views

Solar Cell Market Set to Soar with Perovskite Tandem Technology

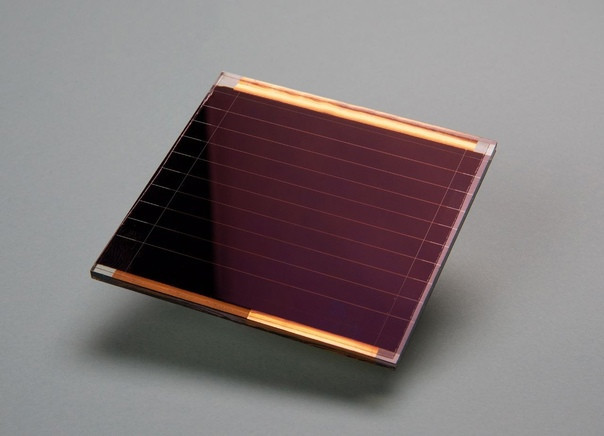

The Solar Cell Market encompasses photovoltaic (PV) modules designed to convert sunlight into clean electricity, including crystalline silicon, thin-film, and emerging perovskite-silicon tandem cells. These products offer advantages such as high energy conversion efficiency, modular scalability, and low environmental impact compared to fossil-fuel-based power generation. Solar cells are integral to residential rooftop installations, utility-scale solar farms, and off-grid applications that address rising electricity demand, carbon emission targets, and distributed energy needs.

Innovations in cell architecture and materials are driving down levelized cost of electricity (LCOE) and improving reliability, while supportive government incentives and net-metering policies are expanding adoption across developed and developing regions. With growing awareness of climate change and energy security concerns, businesses and consumers alike are turning to Solar Cell Market solutions for sustainable power generation.

The solar cell market is estimated to be valued at USD 175.45 billion in 2025 and is expected to reach USD 539.30 billion by 2032, growing at a compound annual growth rate (CAGR) of 17.4% from 2025 to 2032.

Key Takeaways:

Key players operating in the Solar Cell Market are:

-Panasonic Corporation

-JinkoSolar Holding Co., Ltd.

-Trina Solar Co., Ltd.

-SunPower Corporation

-United Renewable Energy,

-LLC

These market players dominate global market share through integrated manufacturing, strategic partnerships, and robust research and development pipelines. Each company continually invests in production capacity expansion and cost-optimization to maintain competitive pricing and meet growing demand.

Significant market opportunities lie in emerging economies where electrification rates remain low and solar offers a cost-effective means to achieve energy access. Off-grid and micro-grid solar solutions present new revenue streams for market companies, while corporate sustainability initiatives and renewable energy procurement goals create demand for large-scale solar installations. Further, second-use solar cell recycling and circular economy models represent untapped avenues to capture value across the product lifecycle.

Technological advancement in perovskite-silicon tandem technology is revolutionizing the solar industry by boosting module efficiency beyond 30% and reducing production costs. This tandem approach, combined with bifacial module designs, enhances energy yield and system reliability. Integration of smart inverters and digital monitoring platforms is improving asset management, and ongoing market research into new absorber materials promises further gains in performance and durability.

Market Drivers

One of the primary market drivers for the Solar Cell Market is the rapid decline in photovoltaic module costs, driven by economies of scale, improved manufacturing processes, and material innovations. Over the past decade, solar cell prices have fallen by more than 80%, enabling broader adoption across residential, commercial, and utility sectors. Coupled with government incentives such as investment tax credits, feed-in tariffs, and renewable portfolio standards, lower module prices have made solar energy economically competitive with conventional sources of electricity. These cost declines stimulate market growth by attracting new market entrants, spurring market research into higher-efficiency cell architectures, and encouraging deployment in regions with historically high fossil-fuel subsidies. As a result, the solar industry benefits from positive market dynamics, sustained investment, and enhanced consumer confidence in renewable energy solutions.

