025, with projected price targets ranging from $0.00009 to $0.0002.

Also Read: Internet Computer Price Prediction 2025, 2026 – 2030

Fundamentally, several factors could support PEPE’s growth: broader market uptrends, strong community engagement, and viral appeal. Its no-tax model and reward system for long-term holders further add to investor interest.

While the recent selloff reflects thin liquidity and meme coin volatility, whale activity and on-chain metrics could still drive explosive moves. For traders and investors with 3–7 years of experience in crypto, this is a classic meme coin scenario—volatile yet packed with potential for sharp rallies. Holding above $0.00001330 remains critical for short-term bullish momentum.

Comments

0 comment