views

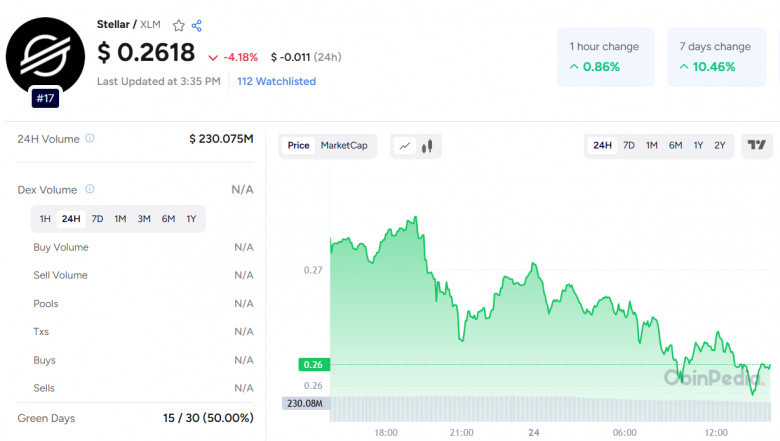

Stellar (XLM) is currently navigating a period of consolidation within a falling wedge pattern — a setup often viewed as a bullish reversal signal. The $0.25 resistance level is emerging as a critical threshold. A confirmed breakout could potentially push XLM to $0.375 or even $0.514 in the coming days, aligning with optimistic Stellar price prediction models. However, downside risks remain. A looming “death cross,” where the 50-day moving average crosses below the 200-day, signals possible declines to $0.19 or $0.14 if $0.21 support is breached.

On the technical front, the SuperTrend indicator recently flashed a macro trend reversal — its first signal since January 2022 — suggesting an upcoming price swing. Additionally, an ascending triangle formation points to a potential 15–17% move, favoring bullish momentum if market sentiment remains strong.

Fundamentally, Stellar received a boost from a major strategic partnership with AEON Group, South Asia’s retail giant. AEON stores in Malaysia will begin accepting XLM for payments starting in H2 2025. This could significantly enhance token utility and drive demand, especially as blockchain adoption grows in the retail sector.

Yet, XLM faces stiff competition from XRP, which is also expanding in Asia via a tracker fund partnership with HashKey Capital. Meanwhile, macroeconomic uncertainties, including global trade tensions and crypto regulation, add pressure to the market.

Also Read: MATIC Price Prediction 2025 - 2030

XLM's strong correlation with Bitcoin also means any BTC volatility could sway Stellar’s momentum. But with promising technical setups and real-world use cases unfolding, XLM appears well-positioned for long-term growth — provided the broader market stabilizes and adoption trends persist.

In a space where utility and partnerships increasingly matter, Stellar is making strategic moves to stay relevant and competitive in the evolving landscape of global blockchain payments.

Comments

0 comment