views

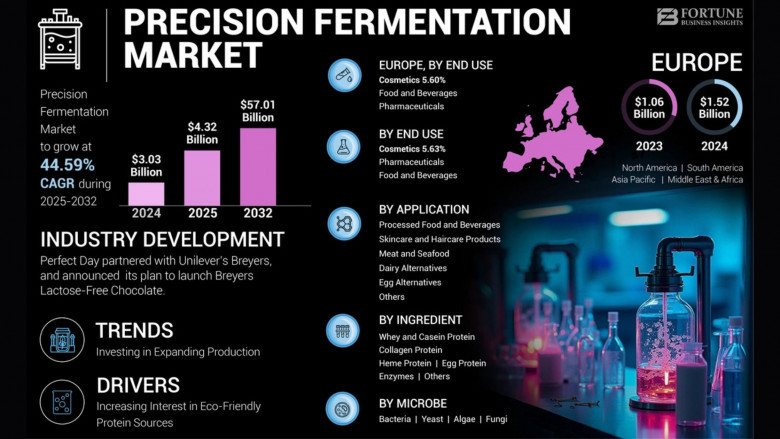

The global precision fermentation market was valued at USD 2.14 billion in 2023 and is expected to expand from USD 3.03 billion in 2024 to USD 57.01 billion by 2032, reflecting a compound annual growth rate (CAGR) of 44.30% throughout the forecast period. Europe led the market in 2023, accounting for a 49.53% share. In addition, the precision fermentation market in the United States is anticipated to experience substantial growth, projected to reach approximately USD 16.04 billion by 2032, fueled by increasing demand for sustainable and eco-friendly protein sources.

Precision fermentation integrates conventional fermentation processes with modern biotechnology innovations to produce proteins, enzymes, and other bio-based molecules efficiently. This synthetic production method for food and beverage proteins minimizes dependency on natural resources like land and water, while also helping to reduce environmental impact. The technology is well-suited to fulfill the growing global interest in alternative protein options.

Information Source: https://www.fortunebusinessinsights.com/precision-fermentation-market-109824

Precision Fermentation Market Segmentation Analysis

By Microbe Type Analysis

Yeast Dominates the Market Due to Its Extensive Industrial Use

Based on microbe type, the market is categorized into bacteria, yeast, algae, and fungi. Yeast is the most commonly utilized microorganism in the production of whey and milk proteins, heme proteins, enzymes, and related ingredients. This wide adoption contributes to its leading share in the global market.

By Ingredient Analysis

Growing Production of Whey and Casein Proteins Due to Their Safety Profiles

Based on ingredients, the market is categorized into egg protein, heme protein, collagen protein, whey and casein proteins, enzymes, and other types. Among these, whey and casein proteins hold the largest market share, primarily due to their recognized safety and nutritional benefits.

By Application Analysis

Dairy Alternatives Segment Leads with Use of Microbial Strains for Milk Substitutes

By application, the market includes meat and seafood, dairy alternatives, egg alternatives, processed food and beverages, skincare and haircare products, and others. The dairy alternatives segment represents the largest market share, driven by the use of various microbial strains to develop milk-based products.

By End Use Analysis

Food and Beverage Sector Leads Due to High Adoption of Fermentation Technology

Based on end use, the market is segmented into food and beverages, cosmetics, and pharmaceuticals. The food and beverage sector leads the market due to the longstanding and widespread use of fermentation in the production of alternative proteins, as well as in traditional food and pharma manufacturing.

REGIONAL INSIGHTS

The global market is divided into regions including North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Europe emerged as the dominant region, generating USD 1.06 billion in market revenue in 2023. This leadership is attributed to the growing shift among consumers from animal-based meat to safer and environmentally friendly alternatives.

North America accounts for the second-largest share of the market, led by the United States which plays a major role in technological adoption.

The Asia Pacific region is witnessing rapid growth, with countries such as Singapore, Australia, China, Japan, and Thailand increasingly employing precision fermentation to develop proteins and enzymes for diverse applications in food, cosmetics, and pharmaceuticals.

Markets in South America and the Middle East & Africa are still developing, with Israel standing out as a key country investing heavily in the technology for alternative protein development.

RESTRAINING FACTORS

High Costs and Limited Consumer Awareness Pose Challenges to Market Expansion

The high cost of producing food through precision fermentation and limited public understanding regarding its safety are key challenges. However, ongoing advancements and rising investments are anticipated to gradually lower production costs.

List of Top Precision Fermentation Companies:

- Perfect Day Inc. (U.S.)

- The Every Co. (U.S.)

- GELTOR (U.S.)

- Imagindairy Inc. (Israel)

- Shiru Inc. (U.S.)

- Impossible Foods (U.S.)

- Change Foods (U.S.)

- Vivici (Netherlands)

- Bon Vivant (France)

- Standing Ovation (U.S.)

Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/precision-fermentation-market-109824

KEY INDUSTRY DEVELOPMENTS:

February 2024: Nestlé SA introduced its first dairy protein powder derived from precision fermentation, offering an animal-free, lactose-free whey isolate. This launch reinforced the company’s presence in the functional nutrition category.