Current Challenges in the Solar Cell Market

The solar cell sector faces several pressing market challenges as demand accelerates. A primary hurdle is raw-material volatility: fluctuations in silicon, silver and rare earth prices can disrupt production costs and erode profitability. Supply chain bottlenecks remain an industry restraint, with limited wafer capacity and logistics delays hampering the ability of manufacturers to meet surging demand. In addition, technical integration issues arise when pairing advanced solar modules with existing grid infrastructure, creating barriers to seamless deployment. Addressing quality control across diverse geographies also demands rigorous market research to ensure consistent module performance and reliability. Regulatory fragmentation further complicates project planning, as incentives and tariffs vary widely by region. Stakeholders must navigate evolving policy landscapes while balancing environmental standards and permitting timeframes. Moreover, intense competition puts pressure on companies to innovate without sacrificing yield or driving down market share through aggressive pricing. Finally, financing constraints and project financing risks can slow capital-intensive installations, especially in emerging markets where credit lines or government backing may be limited. Together, these market dynamics emphasize the need for robust growth strategies, improved cost structures and collaborative efforts across the value chain to overcome current hurdles.

SWOT Analysis

Strength: Rapid technological advances have driven module efficiency gains and cost declines, strengthening the solar cell market’s position within the broader renewable energy landscape. Established R&D pipelines and scalable manufacturing infrastructure support continued improvements in performance.

Weakness: Dependence on a few key raw-material suppliers leaves the industry vulnerable to supply disruptions and price swings. Additionally, energy storage integration remains a technical challenge, limiting the full potential of distributed solar systems in certain applications.

Opportunity: Growing corporate and utility procurement commitments offer significant market opportunities, especially as companies seek to meet sustainability targets and reduce carbon footprints. Expanded off-grid and micro-grid projects in rural regions present further avenues for business growth.

Threats: Geopolitical tensions may trigger trade restrictions or tariffs, threatening cross-border supply chains and undermining market momentum. Meanwhile, emerging alternative energy technologies, such as green hydrogen or next-generation batteries, could compete for investment and policy support, diluting solar-specific incentives.

Geographical Regions by Value Concentration

In terms of overall value concentration, the solar cell market remains most robust in regions with mature clean-energy policies and substantial installed capacity. Europe continues to hold a sizable market share due to comprehensive incentive schemes, long-standing feed-in tariffs and ample grid modernization efforts that support large-scale solar farms. North America also commands significant industry share, backed by extensive utility-scale developments and corporate procurement initiatives that stress renewable portfolios. Meanwhile, Asia’s advanced manufacturing ecosystems and high domestic demand drive considerable value, with targeted market segments shaped by strong government support and local content regulations. These regions benefit from sophisticated market insights, established investment channels and proven deployment models that reinforce revenue streams for solar companies. Moreover, well-developed financing frameworks and public-private partnerships in these areas provide stability and scale, making them focal points for capital investment and further market expansion in the foreseeable future.

Fastest Growing Region for Solar Cell Deployment

Among global markets, Southeast Asia presently stands out as the fastest growing region for solar cell deployment. Accelerating market growth is fueled by rapidly rising energy demand, affordable land availability and improving grid connectivity across countries such as Vietnam, Thailand and the Philippines. Government initiatives to diversify energy mixes and reduce reliance on imported fossil fuels serve as critical market drivers, unlocking extensive project pipelines for both rooftop and utility-scale installations. In addition, international development banks and climate finance institutions are channeling funds into the region’s renewable energy transition, lowering financing costs and de-risking new ventures. Local developers are also capitalizing on falling module prices and streamlined permitting processes to fast-track project execution. Furthermore, evolving market dynamics—such as net-metering schemes and corporate power purchase agreements—bolster investor confidence and stimulate further capital inflows. This combination of policy support, financial incentives and growing private sector participation ensures Southeast Asia will likely maintain its rapid ascent in solar capacity addition over the next several years.

‣ Get this Report in Japanese Language: 太陽電池市場

‣ Get this Report in Korean Language: 태양전지시장

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)