views

Market Overview

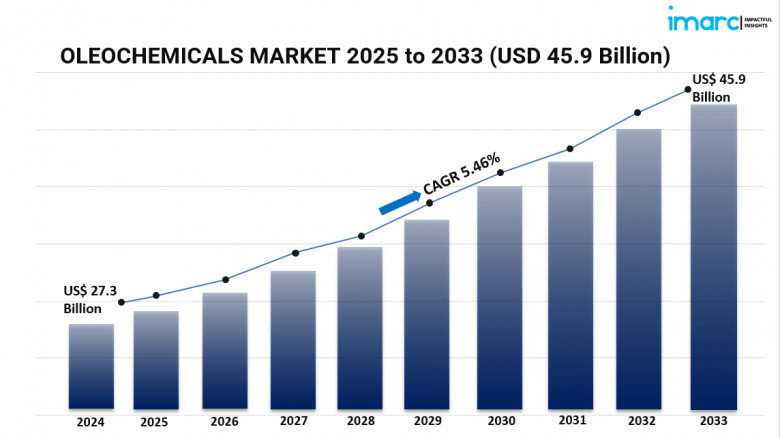

The global oleochemicals market is experiencing robust growth, driven by increasing environmental awareness and a shift towards sustainable alternatives. In 2024, the market reached a value of USD 27.3 billion and is projected to expand to USD 45.9 billion by 2033, exhibiting a CAGR of 5.46% during 2025-2033. Key factors propelling this growth include the rising demand for bio-based skincare products, the adoption of green technologies to minimize carbon footprints, and the easy availability of various feedstocks.

Study Assumption Years

-

Base Year: 2024

-

Historical Years: 2019-2024

-

Forecast Years: 2025-2033

Oleochemicals Market Key Takeaways

-

Market Size & Growth: The global oleochemicals market was valued at USD 27.3 billion in 2024 and is expected to reach USD 45.9 billion by 2033, growing at a CAGR of 5.46% during 2025-2033.

-

Dominant Region: Asia Pacific leads the market, attributed to the increasing number of advanced manufacturing facilities and extensive applications across various industries.

-

Leading Type Segment: Fatty acids represent the largest market segment due to their diverse applications across various industries.

-

Form Preference: Liquid form accounts for the majority of the market share, propelled by its widespread adoption in the pharmaceutical sector and formulation of personal care products.

-

Primary Application: Soaps and detergents hold the biggest market share, driven by the inflating use of oleochemicals like fatty acids and glycerin in manufacturing.

-

Key Feedstock: Palm oil dominates the feedstock segment, serving as a primary source for various oleochemical products due to its cost-effectiveness and abundance.

-

Market Trends: The rising trend of adopting green technologies and the focus on using healthier and natural ingredients are significant growth-inducing factors.

Request for a sample copy of this report : https://www.imarcgroup.com/oleochemicals-market/requestsample

Market Growth Factors

1. Technological innovations in production methods

Constant developments in processing techniques are letting oleochemical producers lower their manufacturing costs, boost their yield, and cut waste, hence boosting their efficiency. These advances are also enabling the production of more pure oleochemicals needed in sectors like medicine and food and beverage. Desmet, for example, unveiled the opening of the Oils and Derivatives Innovation Center in Malaysia in May 2023 with the goal of bringing cutting-edge environmental and efficiency advancements closer to local plant-based oil growers. Investing US$ 19.56 million in the INCITE project, Oleon NV opened an oleochemicals manufacturing facility running totally on all-natural proteins in June 2023. These developments are projected to fuel the expansion of the market by improving manufacturing capacity and satisfying the growing need for premium oleochemicals.

2. Initiatives from the government and regulatory backing

To reduce carbon emissions, regulatory bodies in several nations are establishing tight laws and policies about environmental standards. They are also starting projects to encourage the use of bio-based and renewable substances including oleochemicals. For instance, the U.S. Department of Agriculture's BioPreferred Program seeks to boost the demand and use of biobased goods, hence lowering oil dependency and lowering health and environmental effects. Programs like Horizon Europe and InvestEU allow the European Union to financially support businesses moving to sustainable chemical industries as well. The National Mission on Edible Oils – Oil Palm (NMEO-OP) was started in India to boost local manufacture of edible oils. Such regulatory support is helping the oleochemicals industry by fostering sustainable practices and national production.

