views

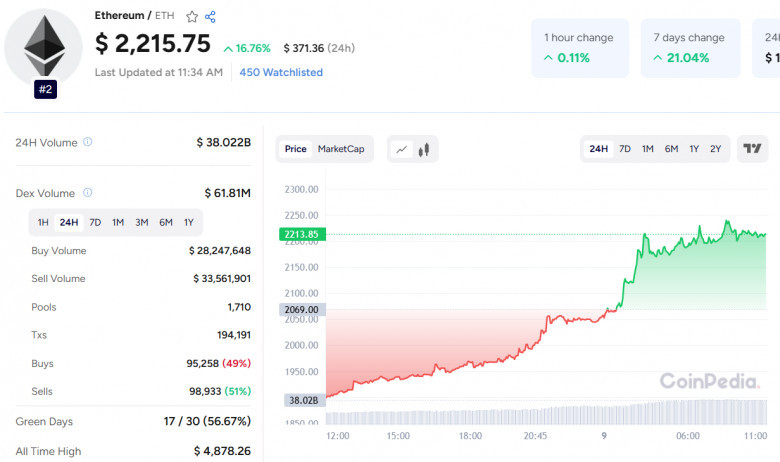

Ethereum (ETH) has gained over 20% in the past 24 hours, soaring above $2,200 and breaking through a key resistance level. After trading between $1,700 and $1,861 for weeks, ETH finally broke out, closing above a descending trendline that had held since early January. This strong move has sparked renewed interest in Ethereum price prediction, with traders eyeing further upside.

Pectra Upgrade Boosts Confidence

The recent rally was largely driven by Ethereum’s successful Pectra upgrade, implemented on May 7. This is the most significant protocol change since the Merge in 2022. The upgrade introduced key improvements:

-

Increased staking efficiency, allowing rewards on up to 2,048 validators

-

Better scalability with more “blobs” per block (from 6 to 9)

-

A deflationary mechanism through gas fee burning

The update also improves user experience by enabling transaction recipients to pay gas fees, a long-standing request from the community.

Technical Indicators Support Bullish Momentum

Technical signals are also favoring the bulls. The RSI is currently at 77, well above the overbought threshold of 70, showing strong momentum. The MACD has formed a bullish crossover, indicating an upward trend may continue. If this rally sustains, Ethereum could test its 200-day EMA at around $2,427, with a potential target near $3,000.

Macro and Institutional Support Add Fuel

Positive macroeconomic news, such as the new US-UK trade agreement, has added to risk-on sentiment across markets. Bitcoin surged past $102,500, and equities also climbed, providing further support for crypto.

Institutional interest is rising:

-

Ethereum’s TVL has climbed 41% in 30 days to $52.8 billion

-

Daily transactions are up 22% to 1.34 million

Notably, Abraxas Capital purchased 50,000 ETH, signaling strong institutional confidence

Comments

0 comment