views

India Hydrocolloids Market Growth, Trends, and Opportunities Analysis 2025-2032

The India Hydrocolloids Market continues to demonstrate robust growth driven by expanding applications across food, pharmaceuticals, and personal care sectors. This industry reflects dynamic shifts influenced by evolving consumer preferences and technological advancements, aligning with broader global trends in sustainability and health-conscious formulations.

Market Size and Overview

The India Hydrocolloids Market is estimated to be valued at USD 155.4 Mn in 2025 and is expected to reach USD 254.5 Mn by 2032, growing at a CAGR of 7.3% from 2025 to 2032.

The expanding industry size is propelled by increasing demand for natural and functional ingredients in processed foods and growing investments in pharmaceutical-grade hydrocolloids. These developments underscore the broadening market scope, reinforcing positive market forecast sentiments backed by recent market insights and revenue growth data.

Market Segments

The India Hydrocolloids market is segmented primarily by source, application, and form.

- Source: Carrageenan, agar, xanthan gum, guar gum, and others constitute core sub-segments. Guar gum dominates due to India’s abundant guar production and rising export volume, while xanthan gum is the fastest-growing, reflecting its adoption in clean-label and gluten-free food products. For example, in 2024, guar gum exports recorded a 10% volume increase driven by global demand for natural stabilizers.

- Application: Food & beverages, pharmaceuticals, cosmetics, and oilfield are key segments. The food & beverage segment remains dominant, with hydrocolloids used extensively for texture modification, while the pharmaceutical sub-segment is the fastest-growing due to rising demand for drug delivery systems enhanced by hydrocolloid formulations.

- Form: Dry and liquid hydrocolloids, where dry form retains dominance given ease of transportation and shelf life; however, liquid hydrocolloids observe rapid growth due to rising use in liquid food and therapeutic products.

Market Drivers

A primary market driver in 2024 is the rising health and wellness trend influencing product formulation. Policy-driven shifts promoting natural additives over synthetic ones have accelerated hydrocolloid adoption, particularly in clean-label food sectors. Statistics from 2024 illustrate a 15% increase in food-grade hydrocolloid consumption, attributable to consumer demand for reduced preservatives and sugar alternatives. Additionally, the government’s support for guar gum exports has expanded market opportunities, underlining critical market trends that fuel business growth in the India Hydrocolloids market.

Segment Analysis: Application

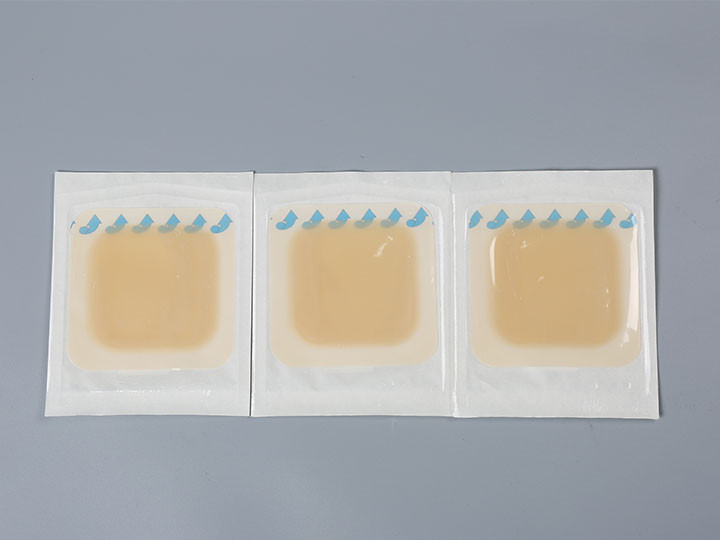

Focusing on the application segment, food & beverage sustains the largest revenue share, leveraging hydrocolloids for emulsification, thickening, and stabilization of dairy, bakery, and meat products. Pharmaceutical applications exhibit the fastest revenue growth, propelled by innovative hydrocolloid-based drug delivery systems and wound care products. In 2025, pharmaceutical-grade hydrocolloids revenue surged by 12%, supported by rising investments in biocompatible materials. This segment analysis highlights clear market dynamics where research and application development are key to market expansion.

Consumer Behaviour Insights

Recent data reveals shifting consumer behavior towards increased demand for customization and sustainability in product formulations. A 2024 survey among Indian FMCG consumers indicated 68% prefer products featuring natural and biodegradable ingredients, aligning with sustainability preferences driving hydrocolloid market trends. Another notable pattern is pricing sensitivity balanced with quality; premium segments are willing to invest more for enhanced functionality and clean-label certification. Furthermore, digital consumption habits have accelerated e-commerce penetration for specialty hydrocolloid products, opening new market opportunities for niche suppliers.

Key Players

Notable market companies in the India Hydrocolloids market include Cargill, Inc.; Koninklijke DSM N.V.; International Flavors & Fragrances Inc.; LUCID COLLOIDS LTD.; and Gujarat Enterprise. Throughout 2024 and 2025, these market players undertook significant initiatives such as capacity expansions, new product launches in plant-based hydrocolloids, and enhanced R&D investments to develop novel hydrocolloid blends. For instance, Cargill expanded its guar gum processing facility in Gujarat in 2024, resulting in a 20% increase in production capacity and improved supply chain stability. These strategic moves underpin the evolving competitive landscape and support positive market revenue trajectories.

Key Winning Strategies Adopted by Key Players

- Sustainability-Centric Product Innovation: Koninklijke DSM N.V., in 2025, launched a new biodegradable hydrocolloid variant targeting eco-conscious personal care brands. This strategic pivot enhanced its market positioning and contributed to a 10% surge in yearly revenue from the personal care segment.

- Regional Capacity Expansion Aligned with Export Demand: Gujarat Enterprise expanded manufacturing capacities in 2024 to leverage rising global demand for guar-based hydrocolloids, optimizing export logistics and reducing lead times. This resulted in a 25% boost in export volume during that fiscal year.

- Digital Integration in Supply Chain and Sales: International Flavors & Fragrances Inc. implemented advanced supply chain analytics and digital sales platforms in 2025, improving market reach and operational efficiency, positively impacting order fulfillment rates by 15%.

FAQs

1. Who are the dominant players in the India Hydrocolloids market?

Dominant market players include Cargill, Inc., Koninklijke DSM N.V., International Flavors & Fragrances Inc., LUCID COLLOIDS LTD., and Gujarat Enterprise, which lead through innovation and capacity expansions.

2. What will be the size of the India Hydrocolloids market in the coming years?

The market size is projected to grow from USD 155.4 million in 2025 to approximately USD 254.5 million by 2032, at a CAGR of 7.3%.

3. Which end-user industry has the largest growth opportunity?

The pharmaceutical sector exhibits the fastest growth opportunity, driven by increased demand for hydrocolloid-based drug delivery and wound healing products.

4. How will market development trends evolve over the next five years?

Market trends indicate increased adoption of sustainable hydrocolloids, digital supply chain integration, and customized formulations targeting health-conscious consumers.

5. What is the nature of the competitive landscape and challenges in the India Hydrocolloids market?

The competitive landscape is marked by capacity expansions, product innovation, and regional penetration. Challenges include raw material price volatility and compliance with evolving food safety regulations.

6. What go-to-market strategies are commonly adopted in the India Hydrocolloids market?

Key strategies include sustainability-driven product innovation, regional manufacturing expansions, and digital transformation of sales and supply chain operations.

‣ Get More Insights On: India Hydrocolloids Market

‣ Get this Report in Japanese Language: インドのハイドロコロイド市場

‣ Get this Report in Korean Language: 인도하이드로콜로이드시장

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191