views

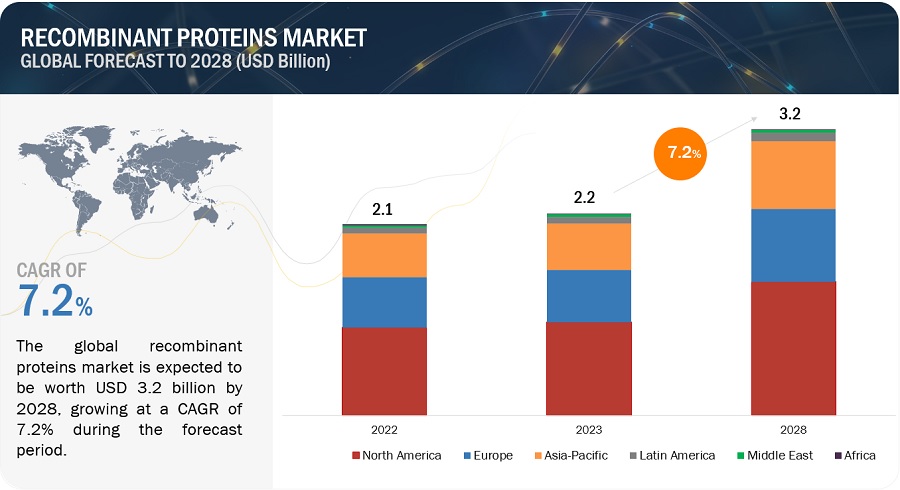

The global recombinant proteins market growth forecasted to transform from USD 2.2 billion in 2023 to USD 3.2 billion by 2028, driven by a CAGR of 7.2%. Growth in the market can be attributed to factors such as rising incidence of chronic diseases, growing demand for biologics and biosimilars due to expiration of patents, rising demand for customized medicine and increasing government initiatives for R&D in life sciences research.

Browse 432 market data Tables and 43 Figures spread through 406 Pages and in-depth TOC on "Recombinant Proteins Market by Product (Growth Factors, Chemokines, Structural Proteins, Membrane Proteins), Application (Drug Discovery & Development (Biologics, Vaccines, Cell & Gene Therapy), Research, Biopharma Production) & Region - Global Forecast to 2028"

View detailed Table of Content here - https://www.marketsandmarkets.com/Market-Reports/recombinant-proteins-market-70095015.html

The global recombinant proteins market is expected to grow at a CAGR of 7.2% during the forecast period. The growth of the market is projected to be driven by factors such as rising incidence of chronic diseases, increasing demand for biologics and biosimilars due to patent expirations, increasing government support for R&D and growing preference for personalized medicine.

The growth factors and chemokines segment is expected to have the dominant share of the recombinant proteins market in 2023.

Based on product, the global recombinant proteins market is segmented into growth factors and chemokines, immune response proteins, structural proteins, membrane proteins, kinase proteins, regulatory proteins, recombinant metabolic enzymes, adhesion molecules and receptors, and other recombinant proteins. The growth factors and chemokines segment is segmented into interferons & interleukins. In 2023, the growth factors and chemokines segment held the largest share of the recombinant proteins market. The largest segment is due to their utilization in a range of research domains like neurobiology, wound healing, immunology, transplantation, apoptosis, cancer, HIV/AIDS, COVID-19, cell culture, and stem cell research.

The drug discovery & development segment accounted for the largest share of the application segment in the recombinant proteins market in 2023.

Based on application, the recombinant proteins market is segmented into drug discovery & development, biopharmaceutical production, research, diagnostics, and other applications. The drug discovery & development segment is segmented into biologics, vaccines and cell & gene therapy. The research segment is further segmented into academic research and biotechnology research. The drug discovery & development segment is anticipated to grow at significant CAGR during the forecast period owing to application of recombinant proteins in developing novel compounds that impact the function of disease-associated proteins or their interactions and the increasing focus on research and development in this field emphasizes the importance of these elements.

In 2022, the bacterial cells segment accounted for the largest share of the recombinant proteins market.

Based on host cell, the global recombinant proteins market is segmented into mammalian systems, insect cells, yeast & fungi, bacterial cells and other host cell. In 2022, the bacterial cells segment accounted for the largest share of the recombinant proteins market owing to factors such as distinctive genetic characteristics, ease of manipulation, and cost-effectiveness when compared to other systems.

The Asia Pacific region is the fastest-growing region of the recombinant proteins market in 2023.

The Asia Pacific is accounted to be the fastest-growing segment of the market. The growth of the recombinant proteins markets in the region is driven by the rising investment by pharmaceutical & biotechnology companies, increasing awareness regarding personalized therapeutics and favourable government policies in Asian countries are pivotal drivers fostering growth in this regional market.

The recombinant proteins market is competitive, with a small number of players competing for market shares. Bio-Techne (US), Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Abcam plc (UK), Abnova Corporation (Taiwan), Biolegend Inc (US), Bio-Rad Laboratories, Inc. (US), BPS Bioscience, Inc. (US), Enzo Biochem, Inc. (US), GenScript (China), Miltenyi Biotec B.V. & Co. KG (Germany), Proteintech Group, Inc. (US), Sino Biological Inc. (China), Acrobiosystems Group (US) and Aviva Systems Biology Corporation (US) are some of the leading players in this market. Most companies in the market focus on organic and inorganic growth strategies, such as product launches, expansions, acquisitions, partnerships, and agreements, to increase their product offerings, cater to the unmet needs of customers, increase their profitability, and expand their presence in the global market.

Thermofisher Scientific Inc (US)

Thermo Fisher Scientific (US) held a dominant position in the market in 2023. The company adopts organic and inorganic growth strategies to maintain its dominant position in the market. The company caters to more than 400,000 customers in the pharmaceutical and biotechnology industry; hospitals, clinical diagnostics, and research laboratories; and universities and government agencies. The company offers recombinant protein solutions through its Life Science business segment, which is its highest revenue generator. For instance, in 2023, Thermo Fisher Scientific Inc (US) acquired Olink Holding AB (Sweden) to advance capabilities in proteomics discovery & development.

Merck KGaA (Germany)

Merck KGaA (Germany) held a leading position in the recombinant proteins market. The company offers an array of recombinant proteins and has a portfolio of more than 300,000 products offered through Life Science Research business segment. The company focuses on the high-growth Asia Pacific region to increase its market share and revenue. For instance, in 2023, Merck KGaA (Germany) opened a New Biologics Testing Center in Shangai, China, that enabled clients to access a broad range of local testing services.

Bio-Techne (US)

Bio-Techne (US) is also one of the key players in the recombinant proteins market in 2023. The company has been able to build a strong customer base, owing to its broad range of recombinant proteins offering along with adoption of organic & inorganic strategies. For instance, in 2023, Bio-Techne (US) and Cell Signaling (US) partnered to allow researchers to validate simple Western antibodies. Also in 2021, Bio-techne (US) opened a new distribution hub facility in Dublin, Ireland for supporting the life sciences industry in Europe.

Comments

0 comment