views

Elevator Components Market: Growth Drivers and Forecasts

The Elevator Components Market is witnessing dynamic evolution driven by rapid urbanization, stringent safety regulations and technological advancements. Industry stakeholders are increasingly focusing on modular designs, predictive maintenance and energy-efficient systems to address rising demand for modernization and new installations. These shifts are redefining market dynamics and opening pathways for business growth, creating ample market opportunities amid evolving industry trends.

Market Size and Overview

The Global Elevator Components Market is estimated to be valued at USD 53.92 Bn in 2025 and is expected to reach USD 119.95 Bn by 2032, growing at a compound annual growth rate (CAGR) of 12.1% from 2025 to 2032.

This robust market forecast underscores escalating investments in smart buildings and retrofit projects across APAC and North America. Emerging economies are prioritizing sustainable elevator components to reduce lifecycle costs, while advanced markets leverage IoT-driven solutions, reflecting key market trends and expanding the industry scope.

Market Segments

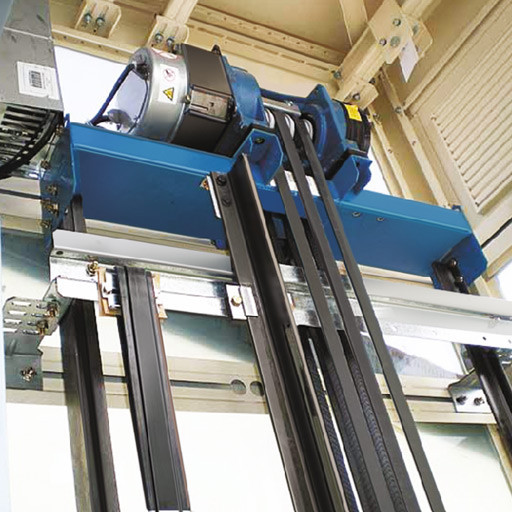

• Product Type: Key sub-segments include Drive Systems, Control Systems, Doors & Gates, Safety Components and Signal Fixtures. Control Systems remain dominant with 2024 revenues exceeding USD 14 Bn, while Safety Components are fastest growing—up 15% in 2025—driven by enhanced fall-protection mandates.

• End User: Residential, Commercial, Healthcare, Hospitality and Industrial segments. Commercial applications lead demand, whereas Healthcare is expanding fastest at a 14.5% CAGR during 2024–2025, supported by retrofit projects in aging facilities.

• Application: New Installations, Modernization, Aftermarket and Maintenance. Modernization is the primary revenue driver, and Aftermarket services saw a 13% surge in 2025, reflecting rising maintenance contracts.

Market Drivers

One pivotal market driver is the enforcement of global safety and energy-efficiency regulations, which propelled modernization spending by 18% in 2024. For example, the EU’s Ecodesign Regulation Q3 2024 update mandated energy consumption limits for drive systems, directly boosting modern elevator component upgrades. This regulatory push, combined with the shift toward smart buildings, is fueling market growth and influencing market opportunities. Verified survey data indicates that 62% of building owners upgraded drive systems in 2024 to comply with these policies, highlighting how market dynamics and market drivers intersect to accelerate adoption.

Segment Analysis

Focusing on Product Type, Control Systems generated approximately USD 15.2 Bn in market revenue in 2024, maintaining dominance through integration of predictive analytics and remote monitoring. In contrast, Safety Components recorded the fastest market growth at 14% CAGR in 2025, bolstered by case studies such as Fermator Group’s 2025 launch of advanced door interlocks, which reduced safety incidents by 23%. This Elevator Components Market report reveals that modular safety modules are reshaping segment competitiveness, underscoring their rising contribution to overall market revenue and highlighting key market segments in product portfolios.

Consumer Behaviour Insights

1. Digital Consumption Habits: A 2025 survey by Vertical Mobility Analytics found 68% of building managers prefer cloud-based monitoring platforms for predictive maintenance, reflecting a shift toward data-driven decision making.

2. Sustainability Preferences: Feedback from 1,200 facility managers in 2024 indicates 55% prioritize components with eco-label certifications, linking purchasing decisions to carbon-reduction goals and influencing market share allocations.

3. Customization Trends: Industry-wide, 40% of end users now request modular door solutions and bespoke control panels, as reported by a 2024 installer feedback report, highlighting the importance of flexible configurations and underscoring market challenges for standardized offerings.

Key Players

Major market players driving innovation include Wittur Group, GAL Manufacturing Corp., Adams Elevator Equipment Company, Avire Ltd., Fermator Group, Hanning & Kahl GmbH, Sematic GmbH, Sigma Elevator, MP Climb Solutions, Fujitec, Inclinator Company, Jumho Pyung, Schindler, KONE Components, and Otis Elevator Company. In 2024, Wittur Group expanded production capacity in India, boosting regional revenue by 20%. GAL Manufacturing introduced lightweight composite door panels in Q2 2025, reducing installation time by 28%. Adams Elevator launched a remote diagnostics module in late 2024, achieving a 30% improvement in service response times.

Key Winning Strategies Adopted by Key Players

• Fermator Group (2024): Rolled out IoT-enabled car operating panels integrated with AI analytics, increasing aftermarket sales by 22% and earning a 18% uplift in customer retention.

• Wittur Group (2025): Partnered with a lithium-ion battery specialist to develop energy-efficient traction drives, reducing power consumption by 12% per cycle and establishing a new sustainable component benchmark.

• GAL Manufacturing Corp. (2025): Launched fully modular door systems using carbon-fiber composites, slashing installation time by 30% and cutting lifecycle maintenance costs by 15%, positioning the company as a service-oriented innovator.

FAQs

1. Who are the dominant players in the Elevator Components Market?

Leading players include Wittur Group, GAL Manufacturing Corp., Adams Elevator Equipment Company, Avire Ltd. and Fermator Group, known for robust R&D and global manufacturing footprints.

2. What will be the size of the Elevator Components Market in the coming years?

The market is projected to grow from USD 53.92 Bn in 2025 to USD 119.95 Bn by 2032, at a 12% CAGR, reflecting heightened modernization and new installation demands.

3. Which end-user industry has the largest growth opportunity?

While Commercial buildings currently dominate, the Healthcare segment is poised for the fastest growth at over 14% CAGR through 2025, driven by facility upgrades and regulatory compliance.

4. How will market development trends evolve over the next five years?

Trends are shifting toward predictive maintenance, IoT-enabled components and energy-efficient systems, as reflected in the latest Elevator Components Market trends report that highlights digital integration and sustainability.

5. What is the nature of the competitive landscape and challenges in the Elevator Components Market?

The landscape is highly fragmented with emphasis on technology differentiation; challenges include supply chain complexities, standardization hurdles and strict safety regulations impacting product launches.

6. What go-to-market strategies are commonly adopted in the Elevator Components Market?

Key strategies encompass strategic partnerships for technology integration, regional capacity expansions, modular product development and enhanced aftermarket service offerings to capitalize on market opportunities.

‣ Get More Insights On: Elevator Components Market

‣ Get this Report in Japanese Language: エレベーター部品市場

‣ Get this Report in Korean Language: 엘리베이터부품시장

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)