views

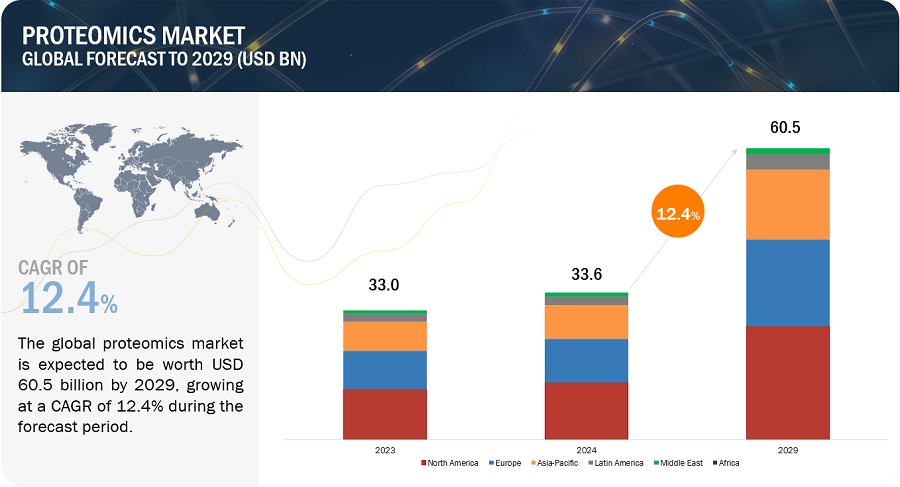

The Proteomics Market growth forecasted to transform from USD 33.6 billion in 2024 to USD 60.5 billion by 2029, driven by a CAGR of 12.4%. The major factors driving growth in the proteomics market are the growing demand for personalized medicines for clinical practices, rising applications in drug discovery and development, growing government & private funding, clinical trial and translational research expansion, biologics and biosimilars development, increasing focus on monoclonal antibodies and therapeutic proteins, and improved techniques in protein quantification. Additionally, advancements in single-cell proteomics and bioinformatics are further driving the growth of the proteomics market.

Browse in-depth TOC on "Proteomics Market"

707 - Tables

49 - Figures

604 – Pages

Key Market Players:

The key players in the proteomics market include Thermo Fisher Scientific Inc. (US), Agilent Technologies, Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Waters Corporation (US), Bio-Rad Laboratories, Inc. (US), Bruker Corporation (US), Revvity (US), Shimadzu Corporation (Japan), Illumina Inc. (US), Promega Corporation (US), Eurofins (Luxembourg), QIAGEN (Netherlands), Charles River Laboratories (US), and Protagene (Germany), among others.

Drivers: Rising demand for personalized medicine

Proteomics plays an important role in personalized medicine by providing insights at the molecular level. The results make it possible to implement targeted therapies to support individualized medicine through biomarker discovery, identification of drug targets, and follow-up of therapy responses. During the last decade, there has been an increased usage of personalized medicines. In 2021, the FDA's Centre for Drug Evaluation and Research approved 50 novel molecular entities, all but 2 of which were therapeutic goods. Similarly, in 2022, the US FDA approved around 37 NMEs.

Restraints: High cost of instruments

One of the major factors limiting the growth of the proteomics market is the requirement of high investments initially. These are highly sophisticated, fully automated systems, with a relatively high capital expenditure towards procurement, installation, and integration into existing lines of production. This can be very expensive, owing to which raising the stake is quite hard for small and medium-sized enterprises, which form a large part of the manufacturing industry. Although these companies play an important role in product quality and regulatory compliance, steep costs may deter them from adopting essential instruments. Mass spectrometers and chromatography systems are examples of advanced proteomic tools, but they come at a cost. For example, state-of-the-art mass spectrometers run into several hundred thousand dollars—thus posing a considerable expense for research institutions and biotech companies. For example, only reagents for running a single mass spectrometry analysis can be in the range of USD 100–300. The cost in terms of specialists can also run into thousands of dollars a year for institutions if hiring and training are to be done. For small research labs or academic institutions, such expenses are unaffordable.

Opportunities: Advancements in bioinformatics

Advancements in bioinformatics are a key factor driving growth in the proteomics market. Some major technological advancements are software tools for data analysis and interpretation, such as MaxQuant and Proteome Discoverer, that enhance accuracy and speed in identifying and quantifying proteins from mass spectrometry data. Such tools help in the fast, parallel analysis of comprehensive datasets and in predicting the subtle interactions of proteomes and pathways. Technologies in bioinformatics, like computational proteomics and next-generation sequencing technologies, are revolutionizing biological and clinical research. Mass spectrometry allows for high-throughput and exact protein analysis, and NGS allows for fast, inexpensive sequencing of samples to reveal deviations, providing complete transcriptome profiles and identifying microbes. Among the NGS technologies, metagenomic NGS is best suited to detect pathogenic organisms in extremely complex samples. Furthermore, machine learning and artificial intelligence are currently changing the bioinformatics applications in proteomics. For prototyping exact precision in predicting protein structures, functions, and interactions, state-of-the-art algorithms harnessed from artificial intelligence, such as AlphaFold by DeepMind, are increasingly being used. They also empower fast turnaround for designing drug targets and therapeutic molecules.

