views

India Instant Coffee Market Overview

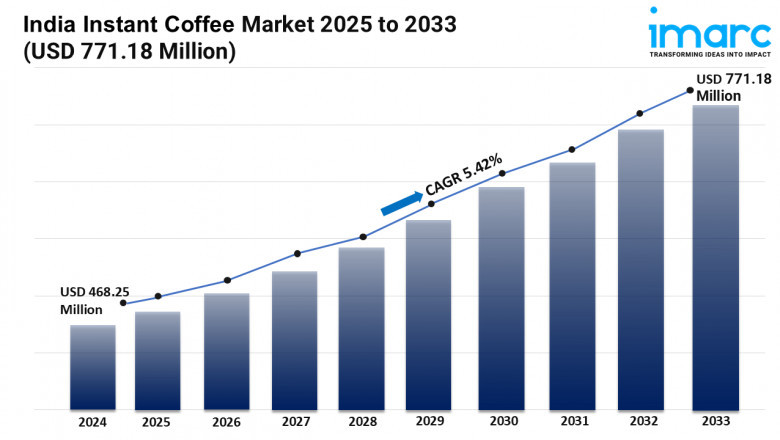

Market Size in 2024: USD 468.3 Million

Market Forecast in 2033: USD 771.2 Million

Market Growth Rate: 5.42% (2025-2033)

According to the latest report by IMARC Group, the India instant coffee market size was valued at USD 468.3 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 771.2 Million by 2033, exhibiting a CAGR of 5.42% from 2025-2033.

India Instant Coffee Industry Trends and Drivers:

A modest expansion is observed in the Indian instant coffee market mainly due to several major catalysts that stand relevant to changing consumer behavior and industry dynamics. The growing trend of urbanization in major cities nationwide leads people to yearn for convenient forms of coffee like instant coffee. These people are getting wealthier, choosing instant coffee in light of their fast-paced lifestyles, and better to adapt to such a lifestyle. Moreover, the growing café culture and expanding footprints of international and local café chains are serving to drive consumer preferences towards premium instant coffee blends. This market is also profiting heavily with an increase in disposable income whereby more consumers are entertaining the idea of parting with their earnings to enjoy the best coffee. These habits are encouraging growth of the market with an emphasis on moving away from traditional coffee to instant coffee, especially within urban and semi-urban areas. This thus basically makes the Instant Coffee Market Growing in India another significant player within the global coffee landscape, representing evolving consumer behavior and preferences.

Technological advancements have also been the key factors trending in the growth of the Indian instant coffee market. Ongoing innovations in coffee-processing techniques (e.g., freeze-drying and spray-drying techniques) ensure that the quality of instant coffee grows, making instant coffee even more appealing to coffee lovers. Also, packaging is on the move; the manufacturers have taken a fancy to sustainable, user-friendly packaging options that give more workability to the product and address the ever-increasing demand for eco-friendly solutions. Blessings of technology- increasing access to good quality instant coffee for the larger audience, bringing it not only to the urban centers but the market and populace in smaller towns and rural areas, and likewise, online shopping for all types of instant coffee is offering a plethora of options before consumers. These technological advancements and consumer behavior changes have really set the stage for the future shaping of the India Instant Coffee Industry Size, Share, Trends, and Forecast by Packaging, Coffee Type, Distribution Channel, and Region, 2025-2033 and perpetuation.

The most important market driver for instant coffee is the share of South India in the entire country. This region is famous for its highly dense coffee cultivation, and this continues to be the coffee-making heart for the nation. This area has the highest coffee consumption per capita, and this has been substantiated gradually with increasing open-end production oriented towards exports to drive the market demand. The ready-to-drink coffee market and the inclination toward premium, indigenous sources of coffee are also promoting the growth. Major coffee processors are possibly capitalizing on the resources by setting up production units in the region, which will be consumed locally and exported. Thus, changing consumer attitudes toward convenience and quality have furthered the increasing rate at which instant coffee is sold in the country. Hence, the India Instant Coffee Market Size, Share, Trend, and Forecast by Packaging, Coffee Type, Distribution Channel, and Region, 2025-2033, will continue to grow according to the demand factors which are both local and international. The expanding coffee culture and innovative technologies, along with a growing attention towards quality and convenience, ensure that instant coffee remains a staple for millions across the country.

Download sample copy of the Report: https://www.imarcgroup.com/india-instant-coffee-market/requestsample

India Instant Coffee Market Forecast Segmentation:

The report has segmented the market into the following categories:

Analysis by Packaging:

- Jar

- Pouch

- Sachet

- Others

Analysis by Coffee Type:

- Spray Dried

- Freeze Dried

Analysis by Distribution Channel:

- Business-To-Business

- Supermarkets and Hypermarkets

- Independent Retailers

- Departmental Stores

- Online

- Others

Regional Analysis:

- North India

- East India

- West and Central India

- South India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Latest News and Developments:

- In February 2025, Nestlé revealed its plans to introduce Starbucks Ready-to-Drink (RTD) coffee in India's retail market, further expanding its premium coffee offerings. This move aims to tap into the growing demand for convenient, high-quality coffee beverages, strengthening Nestlé's presence in India's evolving coffee segment.

- In January 2025, Third Wave Coffee opened its 125th cafe in Chennai, marking a significant expansion in India's premium coffee segment. This growth reflects increasing consumer demand for specialty coffee experiences and strengthens the brand's presence in the competitive market.

- In January 2025, CCL Products, India's largest instant coffee exporter, urged the government to implement measures in the upcoming Union Budget to enhance domestic coffee consumption. The company emphasized the need for supportive policies to stimulate growth in the local market.

- In August 2024, GRM Overseas, India's third-largest rice exporter, acquired a 44% stake in Swmabhan Commerce, the parent company of instant coffee brand Rage Coffee. This strategic move marks GRM's entry into modern consumer brands and aims to diversify its portfolio beyond traditional commodities.

- In January 2024, Continental Coffee partnered with Platinum Outdoor for a 3D anamorphic campaign, highlighting Continental Xtra’s "Xtra strong" flavor. This innovative marketing boosts brand visibility, attracts coffee lovers, and drives demand for premium instant coffee in India's growing urban market.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=1235&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

![¿Cómo puedo contactar con una persona en vivo en los vuelos de Frontier? [Guía paso a paso]](https://timessquarereporter.com/public/upload/media/posts/2025-06/12/como-puedo-contactar-con-una-persona-en-vivo-en-los-vuelos-de-frontier-guia-paso-a-paso_1749705127-s.jpg)

![How Do I Get to a Live Person at Frontier Flights? [Step-by-Step Guide]](https://timessquarereporter.com/public/upload/media/posts/2025-06/12/how-do-i-get-to-a-live-person-at-frontier-flights-step-by-step-guide_1749705004-s.jpg)

Comments

0 comment