views

India Digital Banking Market Size, Share, Trends and Forecast by 2033

The latest report by IMARC Group, “India Digital Banking Market Size, Share, Trends, and Forecast by Services, Deployment Type, Technology, Industries, and Region, 2025–2033,” provides a comprehensive analysis of the India digital banking market.

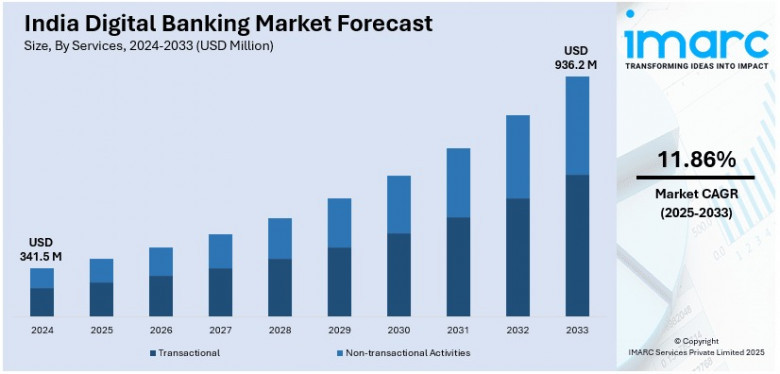

The study covers competitor and regional analysis, as well as a detailed breakdown of segments within the industry. The India digital banking market size reached USD 341.5 Million in 2024. Looking forward, IMARC Group projects the market to reach USD 936.2 Million by 2033, exhibiting a CAGR of 11.86% during 2025–2033.

Report Attribute and Key Statistics:

|

Attribute |

Key Statistics |

|

Base Year |

2024 |

|

Forecast Years |

2025–2033 |

|

Historical Years |

2019–2024 |

|

Market Size in 2024 |

USD 341.5 Million |

|

Market Forecast 2033 |

USD 936.2 Million |

|

Market Growth Rate |

11.86% (2025–2033) |

India Digital Banking Market Overview:

Indian digital banking market is developing at a solid rate since of developing appropriation of versatile managing an account, advanced wallets, and fintech items. Picking up ubiquity in smartphones and moved forward web entrance made a difference within the move towards computerized budgetary administrations. Thrust to this alter has been too given by the activities such as the Advanced India program and advancing a cashless economy. The development of neobanks and selection of wilderness advances like manufactured insights and blockchain are making strides client involvement and operational efficiencies. Buyers and ventures are hence progressively grasping computerized managing an account administrations, and India becomes an imperative player within the global computerized keeping money economy.

Request for Sample Report: https://www.imarcgroup.com/india-digital-banking-market/requestsample

India Digital Banking Market Trends and Drivers:

Among the foremost noticeable patterns in Indian advanced keeping money is the tall development rate of portable keeping money and computerized wallets. The developing smartphone infiltration and get to to high-speed web have engaged more buyers to conduct budgetary exchanges online. Administrators such as Paytm, PhonePe, and Google Pay have gotten to be greatly prevalent, giving moment exchanges, charge installments, and fund exchanges. The government activity to advance a cashless economy with the assistance of campaigns such as the Computerized India campaign has moreover contributed intensely towards this improvement. In expansion, the utilize of QR code installments and the victory of Bound together Installments Interface (UPI), which completed 16.58 billion exchanges in October 2024, show the move towards advanced installment strategies.

Neobank advancement and fintech advancements are a key driver for India's advanced keeping money industry. Neobanks, being absolutely online with no offline physical nearness, give streamlined forms and straightforward interfacing, engaging to a innovatively progressed clientele. Such digital-only banks offer customized monetary administrations, moment account opening, and smooth network with other computerized stages. Moreover, fintech organizations are advertising imaginative items that are expanding client encounters, counting AI-powered budgetary arranging instruments and blockchain-based security components. The partnership between occupant banks and fintech organizations is additionally making a comfortable environment for embracing advanced managing an account, tending to the changing needs of today's buyers.

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/india-digital-banking-market

India Digital Banking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on services, deployment type, technology, and industries.

By Services:

- Retail Banking

- Corporate Banking

- Investment Banking

By Deployment Type:

- On-Premises

- Cloud-Based

By Technology:

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Others

By Industries:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail

- Government

- Others

By Region:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The report provides detailed insights into the competitive structure and profiles of major players in the India digital banking market. Key players include:

- ICICI Bank

- HDFC Bank

- State Bank of India (SBI)

- Axis Bank

- Kotak Mahindra Bank

- YES Bank

- IndusInd Bank

- Paytm Payments Bank

- Fino Payments Bank

- Airtel Payments Bank

India Digital Banking Market News:

- In October 2024, the Unified Payments Interface (UPI) set a record by processing 16.58 billion transactions in a single month, underscoring the rapid adoption of digital payment methods in India.

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=31264&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No.: (D) +91 120 433 0800

Americas: +1 631 791 1145 | Asia: +91-120-433-0800 | UK: +44-753-714-6104

Comments

0 comment