views

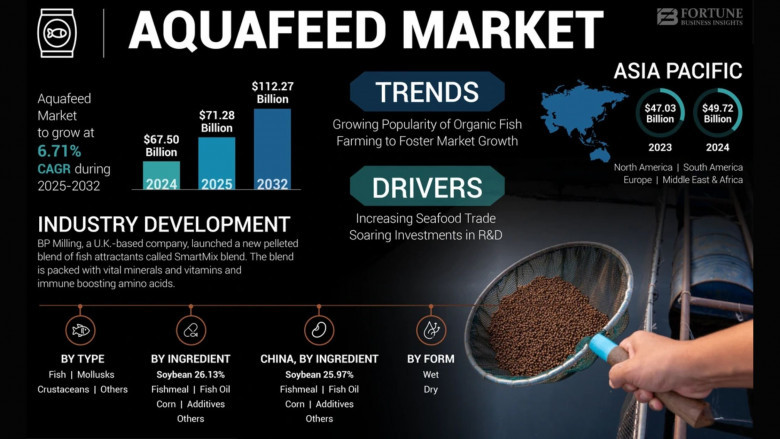

The global aquafeed market was valued at USD 67.50 billion in 2024. It is projected to increase from USD 71.28 billion in 2025 to USD 112.27 billion by 2032, reflecting a compound annual growth rate (CAGR) of 6.71% during the forecast period of 2025 to 2032. In 2024, Asia Pacific held the largest share of the aquafeed market at 73.65%. The aquafeed market in the United States is also expected to expand significantly, reaching a projected value of USD 2.85 billion by 2032, supported by the presence of leading companies such as Cargill Incorporated, Archer Daniels Midland Company, and Alltech Inc.

Seafood consumption has seen consistent growth over the years and is forecasted to accelerate further. According to the U.S. Food and Agriculture Organization, global per capita seafood consumption is expected to exceed 20 kg by 2030. This surge in seafood consumption is a primary driver behind the increasing demand for aquafeed. The market is also gaining momentum due to the growing interest in aquafeed enriched with functional ingredients. Additionally, the rise in international seafood trade, driven by greater fish consumption, is expected to fuel market expansion. Various governmental programs and initiatives are encouraging farmers to adopt high-quality feed, further contributing to market development.

Information Source: https://www.fortunebusinessinsights.com/industry-reports/aquafeed-market-100698

Segmentation:

Based on type, the market is segmented into mollusks, crustaceans, fish, and others. By ingredient, it includes additives, fish oil, fishmeal, soybean, corn, and others. In terms of form, the market is divided into dry and wet. Regionally, the market spans South America, North America, Europe, Asia Pacific, and the Middle East & Africa.

Report Coverage:

- Utilizes Porter’s Five Forces and SWOT analysis for precise market insights

- Assesses the impact of the COVID-19 pandemic

- Includes profiles of key players

- Highlights prevailing market trends

- Provides details on market segmentation by form, type, ingredient, and more

Drivers & Restraints:

Rising Global Seafood Trade to Drive Market Expansion

The growing interest in organic fish farming, though still developing, presents promising opportunities for market growth due to increasing consumer demand. Rising needs for animal-based proteins in Western countries and the expanding global seafood trade are anticipated to significantly support market growth. As seafood consumption rises, so does consumer spending on related products such as fish oils, meals, and silage, boosting aquaculture production and, in turn, the demand for aquafeed.

Investments in research and development by major players to innovate and create new products are also likely to stimulate market growth. However, market expansion may be hindered by the volatility of raw material prices.

Regional Insights:

Asia Pacific Leads Due to Surging Fish Production

Asia Pacific is expected to maintain its dominant position in the global aquafeed market, supported by rapid development in recent years. China and India collectively account for over half of the region’s sales. In particular, rising fish production in China and growing business expansions across both countries are expected to drive regional growth.

Europe is projected to grow steadily, fueled by increased aquaculture production and heightened interest in salmon farming.

In North America, the market is likely to experience substantial growth due to the presence of major players like Archer Daniels Midland and Cargill Incorporated, along with strong aquaculture export profits supporting regional demand.

Competitive Landscape:

Leading Companies Focus on Expanding Product Lines and Distribution Networks

Key industry players are prioritizing the expansion of their product portfolios and distribution reach to strengthen their market presence. Strategies such as mergers and acquisitions, technological advancements, and new product developments are commonly adopted. For example, in January 2020, BioMar A/S enhanced its production capabilities with the opening of a new aquafeed facility in Wesley Vale, Tasmania, capable of producing 110,000 tonnes of aquafeed annually.

Key Players Featured in the Report:

- Cargill Incorporated (Minnesota, U.S.)

- Archer Daniels Midland Company (Illinois, U.S.)

- Alltech Inc. (U.S.)

- Purina Animal Nutrition (Missouri, U.S.)

- Ridley Corp Ltd (Australia)

- Nutreco N.V. (Amersfoort, Netherlands)

- Aller Aqua A/S (Christiansfeld, Denmark)

- BioMar A/S (Denmark)

- Dibaq Aquaculture (Spain)

- Beneo GmbH (Germany)

Get Sample PDF Brochure: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/aquafeed-market-100698

Industry Developments:

- May 2021: BP Milling, a company based in the U.K., introduced a new pelleted fish attractant blend named SmartMix. The product contains essential minerals, vitamins, and immune-enhancing amino acids.

![Asphalt roofing shingles market [New Report] by Updated Development 2033](https://timessquarereporter.com/public/index.php/upload/media/posts/2025-04/15/asphalt-roofing-shingles-market-new-report-by-updated-development-2033_1744714139-s.jpg)

Comments

0 comment