views

Selecting the right investment path begins with understanding the benchmarks that shape the financial market. Among the various indices, Nifty 50 stands as a prominent reference point for investors seeking clarity and direction in their investment journey. This article explains what Nifty 50 is, how it works, and why it matters, making it simple for anyone starting out with equities or mutual funds.

Why Indices Matter?

Indices act as barometers for the stock market, offering a snapshot of how a specific group of companies is performing at any given time. The Nifty 50, in particular, is one of the most tracked indices, providing valuable insights for investors, analysts, and fund managers. By following indices such as Nifty 50, investors can assess market trends and compare their portfolio’s performance against a standard benchmark, making informed decisions about their mutual funds investment plan or direct equity investments.

What is Nifty 50?

Nifty 50 is the flagship index of the National Stock Exchange (NSE), representing the 50 largest and most liquid companies listed on the exchange. Launched in 1996, it covers a broad spectrum of sectors, giving a comprehensive view of the market’s performance. The name “Nifty” is a blend of “National” and “Fifty,” reflecting its composition of 50 companies.

Key Features of Nifty 50:

- Represents about 55% of the total free-float market capitalisation on the NSE.

- Covers 13 sectors, including financial services, IT, oil and gas, consumer goods, and automotive.

- Updated in real time during market hours, reflecting current market sentiment.

How is Nifty 50 Constructed?

The Nifty 50 is a free-float market capitalisation-weighted index. This means each company’s weight in the index depends on the number of shares available for trading and the company’s market value.

Selection Criteria:

- Companies must have a minimum listing history and significant trading volume.

- Only firms allowed in the derivatives segment are eligible.

- The index is reviewed and rebalanced twice a year, ensuring it remains relevant and representative.

Why is Nifty 50 Important?

Nifty 50 serves several crucial roles in the financial market:

- Benchmark for Performance: It acts as a standard for evaluating the performance of mutual funds, ETFs, and portfolios.

- Market Sentiment Indicator: Movements in the Nifty 50 reflect investor sentiment and broader economic trends.

- Investment Tool: Many mutual funds and ETFs are designed to replicate the Nifty 50, offering investors a simple way to gain exposure to a diversified basket of leading companies.

Performance and Returns

Nifty 50 index funds have historically delivered competitive returns. Over the past decade, average annual returns have ranged from 10% to 15%, depending on market conditions and fund expenses. The Nifty 50 TRI (Total Returns Index) is a more accurate benchmark, as it includes both capital gains and dividends, providing a clearer picture of total returns.

Understanding the Nifty 50 Companies

The Nifty 50 includes well-known names such as Reliance Industries, HDFC Bank, Infosys, and Tata Consultancy Services. These companies are leaders in their sectors and have a significant impact on the index’s movement.

Sector Allocation (as of July 2024):

- Financial Services: 32.76%

- Information Technology: 13.76%

- Oil and Gas: 12.12%

- Consumer Goods: 8.46%

- Automotive: 8.22%

Know More: Making the Most of Nifty 50

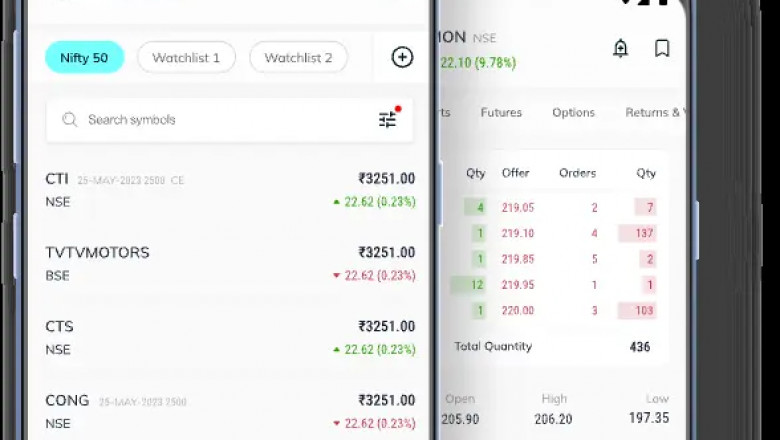

For investors looking to simplify their investment process, platforms like Torus Digital offer seamless access to Nifty 50 index funds, along with other investment products. This enables easy tracking and management of your investments, all in one place.

Conclusion

Nifty 50 remains the benchmark index for the country’s equity mar ket, guiding investment decisions and reflecting economic health. By understanding how the Nifty 50 works and its role among indices, investors can make informed choices and build a strong foundation for their financial future. For those eager to know more or get started, exploring Nifty 50 index funds through reliable platforms can be a practical first step towards long-term wealth creation.

Comments

0 comment