3. Increasing demand in the beauty and cosmetics industry

As they are produced from natural oils, oleochemical adoption is being driven by the growing consumer demand for natural components in skincare goods. Creating preferred textures and consistencies in cosmetic compositions as well as increasing skin barrier function and hydration are among their traction among businesses like KLK OLEO, which provide a broad selection of premium, natural, and sustainable products for the cosmetic sector. Brands are also sponsoring the use of oleochemicals like glycerin; for instance, Medimix launched a digital campaign to persuade customers to change to its glycerin soap. Such trends are greatly affecting the market projections for oleochemicals in the personal care industry.

Market Segmentation

Breakup by Type:

-

Fatty Acids: Derived from natural oils via processes like distillation and hydrolysis, fatty acids serve as essential building blocks for various products, including candles, soaps, lubricants, and biofuels.

-

Fatty Alcohols: Produced through the hydrogenation of fatty acids, fatty alcohols are used in the manufacture of surfactants and detergents, playing a crucial role in personal care and cleaning products.

-

Glycerine: A by-product of biodiesel production, glycerine is utilized in pharmaceuticals, food and beverages, and personal care products due to its moisturizing and emulsifying properties.

-

Others: This category includes various oleochemical derivatives used in specialized applications across different industries.

Breakup by Form:

-

Liquid: Liquid oleochemicals are widely adopted in the pharmaceutical sector to enhance the solubility and bioavailability of certain drugs. They are also prevalent in hair care and skincare product formulations as humectants, emollients, or surfactants.

-

Solid:

-

Flakes: Solid oleochemicals in flake form are used in various industrial applications, offering ease of handling and measurement.

-

Pellets: Pelletized oleochemicals provide uniformity and are utilized in manufacturing processes requiring precise dosing.

-

Beads: Beaded forms are employed in applications where controlled release or specific dissolution rates are necessary.

-

Others: This includes other solid forms tailored for specific industrial needs.

Breakup by Application:

-

Soaps and Detergents: Oleochemicals like fatty acids and glycerin are integral in manufacturing traditional soaps and detergent formulations, serving as key surfactants and cleaning agents.

-

Plastics: Used as plasticizers and lubricants, oleochemicals enhance the flexibility and processability of plastic products.

-

Paper: In the paper industry, oleochemicals function as sizing agents, improving the printability and water resistance of paper products.

-

Lubricants: Bio-based lubricants derived from oleochemicals offer environmentally friendly alternatives to synthetic lubricants, reducing toxicity and improving biodegradability.

-

Rubber: Oleochemicals act as processing aids and softeners in rubber manufacturing, enhancing elasticity and durability.

-

Coatings and Resins: They serve as raw materials in producing eco-friendly coatings and resins, contributing to reduced VOC emissions.

-

Personal Care Products: In personal care, oleochemicals are used for their emollient and moisturizing properties, forming the basis of many skincare and cosmetic products.

-

Others: This includes applications in industries like textiles, adhesives, and agrochemicals, where oleochemicals provide functional benefits.

Breakup by Feedstock:

-

Palm: Palm oil and its derivatives are primary sources for various oleochemical products, offering cost-effectiveness and abundance.

-

Soy: Soybean oil serves as a renewable feedstock for producing fatty acids and alcohols used in multiple applications.

-

Rapeseed:

Rapeseed oil is widely used as a sustainable feedstock for producing bio-lubricants, plasticizers, and surfactants due to its high oil content and favorable fatty acid profile. -

Sunflower:

Sunflower oil is another significant source of oleochemicals, especially in personal care and cosmetic applications, as it is rich in linoleic acid and vitamins. -

Castor:

Castor oil is a unique feedstock that offers hydroxyl functionality, making it highly suitable for high-performance lubricants, polymers, and coatings. -

Others:

This category includes other plant-based and animal-based oils used in specific industrial processes, expanding the versatility of oleochemical production.

Breakup by Region:

-

North America (United States, Canada):

The market is growing due to increased demand for sustainable products and favorable regulations encouraging bio-based chemical adoption. -

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others):

This region dominates the market due to large-scale production, availability of feedstock (particularly palm oil), and expanding applications in personal care, food, and industrial sectors. -

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others):

Growth is driven by stringent environmental regulations, a strong cosmetics and personal care industry, and initiatives promoting green chemistry. -

Latin America (Brazil, Mexico, Others):

Emerging applications in agriculture and increasing industrial investments are fueling market growth in the region. -

Middle East and Africa:

The market is expanding steadily, supported by industrial diversification, rising demand for personal care products, and government-backed sustainability programs.

Competitive Landscape and Key Players:

The global oleochemicals market is moderately consolidated with key players focusing on innovation, capacit