views

North America Crude Oil Prices Q4:

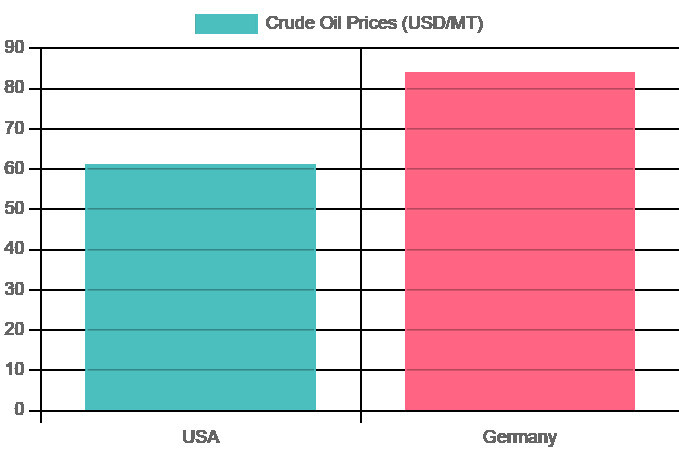

Crude Oil Prices in the United States:

|

Product |

Category |

Price |

|

Crude Oil |

Feedstock |

61 USD/MT |

In the last quarter of 2024, Crude Oil Prices in the U.S. saw notable fluctuations driven by supply disruptions, market sentiment, and policy expectations. In October, prices briefly spiked due to supply constraints from halted production in Libya and damage from hurricanes in the Gulf of Mexico. However, this upward trend was short-lived, as November brought increasing pessimism in market forecasts and worries about falling global demand. By December, Crude Oil Prices settled at 61 USD/MT, reflecting the effects of changing policies and economic uncertainty. Additionally, the Crude Oil Price Forecast Chart suggests Trump's election victory bolstered expectations for policies that would promote increased domestic production, further influencing market dynamics.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/crude-oil-pricing-report/requestsample

Note: This analysis can be adjusted to align with the customer's individual preferences

Europe Crude Oil Prices Movement Q4:

Crude Oil Prices in Germany:

|

Product |

Category |

Price |

|

Crude Oil |

Feedstock |

84 USD/MT |

In the last quarter of 2024, Crude Oil Prices in Germany faced volatility due to supply shortages, geopolitical tensions, and policy expectations. In October, the Crude Oil Prices History Chart shows prices briefly surged as disruptions in Libyan supply and rising tensions between Israel and Hezbollah impacted market stability. However, this spike was temporary, as easing geopolitical tensions and weak global demand led to a price drop in November. By December, Crude Oil Prices stabilized at 84 USD/MT, supported by OPEC+ sticking to its production strategy. Furthermore, Trump's election victory in the U.S. heightened expectations for increased American oil production, affecting global market sentiment.

Regional Analysis: The price analysis can be expanded to include detailed crude oil price data for a wide range of European countries:

such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

What is The Prediction for Crude Oil Prices?

The outlook for crude oil prices is uncertain, shaped by global supply and demand dynamics, geopolitical tensions, and economic policies. Analysts suggest that prices could vary based on OPEC+ production decisions, U.S. shale output, and disruptions in key oil-producing areas. Increasing geopolitical risks in the Middle East and supply constraints due to sanctions on major exporters might drive prices up. However, worries about a global economic slowdown and the rise of renewable energy could dampen demand, helping to keep prices stable. If market conditions remain steady, crude oil prices are likely to stay within a moderate range, with possible short-term fluctuations influenced by external factors.

Speak To an Analyst: https://www.imarcgroup.com/request?type=report&id=22814&flag=C

Key Coverage:

- Market Analysis

- Market Breakup by Region

- Demand Supply Analysis by Type

- Demand Supply Analysis by Application

- Demand Supply Analysis of Raw Materials

- Price Analysis

- Spot Prices by Major Ports

- Price Breakup

- Price Trends by Region

- Factors Influencing the Price Trends

- Market Drivers, Restraints, and Opportunities

- Competitive Landscape

- Recent Developments

- Global Event Analysis

How the IMARC Pricing Database Can Help

The latest IMARC Group study, “Crude Oil Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2024 Edition,” presents a detailed analysis of Crude Oil price trend, offering key insights into global Crude Oil market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Crude Oil demand, illustrating how consumer behavior and industrial needs affect overall market dynamics. The price report uncovers critical factors influencing current and future prices by exploring the intricate relationship between supply and demand.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC’s data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

Comments

0 comment