Challenges: Lack of data management/handling in proteomics research

Although there is a huge volume of proteomics data that is available, the challenge in this market lies in the access and efficient utilization of the same. Poor data management can have a deleterious effect on the outcome of research and may actually turn out to be a growth inhibitor for the market. Recent studies have pointed out that owing to the inefficient handling of data, the use of proteomics data in major applications such as biomarker discovery and drug development has been restricted. For example, researchers in a major biotech company were slowed down while trying to analyze high-throughput proteomics data in the identification of potential therapeutic targets. Such delays slow not only the progress in research but also lengthen the time it takes to translate such discoveries into actionable results, which prolongs the product development cycle. Moreover, the lack of standardization of data formats and lack of interoperability between proteomics platforms make the integration of data from different research initiatives or even institutions very difficult. Besides, high-throughput experiments generate proteomics data that require specialized expertise in processing and analysis. Researchers often invest a huge amount of time in the preprocessing and analysis of proteomics data in order to extract meaningful information. The absence of separation of sample numbers in proteomics repositories makes it extremely hard to formulate the necessary research queries.

Spectroscopy segmented dominated the proteomics market in 2023.

Based on technology, the proteomics market is broadly segmented into spectroscopy, chromatography, electrophoresis, protein microarrays, X-ray crystallography, surface plasmon resonance, protein fractionation, and other technologies. The spectroscopy is further segmented into Mass Spectrometry, NMR Spectroscopy, CD Spectroscopy. The Chromatography is further divided into HPLC, ION Chromatography, Affinity Chromatography and Supercritical Fluid Chromatography. The spectroscopy segment accounted for the largest share of the technology segment of the proteomics market in 2023 followed by chromatography segment. The dominance of the segment is attributable to high accuracy and sensitivity through spectroscopy techniques for complex protein structures, increased use of the spectroscopy in biomarker discovery, drug development, and clinical diagnostics.

Clinical diagnostics segment is likely to grow at the highest CAGR during the forecast period of 2024-2029.

Based on applications, the market is segmented into clinical diagnostics, drug discovery & development and other applications. Clinical diagnostics dominated the market in 2023 owing to various factors such as use of proteomics in personalized medicine, demand for proteomics for identification and validation of protein biomarkers associated with various diseases. These biomarkers can be used for early diagnosis, prognosis, and monitoring of disease progression.

North America dominated the global proteomics industry in 2023.

Based on region, the proteomics market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the global proteomics market in 2023 and is likely to dominate throughout the forecast period. The presence of many pharmaceutical companies and the rising demand for precision medicines are likely to boost the market in the region. Additionally, the rising research funding further drives the growth of the proteomics market in North America.

Recent Developments

- In March 2024, Thermo Fisher Scientific Inc. (US) introduced the Thermo Scientific Stellar mass spectrometer (MS), a mass spectrometer that combines fast throughput and high sensitivity. This allows researchers to advance their translational omics research and make breakthrough discoveries more efficiently.

- In October 2023, Thermo Fisher Scientific Inc (US) acquired Olink Holdings (Sweden) with an aim to enhance Thermo Fisher’s capabilities in the high-growth proteomics market.

- In June 2024, Agilent Technologies, Inc. (US) launched two new products, the Agilent 7010D Triple Quadrupole GC/MS System and the Agilent ExD Cell available for the 6545XT AdvanceBio LC/Q-TOF, at the 72nd ASMS Conference on Mass Spectrometry and Allied Topics to advance gas chromatography-mass spectrometry (GC/MS) and LC/Q-TOF technology.

- In June 2024, Danaher Corporation (US) and Mass Analytica (Spain) collaborated to reveal artificial intelligence quantitation (AI quant) software, which offers high-resolution MS/MS analysis with an intelligent fragment selection algorithm.

- In February 2023, Waters Corporation (US) acquired Wyatt Technology (US), which enhanced the portfolio of separation and detection and provided customers with an unmatched set of analytical solutions across a wide range of applications.

Content Source:

https://www.marketsandmarkets.com/Market-Reports/proteomics-market-731.html

https://www.marketsandmarkets.com/PressReleases/proteomics.asp

Comments

0 comment