views

Market Overview

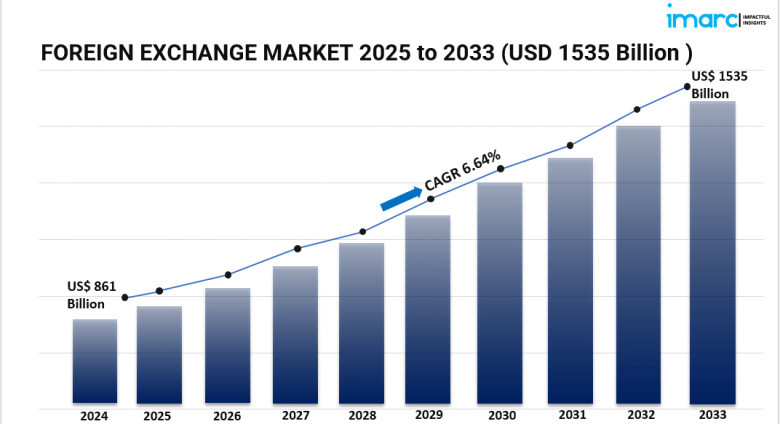

The global foreign exchange market, a cornerstone of international finance, reached a valuation of USD 861 billion in 2024. Driven by the globalization of trade, technological advancements in trading platforms, and macroeconomic factors like interest rate differentials and inflation, the market is poised for substantial growth. Projections indicate that by 2033, the market will expand to USD 1,535 billion, reflecting a CAGR of 6.64% from 2025 to 2033.

Study Assumption Years

-

Base Year: 2024

-

Historical Period: 2019–2024

-

Forecast Period: 2025–2033

Foreign Exchange Market Key Takeaways

-

Market Size & Growth: Valued at USD 861 billion in 2024, the Forex market is expected to reach USD 1,535 billion by 2033, growing at a CAGR of 6.64%.

-

Regional Dominance: North America leads the market, accounting for 25.8% of the global share in 2024, attributed to technological integration and economic factors.

-

Counterparty Insights: Reporting dealers dominate the counterparty segment, acting as intermediaries in the majority of Forex transactions.

-

Product Segmentation: Currency swaps hold the largest market share among Forex instruments, indicating their widespread use in hedging and investment strategies.

-

Technological Advancements: The adoption of electronic trading platforms has streamlined Forex transactions, enhancing market efficiency and accessibility.

-

Economic Indicators: Interest rate differentials, inflation rates, and GDP growth are significant drivers influencing currency valuations and trading volumes.

-

USD Prevalence: The U.S. dollar remains central to Forex trading, involved in approximately 88% of all transactions, underscoring its global dominance.

Request for a sample copy of this report : https://www.imarcgroup.com/foreign-exchange-market/requestsample

Market Growth Factors

1. Levels of Advancement in Technology on Trading Platforms

The activities of the Forex market have taken a new direction through a modern extension that saw the incorporation of an advanced technology. E-trading systems have changed the course of money transfers from one country to another with constant data, with fully automated trading algorithms and more intensified security features. They have torn down the barriers to market entry into Forex trading, allowing institutional as well as retail investors to participate as active trading actors. With trading processes becoming more automated, human errors are reduced, speed of transactions increases, and execution of complex trading strategies is made possible. The addition of artificial intelligence and machine-learning predictive analytics into trading further aids traders through decision-making. The effect is that with upcoming developments in technology, Forex markets globally will become even more efficient, transparent, and accessible. Such an environment will entice more participants to the market while creating avenues for growth.

2. Regulation Impact and Monetary Policies

Regulatory frameworks and monetary policies significantly create the very shape of travel for the Forex market. Through their monetary policies channels, central banks educate interest rates, and interest rates influence the value of currencies. Generally, a nation that promises high-interest rates draws forth international investors, thus boosting the country's currency value. The stability of that market is obtained through the articulation of such policies that promote transparency, reduce chances of systemic risks, and protect investors. Tighter compliance measures such as anti-money laundering (AML) and know-your-customer (KYC) regulations enhance Forex market credibility. Further, international cooperation among regulatory authorities helps in harmonizing their standards and thus gives rise to a more integrated and resilient global Forex market. These improvements in regulation assure both market integrity and the confidence of investors, thereby promoting growth in the market.

3. Increasing Global Trade and Investment Demand

The growing international transaction of goods and cross-border investments increases the need for foreign exchange. An importing or exporting business always has a need of Forex transactions to hedge against foreign currency risk, and a good portion of such transaction needs arise from multinational corporations that invest in foreign countries, so they would require currency conversion for capital expenditures, mergers, and acquisitions. Emerging market growth is accelerating trade levels, thus increasing participation in the Forex market. The increased reliance of small and medium enterprises (SMEs) on e-commerce and the digital platforms which have helped to open SMEs into international trading has, therefore, led to more demand for Forex services. So as new economies weave more into each other in globalization, the need for Forex markets to complement and encourage such fluid operations becomes undeniable, which indeed drives market growth in the long run.

Market Segmentation

Breakup by Counterparty:

-

Reporting Dealers: Financial institutions that act as intermediaries in Forex transactions, providing liquidity and facilitating trades.

-

Other Financial Institutions: Includes non-dealer financial entities like investment firms and insurance companies participating in Forex markets.

-

Non-financial Customers: Corporations and individuals engaging in Forex transactions for trade, investment, or hedging purposes.

Breakup by Type:

-

Currency Swap: An agreement to exchange currency between two parties, often used to hedge against exchange rate fluctuations.

-

Outright Forward and FX Swaps: Contracts to buy or sell currency at a future date at a predetermined rate, aiding in risk management.

-

FX Options: Financial derivatives granting the right, but not the obligation, to exchange currency at a specified rate before a set date.

Breakup by Region:

-

North America (United States, Canada)

-

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

-

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

-

Latin America (Brazil, Mexico, Others)

-

Middle East and Africa

Regional Insights

North America, particularly the United States, dominates the global Forex market, holding a 25.8% share in 2024. This leadership is attributed to the region's advanced financial infrastructure, widespread adoption of electronic trading platforms, and the U.S. dollar's status as the world's primary reserve currency. The robust economic indicators and proactive monetary policies further enhance North America's prominence in the Forex landscape.

Recent Developments & News

The foreign exchange market has experienced notable developments driven by digital innovation and evolving investor behavior. Financial institutions are increasingly integrating blockchain technology to enhance transparency and reduce transaction time in cross-border trading. Furthermore, the rise of algorithmic and AI-powered trading tools is revolutionizing trade execution strategies, ensuring higher accuracy and efficiency. Central banks are also exploring digital currencies, which could reshape Forex dynamics. With these technological advancements and the adoption of digital platforms, the Forex landscape continues to transform, promising a more agile and inclusive trading environment.

Key Players

-

American Express Company

-

Bank of America Corporation

-

Capital One

-

Citigroup Inc.

-

JPMorgan Chase & Co.

-

Mastercard Inc.

-

Payoneer Inc.

-

PayPal Holdings Inc.

-

Paystand Inc.

-

Stripe Inc.

-

Visa Inc.

-

Wise Payments Limited

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5143&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Comments

0 comment