views

US Autonomous Cars Market to Surge on Ride-Sharing Opportunities

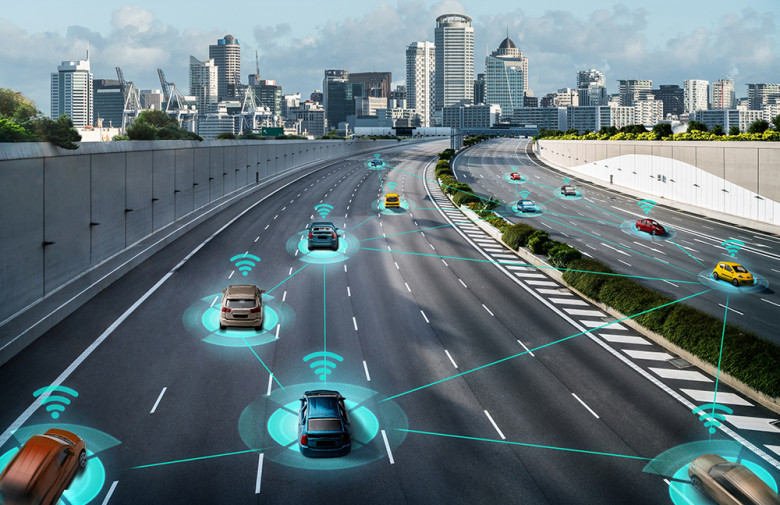

Autonomous cars combine advanced sensors, artificial intelligence, machine learning and connectivity platforms to deliver driverless mobility solutions. These vehicles leverage lidar, radar and high-resolution cameras to navigate complex urban roads, offering significant advantages such as enhanced safety, reduced traffic congestion, lower emissions and improved fuel efficiency. Growing consumer demand for contactless travel and smart transportation has driven investments in self-driving prototypes and pilot deployments across ride-sharing fleets.

The integration of edge computing and over-the-air software updates further elevates system reliability and flexibility. As fleets transition from Level 3 to Level 4 autonomy, there is a pressing need for robust mapping services, cybersecurity frameworks and standardized regulations. Strong collaboration among automakers, technology firms and telecommunication companies is critical to scale production and real-world testing. Continuous market research and customer feedback spur iterative improvements in user experience, unlocking new business growth pathways for United States Autonomous Cars Market.

The United States Autonomous Cars Market is estimated to be valued at USD 17.85 Bn in 2025 and is expected to reach USD 66.62 Bn by 2032, growing at a CAGR of 20.7% from 2025 to 2032.

Key Takeaways

Key players operating in the United States Autonomous Cars Market are:

-Tesla Inc.

-General Motors

-Ford

-Waymo

-Aurora

These market players have established significant market share through aggressive R&D spending, strategic partnerships and early pilot programs. Tesla’s Autopilot platform, GM’s Cruise division and Waymo’s robo-taxi trials have become benchmarks for reliability, while newer entrants like Aurora drive competitive innovation in sensor fusion and simulation tools.

Rising demand for safe, contactless travel is a major growth driver. Urbanization, aging populations and heightened focus on road-safety regulations have amplified interest in autonomous mobility solutions. Ride-hailing companies are exploring fully driverless fleets to optimize operational costs, and public transit agencies are evaluating autonomous shuttles to supplement first-/last-mile connectivity. Shifting consumer preferences toward subscription-based transportation and eco-friendly travel further boost market growth.

Technological advancement in artificial intelligence, sensor accuracy and vehicle-to-everything (V2X) communication underpins the market’s rapid evolution. High-definition mapping, over-the-air updates and edge computing reduce system latency, while 5G networks enhance real-time data exchange. Partnerships with semiconductor firms accelerate development of proprietary chips optimized for autonomous driving workloads. Ongoing improvements in deep learning algorithms and obstacle detection reinforce safety and reliability, offering valuable market insights for stakeholders.

Market Trends

One key trend is regulatory harmonization across federal and state levels. Standardized safety protocols and certification processes accelerate commercial rollouts and improve consumer confidence. Another important trend is the rise of mobility-as-a-service (MaaS) platforms that bundle autonomous taxis, shuttles and car-sharing under unified booking systems. These platforms leverage AI-driven fleet management tools to reduce idle time and increase utilization rates, reflecting broader industry trends toward asset-light business models.

Market Opportunities

First, integration of autonomous cars with ride-hailing networks presents a lucrative opportunity. Major transportation network companies can slash labor costs and optimize dynamic pricing by deploying driverless fleets on high-density routes. Second, collaboration with telecom providers on 5G-enabled vehicle-to-infrastructure (V2I) systems offers growth potential. Low-latency networks support over-the-air updates, real-time traffic management and cooperative adaptive cruise control, unlocking new service offerings and revenue streams in smart cities.

