views

Market Overview

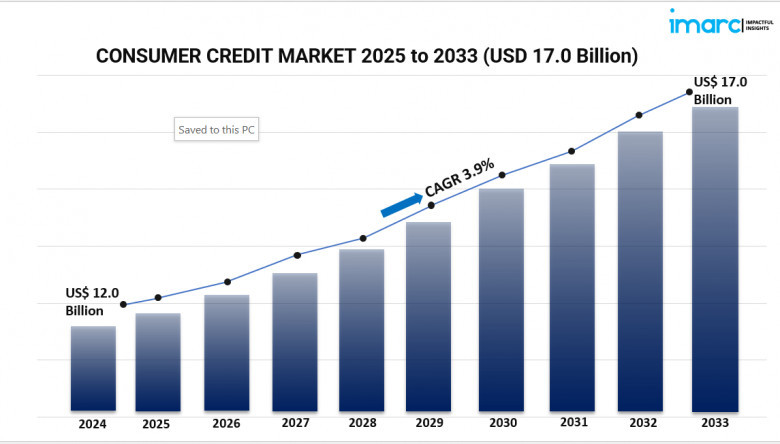

The global consumer credit market is experiencing significant growth, driven by technological advancements, economic development, and increasing demand for flexible financial solutions. In 2024, the market was valued at USD 12.0 billion and is projected to reach USD 17.0 billion by 2033, growing at a CAGR of 3.9% during the forecast period. Key factors contributing to this growth include the expansion of the banking, financial services, and insurance (BFSI) sector, rising adoption of digital lending platforms, and increasing consumer demand for credit to support major purchases and personal expenses.

Study Assumption Years

-

Base Year: 2024

-

Historical Years: 2019-2024

-

Forecast Years: 2025-2033

Consumer Credit Market Key Takeaways

-

Market Size & Growth: The consumer credit market is expected to grow from USD 12.0 billion in 2024 to USD 17.0 billion by 2033, at a CAGR of 3.9%.

-

Dominant Credit Type: Non-revolving credits hold the largest market share, driven by demand for fixed-term loans like mortgages and auto loans.

-

Leading Service Type: Credit services dominate the market, encompassing a wide range of financial solutions essential for managing consumer credit effectively.

-

Primary Issuers: Banks and finance companies represent the largest segment, offering diverse credit products and leveraging established trust among consumers.

-

Preferred Payment Method: Debit cards are the most widely used payment method, offering convenience and widespread acceptance for everyday transactions.

-

Regional Leader: North America leads the market, accounting for over 35% of the global share in 2024, supported by a mature financial infrastructure and high consumer credit adoption.

-

Emerging Trends: The integration of digital technologies, such as AI and blockchain, is enhancing credit assessment processes and expanding access to credit services.

Request for a sample copy of this report : https://www.imarcgroup.com/consumer-credit-market/requestsample

Market Growth Factors

1. Technological Advancements in Financial Services

Technological innovations have profoundly reshaped the global consumer credit landscape towards its growth and transformation. With developments in digital lending platforms, artificial intelligence (AI), and blockchain technology, credit approval has become speedier and more accessible. Digital lending platforms use big data analytics and machine-learning techniques to gauge creditworthiness more precisely, thereby reducing the reliance on traditional credit scoring. The implication for a lender is that it may now be able to cater to a wider demographic, including those without formal credit history. Artificial intelligence, on the other hand, influences the decision-making process by analyzing voluminous data sets to better predict consumer behaviors and credit risk, thus minimizing default rates and making credit management more efficient. For better security and transparency in transactions, blockchain technology reduces the chances of fraud and guarantees that the data remain intact. Smart contracts on blockchain platforms come with the capacity to automatically enforce contractual obligations, reducing the need for intermediaries and decreasing transaction costs.

2. Economic Growth and Rising Disposable Incomes

Economic prosperity and growing disposable incomes essentially feed into the global consumer credit market. As economies grow, consumers typically see a rise in their disposable income; increased consumer expenditure and borrowing activities usually result. Higher nowadays whereby income levels give consumers greater ability to acquire goods and services; an increase in demand for credit often follows such a great purchase involving huge prices in real estate, automobile, and further education.

3. Expanding BFSI Sector and Financial Inclusion Initiatives

The global BFSI industry is witnessing huge growth, one of the main driving forces behind the market. Beyond it, banks and other financial institutions have been continuing their investments into micro, small and medium enterprises (MSMEs) to reduce the credit gaps faced by local vendors, thereby offering a positive outlook for the market. Driving the market is also the adoption of credit data that presents information related to cash flows and analytics. The data assist in real-time pricing, individual credit cases, capital management, and minimizing risks on a firm-wide basis through consistency, transparency, and automation. Moreover, top players are leveraging social media for their campaign launches and for expanding their consumer base.

Market Segmentation

By Credit Type:

-

Revolving Credits: Credit lines that allow consumers to borrow up to a certain limit and repay over time, such as credit cards.

-

Non-revolving Credits: Fixed-term loans with structured repayment plans, including mortgages and auto loans.

By Service Type:

-

Credit Services: Encompasses a wide range of financial solutions, including credit score monitoring and debt counseling.

-

Software and IT Support Services: Technological solutions that support credit operations and management.

By Issuer:

-

Banks and Finance Companies: Traditional financial institutions offering various credit products.

-

Credit Unions: Member-owned financial cooperatives providing credit services.

-

Others: Includes alternative lenders and fintech companies.

By Payment Method:

-

Direct Deposit: Electronic transfer of funds directly into a recipient's account.

-

Debit Card: Payment cards that deduct funds directly from a consumer's bank account.

-

Others: Includes alternative payment methods such as mobile wallets.

Breakup by Region:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Regional Insights

North America currently leads the global consumer credit market, holding over 35% of the market share in 2024. This dominance is attributed to a mature financial infrastructure, high consumer credit adoption, and continuous technological advancements in credit services. The region's robust economic conditions and supportive regulatory environment further bolster market growth.

Recent Developments & News

In November 2024, Visa introduced the Flexible Credential in partnership with the Affirm Card, allowing users to seamlessly choose payment methods, including debit and Buy Now, Pay Later (BNPL), enhancing payment flexibility. This innovation reflects the growing trend of integrating BNPL services into traditional financial products, offering consumers more versatile credit options.

Key Players

-

Bank of America

-

Barclays

-

BNP Paribas

-

China Construction Bank

-

Citigroup

-

Deutsche Bank

-

HSBC

-

Industrial and Commercial Bank of China (ICBC)

-

JPMorgan Chase

-

Mitsubishi UFJ Financial

-

Wells Fargo

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=2291&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Comments

0 comment