views

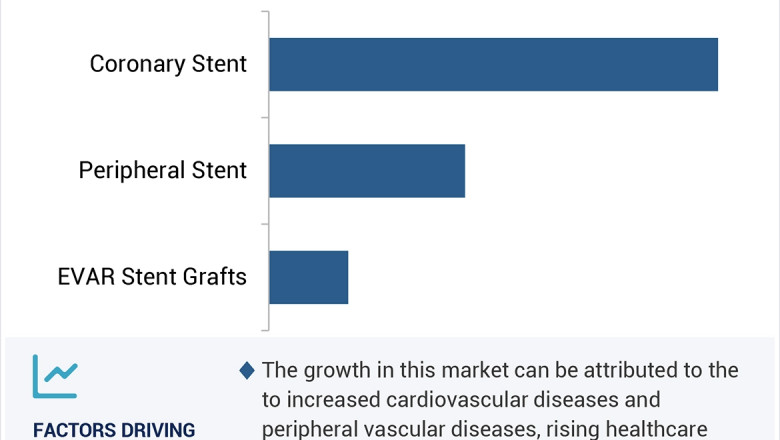

The vascular stents market projected to reach USD 15.6 billion by 2029 from USD 11.4 billion in 2024, at a CAGR of 6.5% during the forecast period. The growth of the vascular stents market is primarily attributed to the increasing incidence of vascular diseases (such as coronary artery diseases, peripheral artery diseases, and endovascular aortic aneurysms) and the rising uptake of angioplasty procedures. The growing preference for minimally invasive surgical procedures is also expected to contribute to market growth. However, the availability of open surgical procedures, such as open heart surgeries, and the increasing number of product recalls are expected to restrain the market growth to a certain extent. Additionally, the potential of emerging economies and the development of bioresorbable vascular scaffold stents are expected to provide growth opportunities for market players during the forecast period.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=199869009

Browse in-depth TOC on "Vascular Stents Market"

620 - Tables

53 - Figures

426 - Pages

Driver: Growing preference for minimally invasive procedures

The market for vascular stents is primarily driven by the growing preference and demand for minimally invasive surgical procedures. Patients are increasingly opting for angioplasty and other-related procedures owing to several advantages, including shorter recovery periods, minimal post-surgery complications, and smaller incisions. Maintaining arterial blood flow is essential for treating peripheral artery disease (PAD) and coronary artery disease (CAD). Consequently, there is a growing need for advanced medical procedures such as stenting, a standard method used in angioplasty. Therefore, the increasing demand for vascular stents is driven by the subsequent rise in chronic heart conditions. For instance, in 2021, over a million percutaneous coronary interventions (PCIs) were performed annually in the US, and 1.1 million transluminal coronary angioplasties were performed across 25 EU nations. These statistics demonstrate the crucial role that stents play in delivering contemporary vascular therapy.

Restraint: Stringent regulatory guidelines for product approval

The growth of the vascular stents market is expected to be hindered by stringent regulatory policies and guidelines related to medical device approval. These regulations aim to ensure the efficacy & safety of vascular stents. Clinical efficacy must also be considered, in addition to meeting stringent quality standards. The mandatory compliance may lead to businesses bearing hefty financial & operational burdens that may impede the ability to develop & launch innovative stent technologies. Financial obstacles like protracted approval processes and high compliance fees can also limit patients' access to advanced stenting products.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=199869009

Opportunity: Development of bioresorbable vascular scaffold stents

Vascular stents offer a substantial growth opportunity in developing bioresorbable vascular scaffolds (BRS) stents. BRSs, as opposed to permanent metallic stents, offer transient mechanical support to the vascular wall before progressively dissolving to lessen the chance of adverse reactions and reduce the presence of foreign bodies in time. The growing popularity of bioresorbable materials is expected to contribute to market growth. Continuous advancements in medical devices are expected to increase the safety & efficacy of vascular stents in the coming years. The prominent firms offering bioresorbable stents for the treatment of cardiac & peripheral vascular diseases include BIOTRONIK SE & Co. KG (Germany), Arterius Ltd. (UK), and Meril Life Sciences Pvt. Ltd (India).

Challenge: Complications associated with stenting procedures

Issues with stents are a primary risk to clinical outcomes, procedural success rates, and patient safety throughout treatment. Allergy to chemicals or imaging dyes used during the treatment is a common side effect that can lead to unpleasant responses, extended hospital stays, and the increasing need for additional medical interventions. Hemorrhages at the operation location may hinder recovery, thus escalating medical expenses and resulting in lower patient satisfaction. Hence, healthcare professionals are hesitant to opt for stenting procedures, which may eventually alter market dynamics and hinder widespread adoption.

Global Vascular Stent Market Ecosystem Analysis

The ecosystem of the vascular stents market comprises elements present in this market, and these elements are defined with a demonstration of the bodies involved. It includes manufacturers, distributors, research & product developers, and end users.

Request 10% Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?utm=even&id=199869009

Key Market Players

The vascular stent market is highly consolidated, with several key players dominating the field. Major companies include Medtronic Plc (Ireland), Abbott Laboratories (US), Boston Scientific Corporation (US), B Braun SE (Germany), Terumo Corporation (Japan), Biotronik SE & Co.KG (Germany), and Shanghai Microport Medical (Group) Co., Ltd (China), among others. These companies are known for their advanced technologies and substantial investments in research and development.

Recent Developments of Vascular Stent Market industry

- In May 2024, Abbott Laboratories launched the XIENCE Sierra Everolimus Drug-eluting Coronary Stent System in India. XIENCE Sierra is one of the latest generation stents in the XIENCE family, designed for individuals with blocked coronary arteries.

- In April 2024, Abbott Laboratories declared that the US FDA had approved the Esprit BTK Everolimus Eluting Resorbable Scaffold System (Esprit BTK System), marking a breakthrough innovation for individuals with chronic limb-threatening ischemia (CLTI) below-the-knee (BTK).

Comments

0 comment