Impact of COVID-19 on Market Growth

The onset of the COVID-19 pandemic in early 2020 introduced significant disruptions to the United States autonomous cars market, triggering a shift in market dynamics and driving urgent adaptations among industry participants. Pre-COVID, the sector was characterized by aggressive investments, promising pilot programs, and a rising consumer interest in driverless solutions. Market research at that time highlighted strong market growth driven by robust industry partnerships and substantial funding from venture capitalists and established automakers. However, when lockdowns and social distancing measures took effect, many testing facilities paused operations, supply chains became constrained, and automotive chip shortages intensified. These market restraints slowed the deployment of new autonomous fleets and delayed software updates, impacting the anticipated market forecast for mid-2020.

As restrictions eased in late 2020 and into 2021, the market began to recover. Post-COVID, companies accelerated digital initiatives, integrating remote software diagnostics, virtual simulations, and expanded over-the-air updates to mitigate on-site testing challenges. Renewed emphasis on contactless mobility boosted consumer acceptance, positioning autonomous vehicles as safer alternatives to public transport. Market insights now indicate a resurgence in business growth, with reshaped market drivers including heightened care for hygiene, regulatory incentives on emissions, and growing ride-hailing partnerships.

Future strategies must incorporate these lessons. Stakeholders should focus on diversified supply chain networks to reduce vulnerability, invest in advanced telematics platforms, and strengthen collaborations with technology firms to streamline sensor manufacturing. Emphasizing cybersecurity protocols will address emerging market challenges around data privacy. Flexible financing models and subscription services can broaden customer reach, tapping evolving market opportunities. By leveraging comprehensive market analysis and deploying agile market growth strategies, industry participants can fortify resilience against potential disruptions and support sustained expansion in the post-pandemic era.

Geographical Regions Concentrating Value

In the United States autonomous cars sector, market concentration of value is unevenly dispersed, with several regions emerging as hubs for research, testing, and commercialization. The West Coast, led by California, commands a significant market share thanks to a robust ecosystem of technology startups, major research universities, and supportive regulatory frameworks. Silicon Valley’s proximity to venture capital and expertise in artificial intelligence has catalyzed rapid innovation. The concentration of pilot programs in Los Angeles and Silicon Valley underscores the region’s dominance in industry trends and market segments such as advanced driver assistance systems and full autonomy testing.

The Northeast corridor, encompassing New York, New Jersey, and Massachusetts, presents another major cluster. Renowned for its dense urban settings and complex traffic patterns, this region offers valuable real-world testing environments. With access to leading academic institutions and financial centers, autonomous car firms benefit from deep market research capabilities and strategic partnerships. State-level incentives and infrastructure grants have further accelerated deployment, enhancing the Northeast’s role in overall market revenue generation.

The Midwest contributes meaningful value through the automotive heartland of Michigan and Ohio. Traditional automakers, research labs, and tier-one suppliers are deeply embedded here, ensuring a strong manufacturing base and supply chain resilience. Collaborations between established industry giants and technology startups foster comprehensive market analysis, bridging hardware expertise with software innovation. Lastly, the Southern region, notably Texas and Florida, is gaining traction. Lower operational costs and permissive regulatory environments attract pilot projects, making the South a rising center for both autonomy trials and commercial rollouts.

Fastest Growing Region

Among all U.S. regions, the Southern states are emerging as the fastest growing territory for autonomous cars, propelled by favorable legislation and strategic infrastructure investments. Texas has been especially proactive, enacting laws to allow wide-scale testing of driverless vehicles on public roads without human backup drivers. Coupled with affordable land for proving grounds and strong partnerships with major research universities, Texas exemplifies a regional dynamic of rapid growth. Florida, with its tourism-driven economy, has also proven fertile for deployment of autonomous shuttles and last-mile delivery robots, further boosting regional market trends.

The Southeastern corridor leverages significant federal and state funding for smart city initiatives. In Jacksonville and Miami, pilot programs focus on autonomous ride-sharing, integrating advanced sensor networks and 5G connectivity. The availability of diverse urban, suburban, and rural testing sites accelerates the development of robust autonomous solutions capable of handling varied environmental conditions. Local utilities and telecommunications companies are collaborating on vehicle-to-infrastructure communications, laying groundwork for future expansions.

Market research underscores the South’s particular market opportunities in logistics and freight automation, driven by major ports and distribution centers in Houston, Savannah, and Charleston. This logistical backbone supports large-scale trials of autonomous trucks and platooning systems. Moreover, the region’s economic policies, including tax incentives for technology investment, reduce operational barriers and attract both startups and established industry participants. As a result, the South’s industry share of new pilot permits and commercial contracts is climbing faster than in traditional automotive hubs. With continued focus on public-private partnerships and targeted infrastructure build-outs, the Southern United States is poised to maintain its leadership as the most dynamic growth region for autonomous vehicle deployment.

‣ Get More Insights On: United States Autonomous Cars Market

‣ Get this Report in Japanese Language: 米国の自動運転車市場

‣ Get this Report in Korean Language: 미국자율주행차시장

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)