views

UK Retail Banking Market Overview

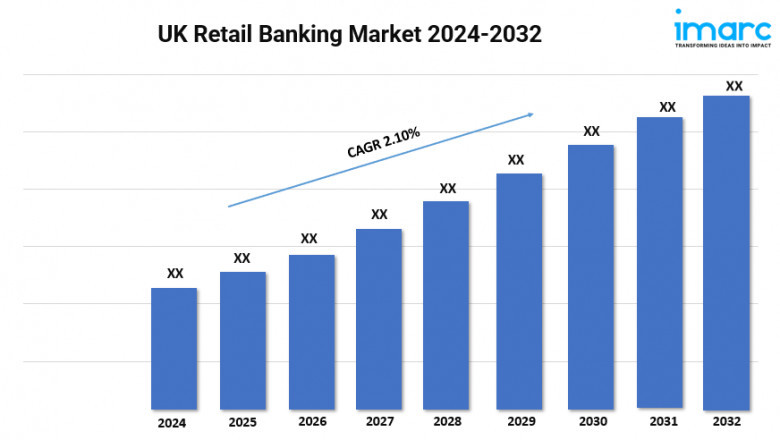

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 8.50% (2024-2032)

The UK banking sector is still growing. It driven by digital innovation, customer-focused services, and strong competition. Steady growth and regulatory improvements characterize a dynamically changing financial environment. According to the latest report by IMARC Group, the UK retail banking market size is projected to exhibit a growth rate (CAGR) of 2.10% during 2024-2032.

Download sample copy of the Report: https://www.imarcgroup.com/uk-retail-banking-market/requestsample

UK Retail Banking Industry Trends and Drivers:

The UK retail banking market is undergoing major changes. These shifts happen because of new technology, changing customer tastes, and updated regulations. A key feature is the quick adoption of digital banking methods. Users expect a smooth, mobile-first experience. Traditional banks are putting a lot of money into digital tools. They want to compete with challenger banks and fintechs. These new firms attract customers with simple apps, lower fees, and tailored services. Open banking gained traction in 2018 and has since made a big impact. It lets third-party providers access customer data, with consent. This access helps create new and innovative financial products. These changes boost competition and spark innovation. Another big trend is artificial intelligence and machine learning. These technologies are changing how banks interact with customers. For example, chatbots provide instant help, while algorithms give tailored financial advice.

These technologies improve customer experiences. They help banks run more efficiently and manage risks better. A big trend in UK retail banking is the focus on sustainability and ethical banking. In this regard, banks have been expected not to be isolated from such value systems. Many institutions are now creating a new product line. This line covers green loans, sustainable investments, and carbon footprint tracking. Regulatory pressures are boosting the green push. The UK government and financial authorities are examining how banks handle climate risks. The cost-of-living crisis has highlighted inclusivity. It has led to low-interest loans, budgeting tools, and education programs for those in need. Banks must innovate and make profits. They also need to stay socially responsible. This balance helps them remain competitive and relevant in a changing market.

IMARCs report provides a deep dive into the UK retail banking market analysis, outlining the current trends, underlying market demand, and growth trajectories.

UK Retail Banking Industry Segmentation:

The report has segmented the market into the following categories:

Services Insights:

- Transactional Accounts

- Savings Accounts

- Debit Cards

- Credit Cards

- Loans

- Others

Channel Insights:

- Direct Sales

- Distributor

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Comments

0 comment